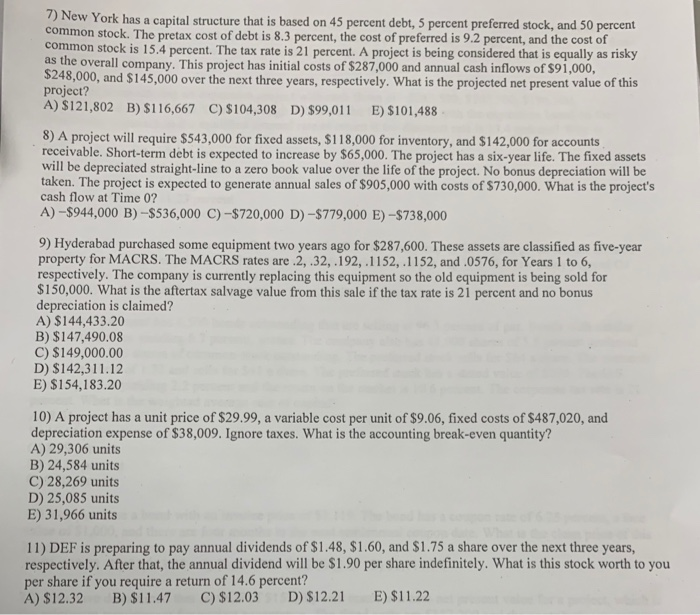

ew York has a capital structure that is based on 45 percent debt, 5 percent preferred stock, and 50 percent common stock. The pretax cost of debt is 8.3 percent, the cost of preferred is 9.2 percent, and the cost of common stock is 15.4 percent. The tax rate is 21 percent. A project is being considered that is equally as risky as the overall company. This project has initial costs of $287,000 and annual cash inflows of $91,000, 00, and $145,000 over the next three years, respectively. What is the projected net present value of this $248,0 project? A) S121,802 B) S116,667 C)S104,308 D) $99,011 E) $101,488 8) A project will require $543,000 for fixed assets, $118,000 for inventory, and $142,000 for accounts receivable. Short-term debt is expected to increase by $65,000. The project has a six-year life. The fixed assets will be depreciated straight-line to a zero book value over the life of the project. No bonus depreciation will be taken. The project is expected to generate annual sales of $905,000 with costs of $730,000. What is the project's cash flow at Time 0? A)-$944,000 B)-$536,000 C)-$720,000 D)-$779,000 E)-$738,000 9) Hyderabad purchased some equipment two years ago for $287,600. These assets are classified as five-year property for MACRS. The MACRS rates are .2,.32,.192,.1152,.1152, and.0576, for Years 1 to 6, respectively. The company is currently replacing this equipment so the old equipment is being sold for $150,000. What is the aftertax salvage value from this sale if the tax rate is 21 percent and no bonus depreciation is claimed? A) $144,433.20 B) $147,490.08 C) $149,000.00 D) $142,311.12 E) $154,183.20 10) A project has a unit price of $29.99, a variable cost per unit of $9.06, fixed costs of $487,020, and depreciation expense of $38,009. Ignore taxes. What is the accounting break-even quantity? A) 29,306 units B) 24,584 units C) 28,269 units D) 25,085 units E) 31,966 units 11) DEF is preparing to pay annual dividends of $1.48, $1.60, and $1.75 a share over the next three years, respectively. After that, the annual dividend will be $1.90 per share indefinitely. What is this stock worth to you per share if you require a return of 14.6 percent? A) $12.32 B) $11.47 C) $12.03 D) $12.21 E) $11.22