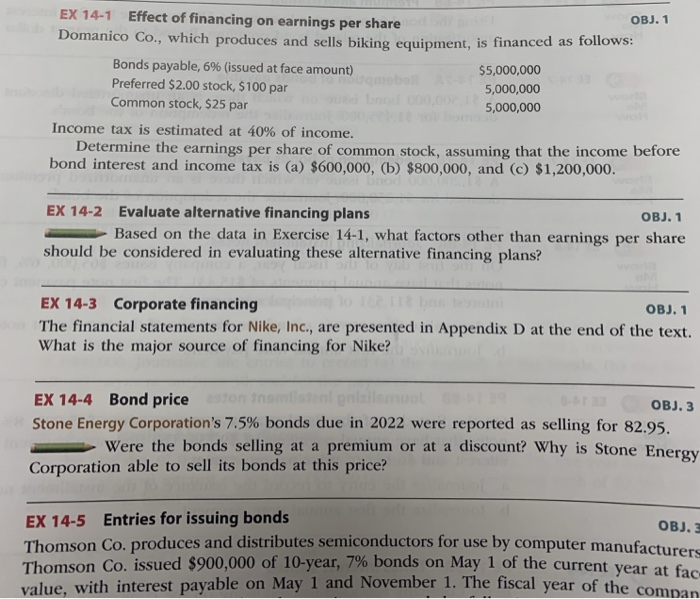

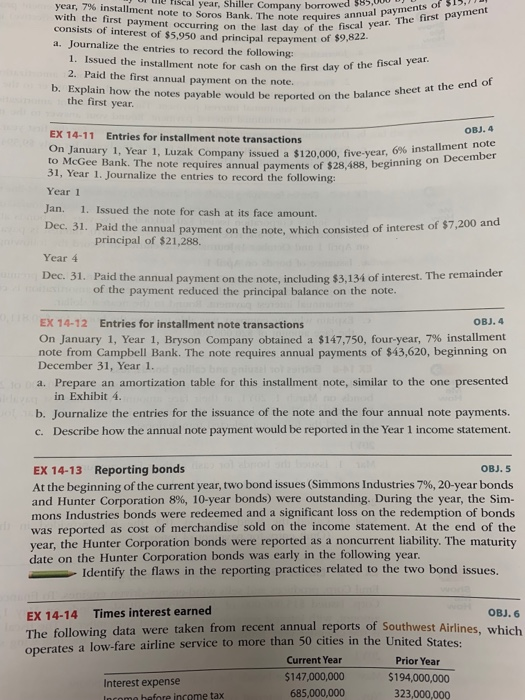

EX 14-1 Effect of financing on earnings per share Domanico Co., which produces and sells biking equipment, is financed as follows: OBJ. 1 Bonds payable, 6% (issued at face amount) Preferred $2.00 stock, $100 par Common stock, $25 par $5,000,000 5,000,000 5,000,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is (a) $600,000, (b) $800,000, and () $1,200,000. EX 14-2 Evaluate alternative financing plans should be considered in evaluating these alternative financing plans? OBJ.1 Based on the data in Exercise 14-1, what factors other than earnings per share EX 14-3 Corporate financing The financial statements for Nike, Inc., are presented in Appendix D at the end of the text. What is the major source of financing for Nike? OBJ. 1 EX 14-4 Bond price Stone Energy Corporation's 7.5% bonds due in 2022 were reported as selling for 82.95. OBJ. 3 Were the bonds selling at a premium or at a discount? Why is Stone Energy Corporation able to sell its bonds at this price? EX 14-5 Entries for issuing bonds Thomson Co. produces and distributes semiconductors for use by computer manufacturers Thomson Co. issued $900,000 of 10-year, 7% bonds on May 1 of the current yea value, with interest payable on May 1 and November OBJ. 3 r at fac coman 1. The fiscal year of the year, 7% installment note to Soros Bank. The note requiresaal yea with the first payment occurring on the last day of the tis riscal year, Shiller Company borrowed . annual yments a. Journalize the entries to record the following: 1. Issued the installment note for cash on the first day o 2. Paid the first annual payment on the note b. Explain how the notes payable would be reported on the balance sheet at the end of OBJ. 4 EX 14-11 Entries for installment note transactions On January 1, Year 1, Luzak Company issued a $120,000, five-year, 6 to McGee Bank. The note requires annual payments of $28,488, beginning on 31, Year 1. Journalize the entries to record the following: Year 1 Jan. 1. Issued the note for cash at its face amount Dec. 31. Paid the annual payment on the note, which consisted of interest of $7,200 and principal of $21,288. Year Dec. 31. Paid the annual payment on the note, including $3,134 of interest. The remainder the payment reduced the principal balance on the note EX 14-12 Entries for installment note transactions OBJ. 4 On January 1, Year 1, Bryson Company obtained a $147,750, four-year, 7% installment note from Campbell Bank. The note requires annual payments of $43,620, beginning on December 31, Year 1 a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4 b. Journalize the entries for the issuance of the note and the four annual note payments. c. Describe how the annual note payment would be reported in the Year 1 income statement. EX 14-13 Reporting bonds At the beginning of the current year, two bond issues (Simmons Industries 7% 20-year bonds and Hunter Corporation 896 10-year bonds) were outstanding. During the year, the Sim mons Industries bonds were redeemed and a significant loss on the redemption of bonds was reported as cost of merchandise