Answered step by step

Verified Expert Solution

Question

1 Approved Answer

everything is the same except that new machine cost 6000 and annual revenue of 15,000 and annual operating cost of 6000 please need help! 12-2A

everything is the same except that new machine cost 6000 and annual revenue of 15,000 and annual operating cost of 6000

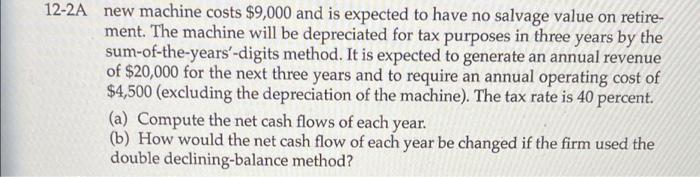

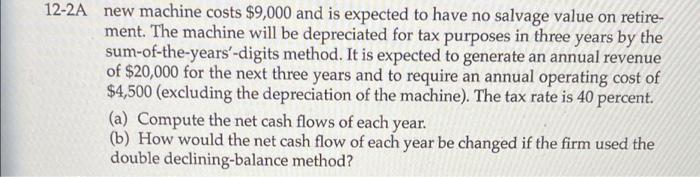

12-2A new machine costs $9,000 and is expected to have no salvage value on retire- ment. The machine will be depreciated for tax purposes in three years by the sum-of-the-years'-digits method. It is expected to generate an annual revenue of $20,000 for the next three years and to require an annual operating cost of $4,500 (excluding the depreciation of the machine). The tax rate is 40 percent. (a) Compute the net cash flows of each year. (b) How would the net cash flow of each year be changed if the firm used the double declining-balance method please need help!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started