Answered step by step

Verified Expert Solution

Question

1 Approved Answer

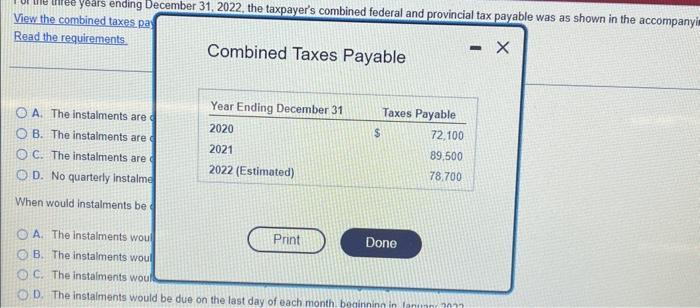

Everything is there For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying

Everything is there

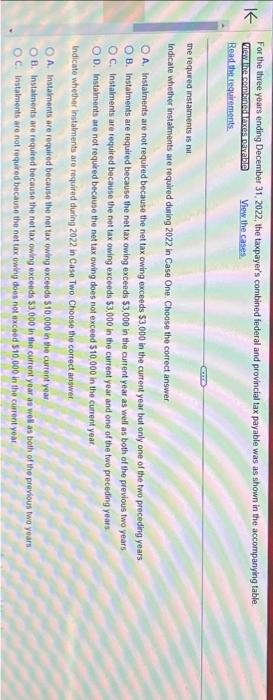

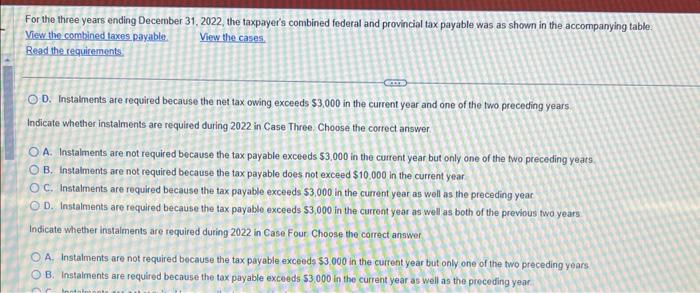

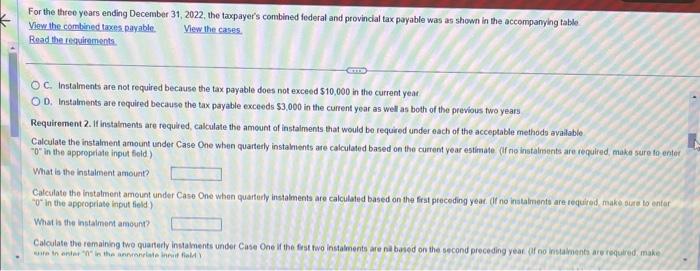

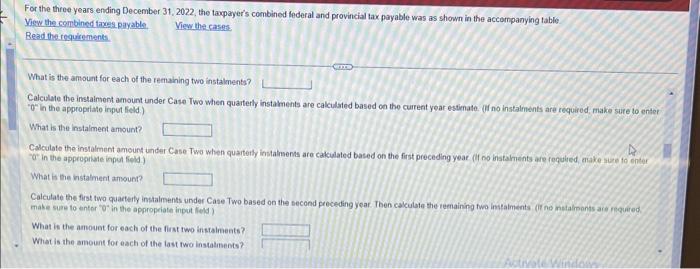

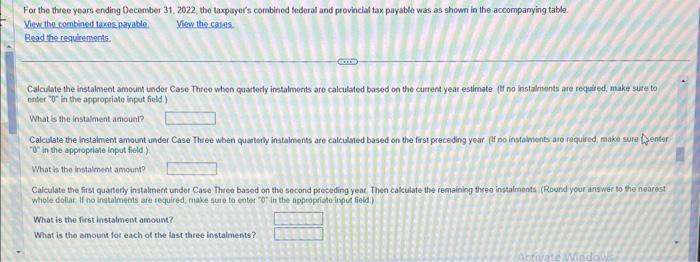

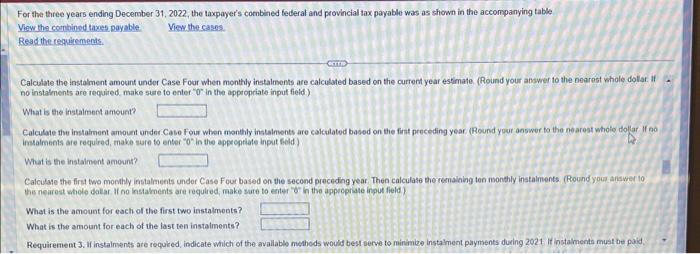

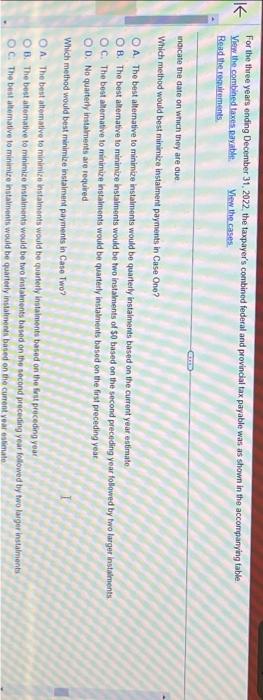

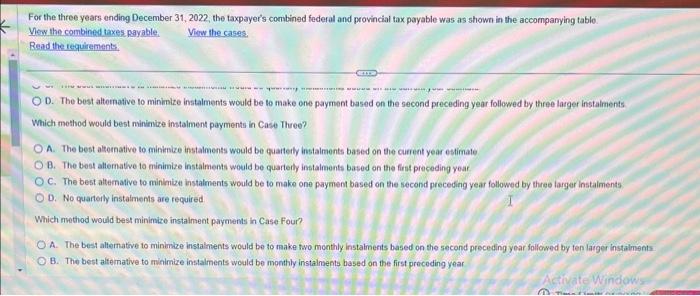

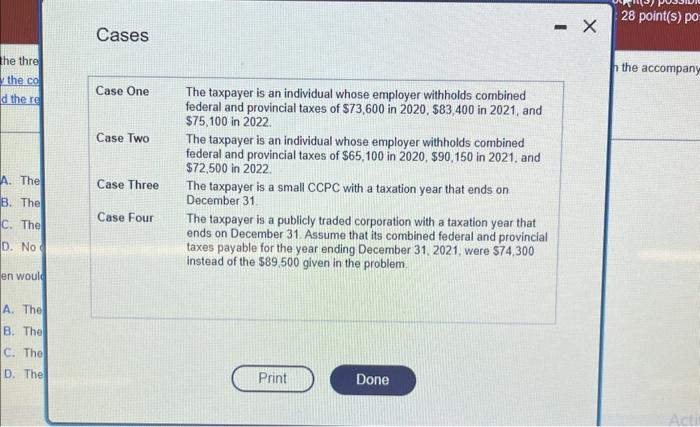

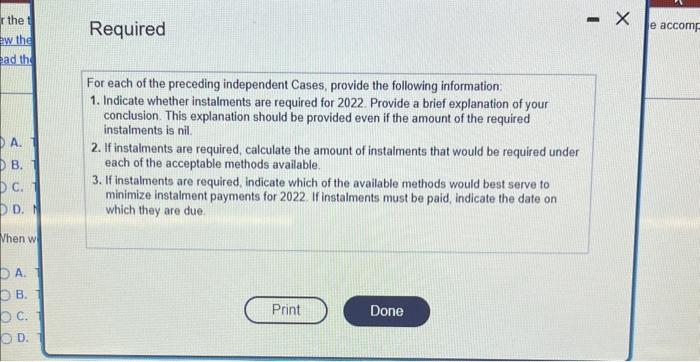

For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying table. Viow the cases Read the requirements the requred instaiments is nil Indicate whether instalments are required duing 2022 in Case One. Choose the correct answer A. Instalments are not required because the net tax owing exceeds $3,000 in the current year but only one of the two preceding years B. Instaiments are required because the net tax owing exceeds $3.000 in the current year as well as both of the previous two years C. Instalments are required because the net tax owing exceeds $3.000 in the current year and one of the two preceding years D. Instahsents are not required because the net tax owing does not exceed $10.000 in the cunent year. Indicate whether instalments are required during 2022 in Case Two. Choose the correct answer. A. Instakments are required becaush the net tax owing exceeds $10,000 in the curient yoar B. Instalnents are required because the net tax owing exceeds $3.000 in fhe current year as well as both of the pravious two years C. Instalments are not required because the net tax owing does not exceed 510,000 in the ciffent year For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying table. Virw the combined laxes payable. View the cases. Read the requirements D. Instalments are required because the net tax owing exceeds $3,000 in the current year and one of the two preceding years. Indicate whether instalments are required during 2022 in Case Three. Choose the correct answer A. Instalments are not required because the tax payable exceeds $3,000 in the current year but only one of the two preceding years. B. Instalments are not required because the tax payable does not exceed $10.000 in the current year C. Instalments are required because the tax payable exceeds $3.000 in the current year as well as the preceding year D. Instalments are required because the tax payable exceeds $3,000 in the current year as well as both of the previous two years Indicate whether instalments are required during 2022 in Case Four Choose the correct answer A. Instalments are not required bocause the tax payable exceeds $3,000 in the curtent year but only one of the two preceding years. B. Instalments are required because the tax payable exceeds $3,000 in the current year as well as the proceding year. For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying table. Verew the combined taxes payable. View the cases. Road the ferguinements. C. Instalments are not required because the tax payable does not exceed $10,000 in tho current year