Question

Evie Excellent is trying to create financial statements for her start-up company, Stinky Soaps. Evie began the business on Jan 1, 2023 with a $1,000

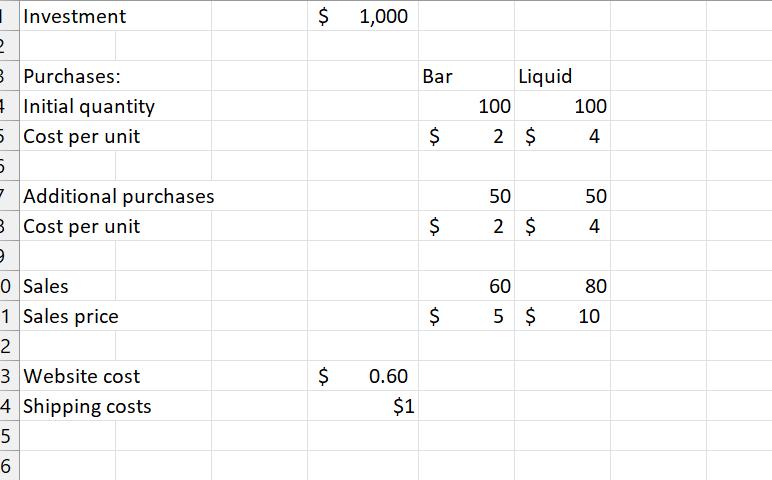

Evie Excellent is trying to create financial statements for her start-up company, Stinky Soaps. Evie began the business on Jan 1, 2023 with a $1,000 investment from her parents. The year 2023 is over, and Evie needs help to generate a profit and loss statement (Income statement) and Balance sheet. She is only able to ascertain that her cash is about even with what she started the year with ($1,000).

Evie has two products, bar and liquid soap. She purchased initial inventory of 100 units of each product in mid-January, 2023. The bar soap cost $2 per bar and the liquid was a bit more expensive at $4 per unit.

Sales have been good. Evie advertises solely on her internet website. Stinky has sold 60 bars and 80 liquid soap dispensers. She charges $5 and $10 each for the products, respectively. Her website hosting site charges $.60 for each unit sold. Evie has replenished her inventory by purchasing 50 units of each type of soap from the manufacturer at the same cost as her initial inventory purchases. Evie’s only other cost is shipping; she pays $1 per unit sold to ship to the retail customers. She does not currently pay herself a salary as she is running the business after her regular job.

input worksheet:

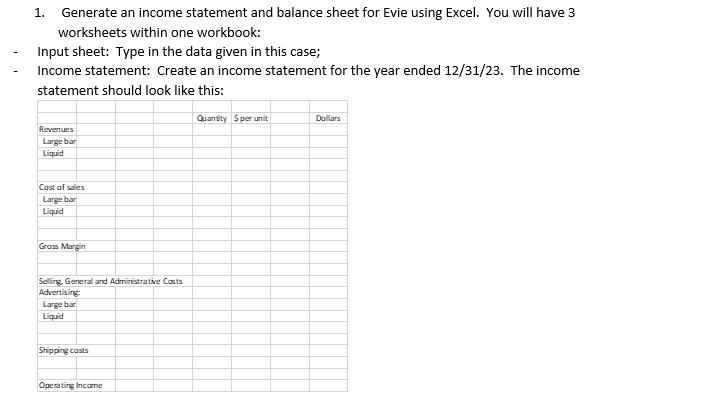

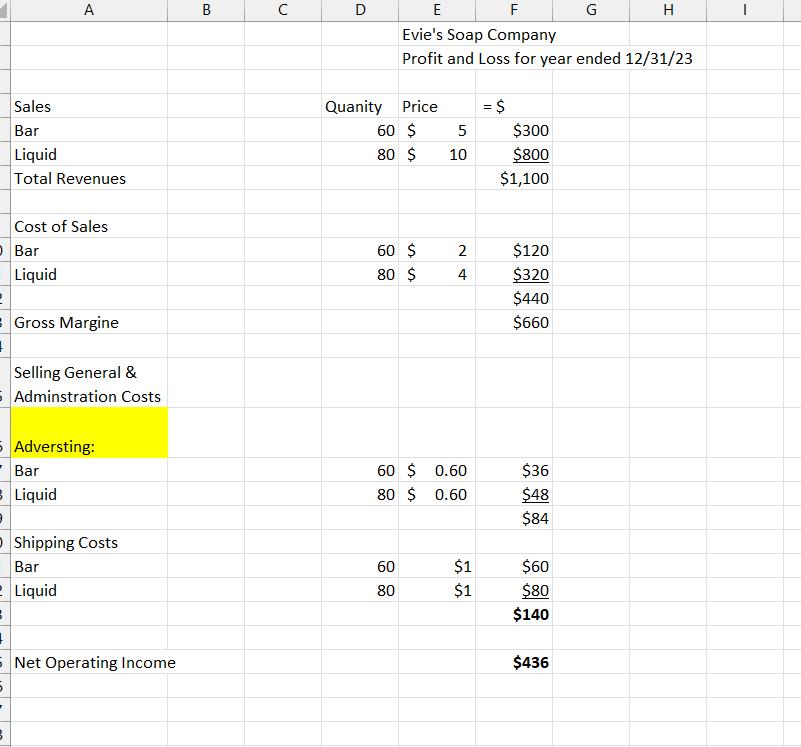

Can your tell if the income statement below is correct?

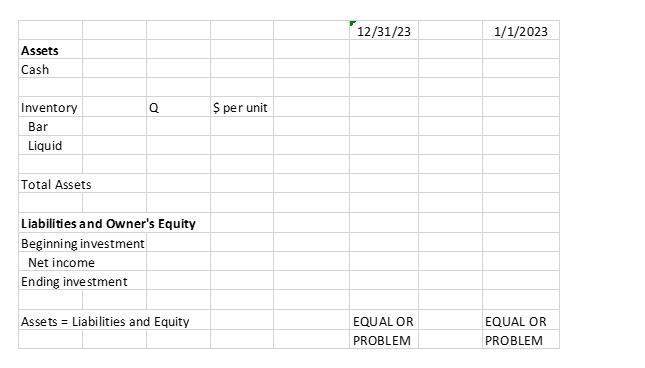

Balance sheet: Create a balance sheet as of 1/1/23 and 12/31/23, which looks like this:

You will need to compute your ending cash balance as of 12/31/23; it is within $100 of the beginning cash balance as of 1/1/23.

- Create a conditional “if” statement showing that Assets = Liabilities + Owner’s Equity. If the condition is met, it should say EQUAL. If the condition is not met, it should say PROBLEM.

- All numbers on the income statement and balance sheet MUST BE either a formula or a cell reference. No numbers can be input on these sheets. You will cell reference back to the input sheet.

(Show formula)

Investment 2 3 Purchases: 4 Initial quantity 5 Cost per unit 5 Additional purchases 3 Cost per unit 9 O Sales 1 Sales price 2 3 Website cost 4 Shipping costs 5 6 $ es $ es 1,000 0.60 $1 Bar $ $ $ es 100 Liquid 2 $ 50 2 $ 60 5 $ 100 4 50 4 80 10

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To verify if the income statement provided is correct and create a balance sheet well go through the process step by step based on the inputs given Income Statement First lets review the income statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started