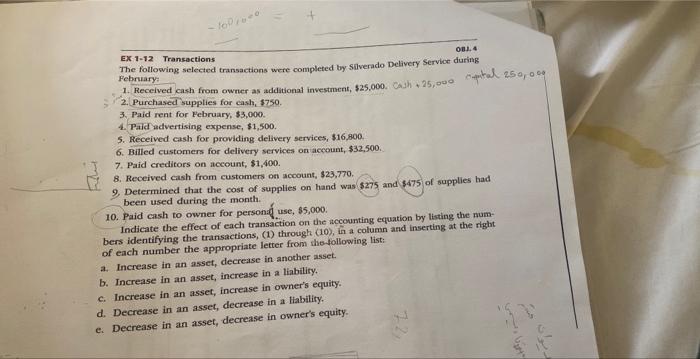

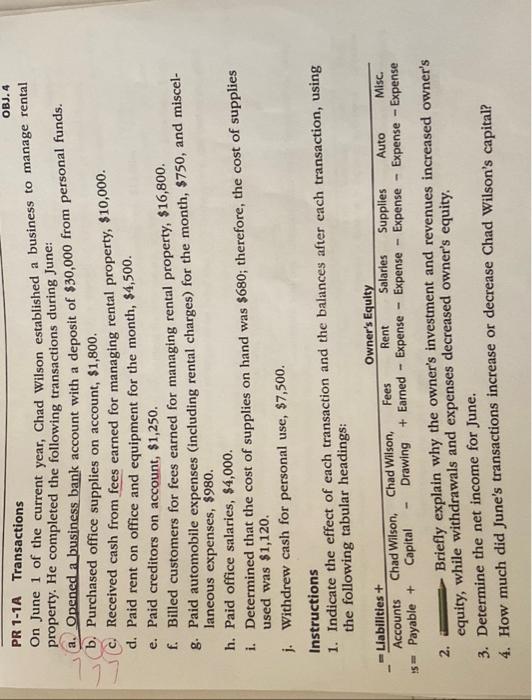

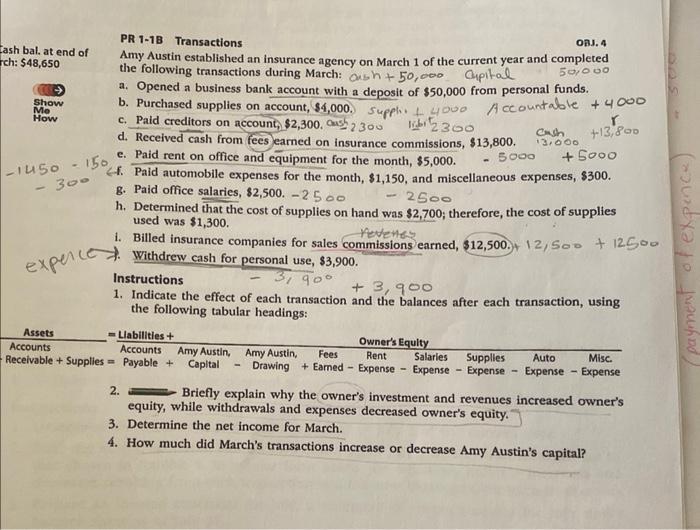

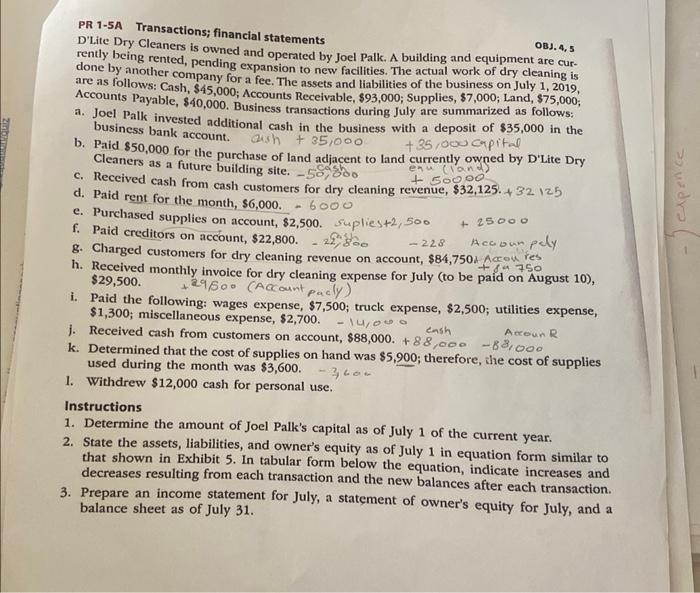

EX 1-12 Transactions The following selected transactions were completed by silverado Delivery Service during Fehruary; 1. Received cash from owner as addational investment, $25,000. Gath +25,000, thithal 2.50,0.0 2. Purchased supplies for eash, $750. 3. Paid rent for February, $3,000. 4. Paic actuertising expense, $1,500. 5. Received eash for providing delivery services, $16,800. 6. Bitled customers for delivery services on account, $32,500. 7. Paid creditors on atceount, \$1,400. 8. Received cash from custcimere on accotant, $23,770. 9. Determined that the cost of supplies on hand was $275 and $475 of supplies had been used during the month. 10. Paid cash to owner for personed use, 55,000 . Indicate the effect of each transaction on the thccounting equation by listing the numbers identifying the transactions, (1) through (10), in a column and inserting at the right of each number the appropriate letter from the following list: a. Increase in an asset, decrease in another asset. b. Increase in an asset, increase in a liability. c. Increase in an asset, increase in owner's equity. d. Decrease in an asset, decrease in a Hability. e. Decrease in an asset, decrease in owner's equity. PR 1-1A Transactions On June 1 of the current year, Chad Wilson established a business to manage rental property. He completed the following transactions during June: a. Opened a business bank account with a deposit of $30,000 from personal funds. b. Purchased office supplies on account, $1,800. c. Received cash from fees earned for managing rental property, $10,000. d. Paid rent on office and equipment for the month, $4,500. e. Paid creditors on account, $1,250. f. Billed customers for fees earned for managing rental property, $16,800. g. Paid automobile expenses (including rental charges) for the month, $750, and miscellaneous expenses, \$980. h. Paid office salaries, $4,000. i. Determined that the cost of supplies on hand was $680; therefore, the cost of supplies used was $1,120. j. Withdrew cash for personal use, $7,500. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: 2. Briefly explain why the owner's investment and revenues increased owner's equity, while withdrawals and expenses decreased owner's equity. 