D. Instalments are required because the tax payable exceeds $3,000 in the current year as well as both of the previous fwo years Requirement 2. If instalments are required, calculate the amount of instalments that would be required under each of the acceptable methods avalable Calculate the instalment amount under Case One when quarterly instalments are calculated based on the current year estimate (if no instalments are fequired, make sure fo enter 0 in the appropriate input foid) What is the instalment amount? Calculate the instalment amount under Caso One when quarterly instalments are calculated based on the frat preceding year (If no instalments are tequired, make oure to enfar "- 0 in the appropriate input field) What the instalment amount? Calculate the remaining twe quarterly instaiments under Case One if the frat fwo instalments are na based on the second preceding year af no inslainnents are iequired make For the three years ending December 31. 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accernpanying lable View the combined taxes payable. View the casess Read the reguicements. What is the amount for each of the remaining two instalments? Calculate the instaiment amount under Case Two when quarterly instaments are calculated based oa the current year estimate. (If no instalments are required. make sure to enter "O. In the appropriate input field.) What is the instalment amount? Calculate the instalment amount under Case Two when quarterly instalnsents are cakulated based on the first preceding year (if no instalneints are reguired, enake alse fo enter 0 in the approgilare input field) What is the istalment anount? Calculate the first two quarterty instaiments under Case Two based on the second preceding year. Then calculote the remaining two instalments if ne instaliponts are rigiuited make sure to enter "o" in the appropeiate inpot fleld) What is the amouet for each of the first two instalments? What is the amount for each of the last two instatiments? For the three years ending December 31, 2022, the taxpayer's combined federal and provincial lax payable was as shown in the accompanying table. Ylev the sombined taxesinaryable. Read the requinements. Calculate the instalment amount under Case Three whon quarterly instalments are calculated based on the cunnert year estimate (fi no instalments are required, make sure to enter "0" in the appropriate input field.) What is the instalment amount? Calculate the instalment amount under Case Three when quartelly instalments are calculated based on the frst preceding year (ff no instalnients are required, make sure igenter 0 in the appropelate input field.) What is the instalment anount? Calculate the first quartedy instalinent under Case Three based on the socond pocceding year. Then calculate the reataining thres instaiments (Round your answer to the nearest whole dollar If no instalments are fequired, make sure to enter 0 in the approprieto inpul field) What is the first instalment amount? What is the amount fot each of the last three instaiments? For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying table Yiew the combinod taxee payable. Read the requerements. Calculate the instalment