Question

Everything else constant, the international trade effect indicates that aggregate expenditures in the domestic economy fall when: A) domestic prices fall relative to foreign prices.

Everything else constant, the international trade effect indicates that aggregate expenditures in the domestic economy fall when:

A) domestic prices fall relative to foreign prices.

B) domestic interest rates fall relative to foreign interest rates.

C) domestic prices rise relative to foreign prices.

D) domestic purchasing power rises relative to foreign purchasing power.

E) domestic interest rates rise relative to foreign interest rates.

The aggregate demand curve shows:

A) how the equilibrium level of aggregate expenditure changes in response to changes in production.

B) the amount people spend at different real GDP levels.

C) the positive relationship between the price level and real GDP.

D) the negative relationship between aggregate expenditure and real GDP.

E) how the equilibrium level of aggregate expenditure changes as the price level changes.

Which of the following is associated with an increase in the average price level?

A) A decrease in the aggregate quantity demanded

B) An increase in the aggregate quantity demanded

C) A leftward shift of the aggregate demand curve

D) A rightward shift of the aggregate demand curve

E) Aggregate quantity demanded remains unchanged but the aggregate expenditures curve shifts leftward.

Suppose an appreciation of the French franc causes U.S. prices of French wine imports to rise sharply. On the other hand, Californian wine becomes relatively inexpensive to French consumers. Other things equal, this will result in:

A) an increase in U.S. aggregate expenditures and an increase in the aggregate quantity of U.S. goods and services demanded.

B) a decrease in U.S. aggregate expenditures and a decrease in the aggregate quantity of U.S. goods and services demanded.

C) an increase in U.S. aggregate expenditures and a decrease in the aggregate quantity of U.S. goods and services demanded.

D) no change in either U.S. aggregate expenditures or the aggregate quantity of U.S. goods and services demanded.

E) a decrease in U.S. aggregate expenditures and an increase in the aggregate quantity of U.S. goods and services demanded.

The Keynesian region of the aggregate supply curve is:

A) horizontal.

B) downward-sloping.

C) upward-sloping.

D) vertical.

E) a 45-degree line.

The Keynesian region of the aggregate supply curve explains the situation experienced during the Great Depression. Therefore, we can conclude that the Great Depression was characterized by:

A) high unemployment and low inflation.

B) low unemployment and low inflation.

C) low unemployment and high inflation.

D) high unemployment and high inflation.

E) excess capacity but no unemployment or inflation.

When total planned expenditures are more than real GDP, there will be inventory accumulation.

A) True

B) False

If total planned expenditures exceed real GDP, the economy will contract, causing production of goods and services to decrease and unplanned inventories to rise.

A) True

B) False

When the aggregate expenditures function of a closed economy is plotted against real GDP, any point on the 45-degree line represents C + I + G = Y, where C = Consumption, I = Investment, G = Government spending, and Y = Real GDP.

A) True

B) False

Injections represent outflows of planned expenditures from the real GDP stream.

A) True

B) False

Injections to the economy include consumption, investment, and government spending.

A) True

B) False

Leakages are greater than injections when total planned expenditures exceed real GDP.

A) True

B) False

Other things equal, a reduction in personal income taxes will decrease consumption and will have an expansionary effect on real GDP.

A) True

B) False

Suppose for an economy, investment = $40; saving = $50, government spending + exports = 100; and taxes + imports = $110. Then for this economy, total leakages exceed total injections by $20, so there will be pressure for the economy to contract.

A) True

B) False

The paradox of thrift explains that increased savings by households could actually lower savings for the economy as a whole.

A) True

B) False

A marginal propensity to consume of 0.75 and a marginal propensity to import of 0.05 are associated with an open-economy spending multiplier of 3.33.

A) True

B) False

In general, autonomous spending increases have a lower multiplier effect on real GDP when the economy is open to international trade.

A) True

B) False

If the MPS equals 0.25 and the MPI is 0.15, then an initial change in investment spending of $250 million will result in a total change in equilibrium real GDP of $625 million.

A) True

B) False

Given a constant GDP gap, the higher the spending multiplier, the smaller will be the recessionary gap.

A) True

B) False

The recessionary gap is given by the difference between potential GDP and real GDP.

A) True

B) False

If the spending multiplier equals 6 and equilibrium real GDP is $32 billion below potential real GDP, then total planned expenditures need to decrease by approximately $5.33 billion to close the recessionary gap.

A) True

B) False

Foreign repercussions of changes in domestic imports cause the true domestic spending multiplier to be less than 1/(MPS+MPI)

A) True

B) False

Suppose the multiplier effect for Japan is 0.8 for any $1 billion change in U.S. government purchases. Therefore, Japanese real GDP will rise by $8 billion when U.S. government spending rises by $10 billion.

A) True

B) False

In reality, the simple spending multiplier [1/(MPS+MPI)] is applicable only to countries whose imports are a substantial fraction of income in foreign countries.

A) True

B) False

An increase in U.S. imports from Mexico will cause a decrease in income for Mexican individuals and businesses.

A) True

B) False

If German imports of French products are very important in determining the volume of German exports to France, we would expect the actual German spending multiplier to be larger than 1/(marginal propensity to save +marginal propensity to import).

A) True

B) False

The Keynesian aggregate expenditures model assumes that price level is constant.

A) True

B) False

A change in the price level in an economy will be depicted by a movement along the AE curve and not by a leftward or rightward movement of the curve.

A) True

B) False

Wealth is considered to be a nonincome determinant of consumption.

A) True

B) False

A depreciation of the U.S. dollar will result in an increase in aggregate expenditures in the country.

A) True

B) False

When the price level in an economy falls, the demand for bonds and other nonmonetary financial assets rises.

A) True

B) False

The aggregate demand curve depicts a negative relationship between real GDP and the general price level.

