Question

Ex 1. Calculate the cost of equity of Company A considering that the weighted average cost of capital (WACC) is 3,67%, the total value of

Ex 1. Calculate the cost of equity of Company A considering that the weighted average cost of capital (WACC) is 3,67%, the total value of debt and equity is 12,647,298, and the company holds 35% in debt.

Ex 2. Company B paid dividend in 2021 of 1,7 USD, in line with the expected dividend growth of 5% each year. Company C has announced it expects to pay a 2,1 dividend to common shareholders in 2022, and its cost of equity (CAPM) is of 8.9%. (Company's C paid dividend in 2020 of 2).

a. Which company has the most expensive share price ?

b. Would you rather buy stocks of Company B or C considering that Company B stock is trading at 27 and Company C stock at 99

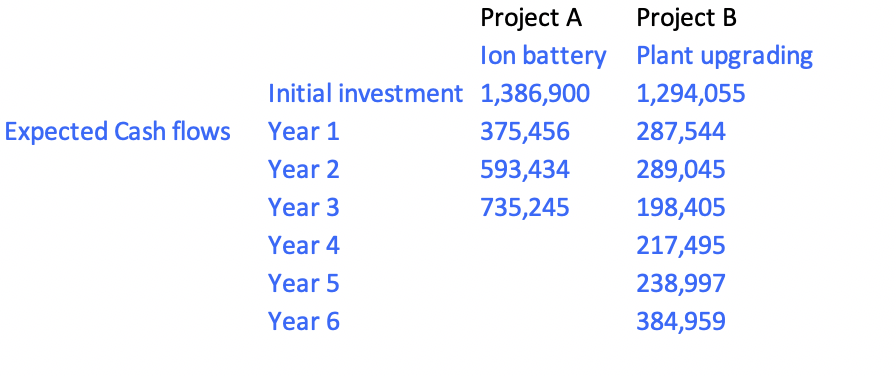

Ex 3. Company D is considering 2 investments: implementing ion-battery or upgrading its current automated factory in the US. How would the Financial Manager compares those 2 options considering the following investments and returns of both options:

Initial investment Expected Cash flows Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Project A Ion battery 1,386,900 375,456 593,434 735,245 Project B Plant upgrading 1,294,055 287,544 289,045 198,405 217,495 238,997 384,959

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly Lets calculate the NPV for both investment options Option 1 Implementing Ion Battery Dis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started