3. Determine the net income for June. 4. How much did June's transactions increase or decrease Chad Wilson's capital? PR 1-1B Transactions Amy Austin established an insurance agency on March 1 of the current year and completed the following transactions during March: 0ubh+50,000 Cupital 50,000 a. Opened a business bank account with a deposit of $50,000 from personal funds. b. Purchased supplies on account, $4,000. Suppli +4000 A countable + 4000 c. Paid creditors on account, $2,300, cash 2300 12b, 2300 , awh +13,800 d. Received cash from fees earned on insurance commissions, $13,800. 13,000+13,800 e. Paid rent on office and equipment for the month, $5,000. g. Paid office salaries, 82,500.25002500 h. Determined that the cost of supplies on hand was $2,700; therefore, the cost of supplies used was $1,300. i. Billed insurance companies for sales commissions earned, $12,500.+12,500+12500 e. Withdrew cash for personal use, $3,900. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: 2. Briefly explain why the owner's investment and revenues increased owner's equity, while withdrawals and expenses decreased owner's equity. 3. Determine the net income for March. 4. How much did March's transactions increase or decrease Amy Austin's capital? PR 1-5A Transactions; financial statements OBJ.4, 5 D'Lite Dry Cleaners is owned and operated by Joel Palk. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company for a fee. The assets and liabilities of the business on July 1,2019 , are as follows: Cash, \$45,000; Accounts Receivable, \$93,000; Supplies, \$7,000; Land, \$75,000; Accounts Payable, $40,000. Business transactions during July are summarized as follows: a. Joel Palk invested additional cash in the business with a deposit of $35,000 in the business bank account. aish +35,000+35,000crpital b. Paid $50,000 for the purchase of land adjacent to land currently owned by D'Lite Dry Cleaners as a future building site. 50,5000 so the land c. Received cash from cash customers for dry cleaning revenue, $32,125+32125 d. Paid rent for the month, $6,000. 6000 f. Paid creditors on account, $22,800=22,560228 Aco oun pely h. Received monthly invoice for dry cleaning exper $29,500. +29/500 (Account Pacly) i. Paid the following: wages expense, $7,500; truck expense, $2,500; thilities expe k. Determined that the cost of supplies on hand was $ used during the month was $3,600. 1. Withdrew Instructions 1. Determine the amount of Joel Palk's capital as of July 1 of the current year. 2. State the assets, liabilities, and owner's equity as of July 1 in equation form similar to decreases resulting from each transaction and the new balances after each transaction. 3. Prepare an income statement for July, a statement of owner's equity for July, and a balance sheet as of July 31