amount under Case Four when monthly instalments are calculated based on the current year estimate. (Round your answer to the nearest ishole dollar. If no instatments are required. make sure to enter " 0 in the appropriate input fieid ) What is the instalmnen amount? Calculate the imstaiment amount under. Case Four when monthly instalments are calculated based on the fint preceding year. (Reund your answer to the nearest whole dollar If ao insialments are required, make sure to enter "0\% in the approprlate input feed.). What is the instalment amount? Calculase the first two monthly instalments under Case Four based on the second preceding year. Then calculate the remaining ten monthly instalments. (Round your answer to. the nearest whole dolar If no hastaknents are required, rake sare to enter tot in the approprate input field) What is the amount for each of the first two instalments? What is the amount for each of the last ten instalments? Requirement 3. If instalments are requked, indicate which of the avallable methods would best serve to minimize instalment payments during 2021 it instahnents must be paid. For the three years ending December 31,2022 , the taxpayer's combined federal and provinclal tax payable was as shown in the accompanying fable. Virw the combined taxes. payable. Yiew the casese. Read the rechuirements ndicate the date on which they are due Which method would best minimize instalment payments in Case One? A. The best alternative to minimize instalments would be quarterly instalments based on the current year estimate. B. The best altemative to minimize instaiments would be two instakients of 50 based on the second preceding year fosowed by tro larger instalments. C. The best allernative to minimize instaiments would be quarterly instalnents based on the first preceding year. D. No quarterly instalments are required Which method would best minimize instaiment payments in Case Twe? A. The best aftemattve to minimize hstalments would be cuarterly instaiments based on the fret preceding year B. The best altemative to minimize instalments would be two listaknents based on the second preceding year folorwed by two larger instalments C. The best altemative to minimize instalments would be quarterly insalinends based on the curent year estimate For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying table. Very the combined taxes payable. View the cases. Rend the requirements. D. The best alternafive to minimize instalments would be to make one payment based on the second preceding year followed by three larger instalments Which mothod would best minimize instalment payments in Case Three? A. The best aleornative to minimize instalments would be quarterly instaiments based on the cuerent year estimate B. The bost altemative to minimize instalments would be quarterly instalments based on the first proceding year. C. The best altemalive to minimize instalments would be to make one payment based on the second preceding year followed by three larger Instalments D. No quarterly instaiments are recuired Which nvethod would best minimize instaiment payments in Case Four? A. The best alternative to minimize instalments would be to