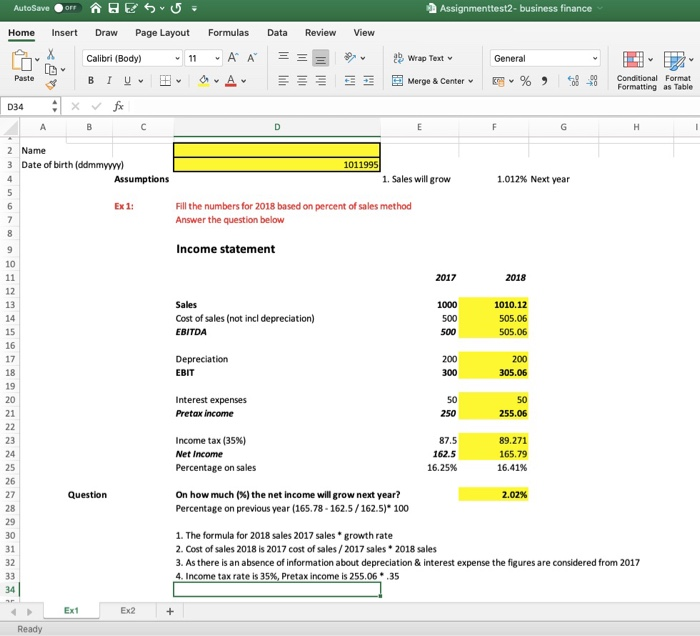

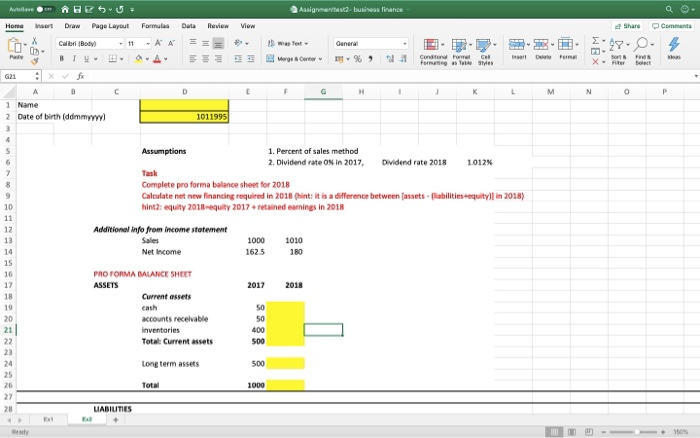

Ex 1 is already answered

Ex 2: briefly explain the principles you follow

for the subject of business finance II

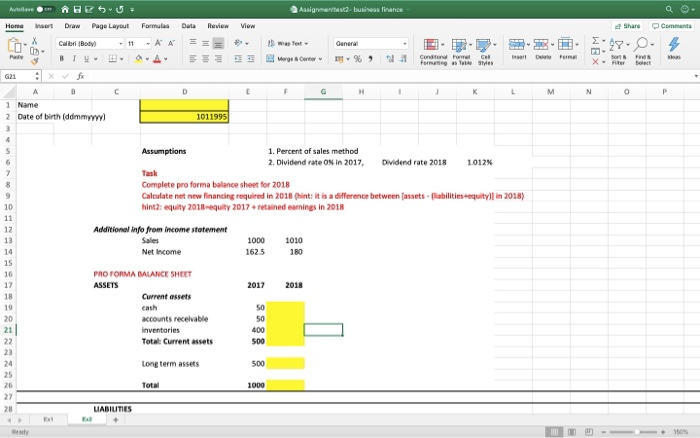

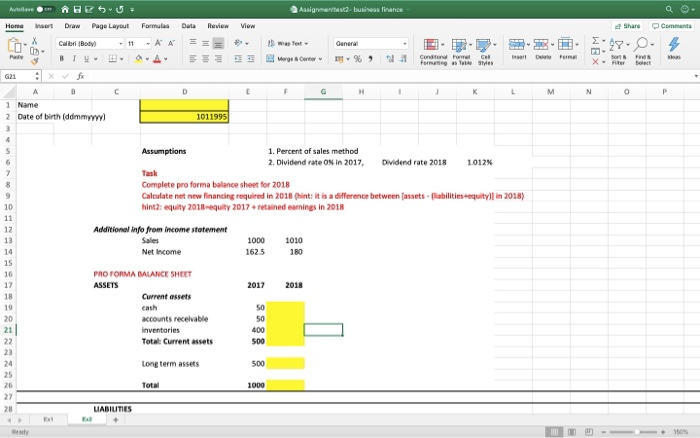

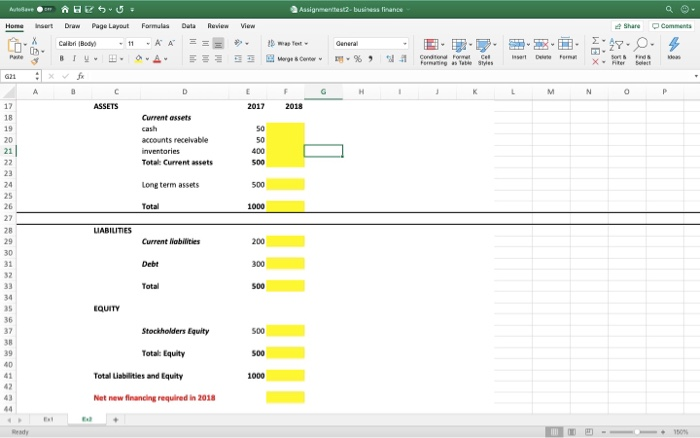

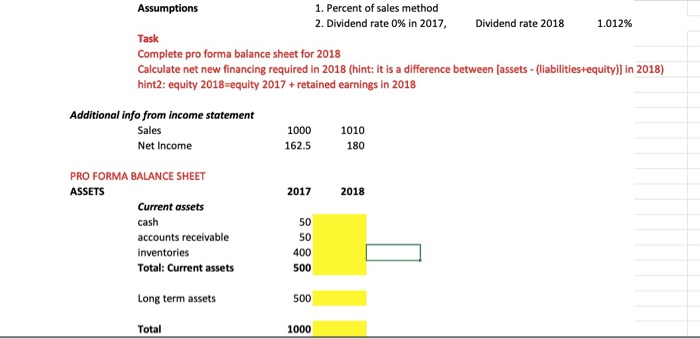

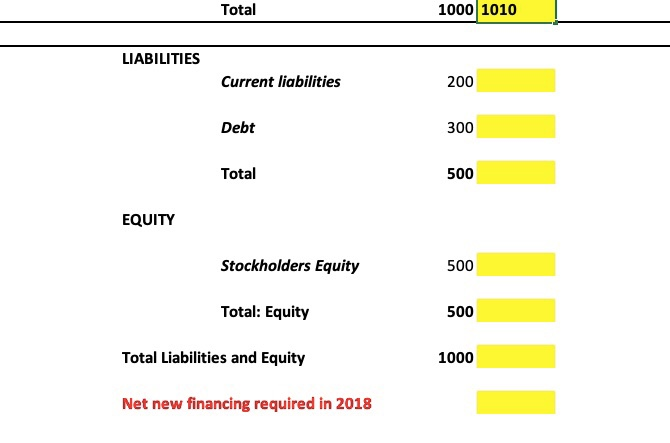

construct a pro forma balance sheet in exercise 1( already done) and pro formance income statement in exercise 2. by using the percent of sales method. Answers must go in in the yellow marked.

briefly explain the steps followed.

Assignment business finance A Home Review View ABESU: Inert Drew Page Layout Calibri (Body - 11 BI B Formulas A A A Duta = E Share 24. Comments 4 . . . . . 2 wa Tot r yt & Center General % . Conditionem R E M N O P 1 Name 2 Date of birth (ddmmww) 1011995 Assumptions 1. Percent of sales method 2. Dividend rate Ox in 2017, Dividend rate 2018 1012% Complete pro forma balance sheet for 2018 Calculate net new financing required in 2018 (hint: it is a difference between assets. liabilities equity in 2018) hint2: equity 2018-quity 2017 retained earnings in 2018 Additional Info from income statement Sales Net Income 1000 1625 1010 180 PRO FORMA MALANCE SHEET ASSETS Current assets 2017 2018 accounts receivable inventaries Total: Current assets Long term assets Total 28 UABILITIES Assignment business finance A Home ABESU: Inert Drew Page Layout Colibri (Body 11 BT. B Formulas A A A Duta = E Review View == > EE Share . Comments 4 . . . . . . LU wafet 891 * Core General % . cotondo . ! De x. ASSETS 2017 2018 Current assets cash accounts receivable inventories Total Current assets Long term assets Total UABILITIES Current Mobilities Debt Total EQUITY Stockholders Equity Total Equity Total Liabilities and