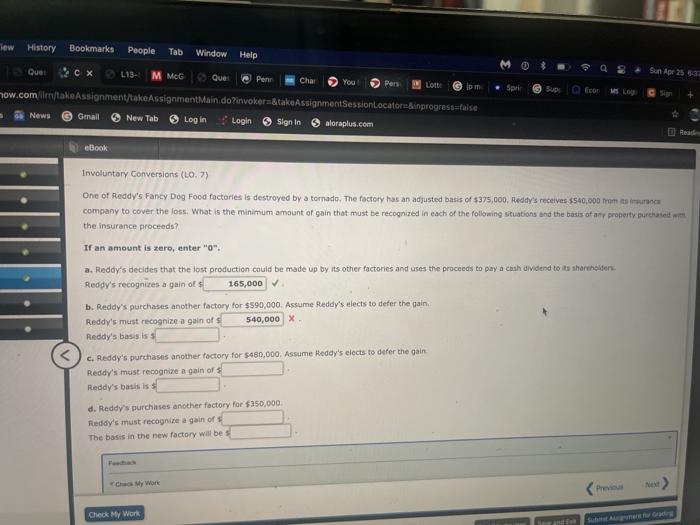

ew History Bookmarks People Tab Window Help Sun Apr 25 Sprin icon Quel cx 1134 M Met Que: Pen Chai You Pers Lost lpm now.com/en/takeAssignment/take Assignment Main.do?invokera&takeAssignmentSessionLocatorn&inprogress=false News Gmail New Tab > Log in Login Sign in aloraplus.com MS LOU eBook Involuntary Conversions (LO. 7) One of Reddy's Fancy Dog Food factories is destroyed by a tornado. The factory has an adjusted basis of $375,000. Reddy's receives $540,000 from toc company to cover the loss. What is the minimum amount of pain that must be recognized in each of the following situations and the basis of any property purchased the insurance proceeds? If an amount is zero, enter "0" a. Reddy's decides that the lost production could be made up by its other factories and uses the proceeds to pay a cash dividend to its shareholders Reddy's recognizes a gain of $ 165,000 b. Reddy's purchases another factory for $590,000. Assume Reddy's elects to defer the main Reddy's must recognize again of 540,000 x Reddy's basis is c. Reddy's purchases another factory for $480,000. Assume Reddy's elects to defer the gain Reddy's must recognize a gain of Reddy's basis is d. Reddy's purchases another factory for $350,000 Reddy's must recognize again of The basis in the new factory will be Check My Work ew History Bookmarks People Tab Window Help Sun Apr 25 Sprin icon Quel cx 1134 M Met Que: Pen Chai You Pers Lost lpm now.com/en/takeAssignment/take Assignment Main.do?invokera&takeAssignmentSessionLocatorn&inprogress=false News Gmail New Tab > Log in Login Sign in aloraplus.com MS LOU eBook Involuntary Conversions (LO. 7) One of Reddy's Fancy Dog Food factories is destroyed by a tornado. The factory has an adjusted basis of $375,000. Reddy's receives $540,000 from toc company to cover the loss. What is the minimum amount of pain that must be recognized in each of the following situations and the basis of any property purchased the insurance proceeds? If an amount is zero, enter "0" a. Reddy's decides that the lost production could be made up by its other factories and uses the proceeds to pay a cash dividend to its shareholders Reddy's recognizes a gain of $ 165,000 b. Reddy's purchases another factory for $590,000. Assume Reddy's elects to defer the main Reddy's must recognize again of 540,000 x Reddy's basis is c. Reddy's purchases another factory for $480,000. Assume Reddy's elects to defer the gain Reddy's must recognize a gain of Reddy's basis is d. Reddy's purchases another factory for $350,000 Reddy's must recognize again of The basis in the new factory will be Check My Work