make two monthly instatments based on the second preceding year followed by ten larger instalments B. The best alternative to minimize instalments would be monthly instalnsents based on the first preceding year For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying table View the combined taxes payable View the cases Read the requirements. C. The best ahternative to minimize instalments would be monthly instalments based on the current year estimate. D. No instalments are required When would instalments be due in Case One? A. The instalments are due on March 15, June 15, September 15, and December 15, 2022. B. The instalments are due on Apri1 15, July 15, October 15, and January 15, 2022. C. The instalments are due on March 31, June 30, September 30, and December 31, 2022. D. No quarterly instaiments are required When would instalments be due in Case Two? A. The instaiments are due on May 1, August 1, November 1 , and February 1,2022 For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying table. View the combined taxes payable. View the cases. Read the requirements. A. The instalments are due on May 1, August 1, November 1, and February 1, 2022 B. The instalments are due on March 15. June 15, September 15, and December 15, 2022. C. The instalments are due on March 31, June 30, September 30, and December 31, 2022 D. The instalments are due on Apri1 15. July 15, October 15, and January 15, 2022. When would instalments be due in Case Three? A. The instalments are due on March 15. June 15, September 15, and December 15, 2022 B. The instalments are due on April 15. July 15, October 15, and January 15, 2022. C. The instalments are due on March 31, June 30, September 30, and December 31, 2022 D. No quarterly instalments are required For the three years ending December 31, 2022, the taxpayer's combined federal and provincial tax payable was as shown in the accompanying table. View the combined taxos pavable; Vlew the cases. Read the requitements A. The instalments are due on March 15, June 15, September 15, and December 15, 2022. B. The instalments are due on Aprii 15, July 15, October 15, and January 15, 2022. C. The instalments are due on March 31, June 30, September 30 , and December 31, 2022 D. No quarterly instalments are required When would instalments be due in Case Four? Combined Taxes Payable A. The instalments are B. The instaiments are C. The instalments are D. No quarterly instalme When would instalments be A. The instalments woul B. The instalments woul Cases the accompany For each of the preceding independent Cases, provide the following information: 1. Indicate whether instalments are required for 2022 . Provide a brief explanation of your conclusion. This explanation should be provided even if the amount of the required instalments is nil. 2. If instalments are required, calculate the amount of instalments that would be required under each of the acceptable methods available. 3. If instalments are required, indicate which of the available methods would best serve to minimize instalment payments for 2022 . If instalments must be paid, indicate the date on which they are due Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started