Equity Net new financing required in 2018 AutoSave OFF ARE S U : Assignmenttest2-business finance Insert View Data = Home v Paste 034 Formulas A A A Review = Draw Page Layout Calibri (Body) 11 IU v fx Wrap Text Merge & Center B General % ) Conditional Format x 2 Name 3 Date of birth (ddmmyyyy) Assumptions 1011995 1. Sales will grow 1.012% Next year Ex 1: Fill the numbers for 2018 based on percent of sales method Answer the question below Income statement 2018 Sales Cost of sales (not incl depreciation) 1010.12 505.06 505.06 EBITDA Depreciation EBIT 200 305.06 Interest expenses Pretax income 250 255.06 Income tax (35%) Net Income Percentage on sales 87.5 162.5 16.25% 89.271 165.79 16.41% Question 2.02% On how much (%) the net income will grow next year? Percentage on previous year (165.78 - 162.5/162.5) 100 1. The formula for 2018 sales 2017 sales growth rate 2. Cost of sales 2018 is 2017 cost of sales/2017 sales 2018 sales 3. As there is an absence of information about depreciation & interest expense the figures are considered from 2017 4. Income tax rate is 35%, Pretax income is 255.06. 35 Ex1 Ex2 + Ready Assumptions 1. Percent of sales method 2. Dividend rate 0% in 2017, Dividend rate 2018 1.012% Task Complete pro forma balance sheet for 2018 Calculate net new financing required in 2018 (hint: it is a difference between (assets - (liabilities+equity)] in 2018) hint2: equity 2018-equity 2017 + retained earnings in 2018 Additional info from income statement Sales Net Income 1000 162.5 1010 180 2017 2018 PRO FORMA BALANCE SHEET ASSETS Current assets cash accounts receivable inventories Total: Current assets Long term assets 500 Total 1000 Total 1000 1010 LIABILITIES Current liabilities 200 Debt 300 Total 500 EQUITY Stockholders Equity 500 Total: Equity 500 Total Liabilities and Equity 1000 Net new financing required in 2018