A) True

B) False

Ceteris paribus, a decline in the general price level in the United States will make foreign-produced goods relatively more expensive to U.S. residents and increase the aggregate demand of domestic goods.

A) True

B) False

A decrease in the general price level is associated with an upward shift in the aggregate expenditures function.

A) True

B) False

If the equilibrium level of income is solely a function of aggregate supply, then the aggregate supply curve must be in the Keynesian region.

A) True

B) False

The portion of the aggregate supply curve that is a positive function of the general price level represents excess capacity and unemployed resources.

A) True

B) False

A horizontal aggregate supply curve indicates that equilibrium real GDP is determined by aggregate supply.

A) True

B) False

According to economists, the fixed-price model of macroeconomic equilibrium depicts the modern economy most closely because it assumes that aggregate supply is independent of price.

A) True

B) False

A major drawback of the Keynesian approach to macroeconomic equilibrium is the assumption that the supply of goods and services in the economy always adjusts to aggregate expenditures

A) True

B) False.

Question.

Homework #2 International Trade

1. Consider the numerical examples of exercise 1 and 2 on page 52 in Krugman and Obstfeld (8th Edition).

Draw the production possibility frontier for each country.

Which country has a comparative advantage in apples, which one in bananas?

Which country has an absolute advantage?

Indicate the range of the international prices within which there will be gains from trade for both countries.

Now imagine that Home's technology is different. It turns out that one unit of Home labor can produce 0.2 apples or 1 banana. What would the pattern of production/trade be in this case? Explain the reason why the trade pattern is the way it is.

2.Take the numerical example we used in class to discuss the Ricardo model.

Draw the world production possibility frontier. (Hint: To do so, ask yourself what world output would be for all possible international prices (Pc/Pw)t). Now assume that both countries consume wine and clothing in equal proportions (i.e., their utility function is of the form U(c,w) = min {c,w}. Wine (w) and clothing (c ) are perfect complements) Now indicate on the graph the exact point on the world production possibility frontier at which the world consumes. Compare that point to the world consumption point before trade and before specialization.

As you notice, there are indeed gains from trade.

The question left is whether a world with free trade is the best of all possible worlds. Convince yourself that it is actually not always the best case. Allow for international mobility of labor. In other words, workers are free to decide where they want to work (at home or abroad). Show us how the production possibility frontier will look like in this case. Convince yourself that indeed, under this scenario, the world is better off than in the case of free trade. Now when you consider the international division of production (i.e., where goods will be produced) with internationally mobile labor, would you say that it is in line with the principle of comparative advantage? Discuss

You should realize while doing this exercise how essential the assumption of the international immobility of labor is for international trade and the theory of comparative advantage.

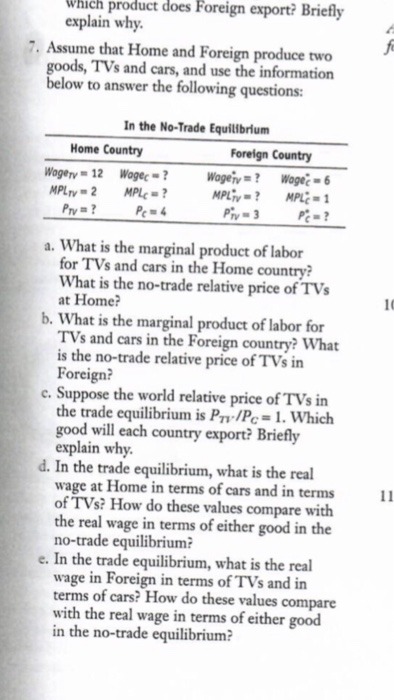

3.Discuss problems 6 and 9 in Krugman and Obstfeld, p. 52.

4.Your country imports high tech products and exports agricultural products.

Suppose you had any control over future technological developments (You have none, but anyway), would you prefer scenario (a), (b) or (c) and why? (Where necessary, illustrate with a graph using the Ricardo nalysis of comparative advantage.)

a. There is a technological revolution abroad in the high tech industry. In other words, productivity increases significantly in the technology sector.

b. There is a productivity increase abroad in the agricultural sector.

c. No technological revolution at all abroad.

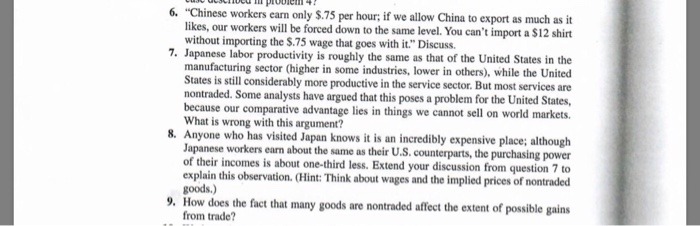

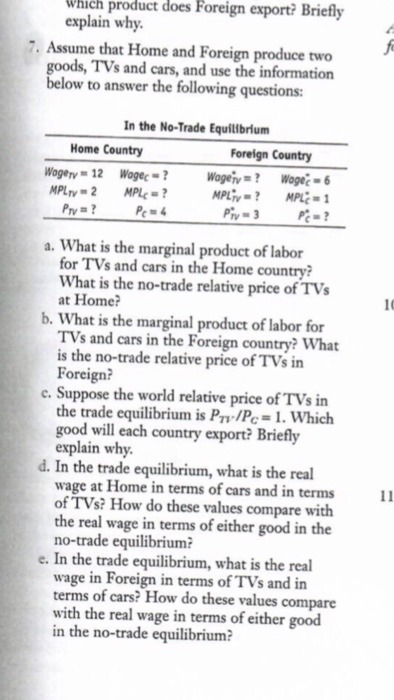

5.Answer the problem 7 in Feenstra and Taylor, p. 57.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started