sold on the income statement. At the end of the year, the Hunter Corporation bonds were reported as a noncurrent liability. The maturity date on the Hunter Corporation bonds was early in the following year OBJ. 5 Identify the flaws in the reporting practices related to the two bond issues. EX 14-14 Times interest earned The following data were taken from recent annual reports of Southwest Airlines, which OBJ. 6 rates a low-fare airline service to more than 50 cities in the United States: Year $147,000,000 685,000,000 Current Prior Year $194,000,000 323,000,000 Interest expense me tax EX 14-1 Effect of financing on earnings per share Domanico Co., which produces and sells biking equipment, is financed as follows: OBJ. 1 Bonds payable, 6% (issued at face amount) Preferred $2.00 stock, $100 par Common stock, $25 par $5,000,000 5,000,000 5,000,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is (a) $600,000, (b) $800,000, and () $1,200,000. EX 14-2 Evaluate alternative financing plans should be considered in evaluating these alternative financing plans? OBJ.1 Based on the data in Exercise 14-1, what factors other than earnings per share EX 14-3 Corporate financing The financial statements for Nike, Inc., are presented in Appendix D at the end of the text. What is the major source of financing for Nike? OBJ. 1 EX 14-4 Bond price Stone Energy Corporation's 7.5% bonds due in 2022 were reported as selling for 82.95. OBJ. 3 Were the bonds selling at a premium or at a discount? Why is Stone Energy Corporation able to sell its bonds at this price? EX 14-5 Entries for issuing bonds Thomson Co. produces and distributes semiconductors for use by computer manufacturers Thomson Co. issued $900,000 of 10-year, 7% bonds on May 1 of the current yea value, with interest payable on May 1 and November OBJ. 3 r at fac coman 1. The fiscal year of the year, 7% installment note to Soros Bank. The note requiresaal yea with the first payment occurring on the last day of the tis riscal year, Shiller Company borrowed . annual yments a. Journalize the entries to record the following: 1. Issued the installment note for cash on the first day o 2. Paid the first annual payment on the note b. Explain how the notes payable would be reported on the balance sheet at the end of OBJ. 4 EX 14-11 Entries for installment note transactions On January 1, Year 1, Luzak Company issued a $120,000, five-year, 6 to McGee Bank. The note requires annual payments of $28,488, beginning on 31, Year 1. Journalize the entries to record the following: Year 1 Jan. 1. Issued the note for cash at its face amount Dec. 31. Paid the annual payment on the note, which consisted of interest of $7,200 and principal of $21,288. Year Dec. 31. Paid the annual payment on the note, including $3,134 of interest. The remainder the payment reduced the principal balance on the note EX 14-12 Entries for installment note transactions OBJ. 4 On January 1, Year 1, Bryson Company obtained a $147,750, four-year, 7% installment note from Campbell Bank. The note requires annual payments of $43,620, beginning on December 31, Year 1 a. Prepare an amortization table for this installment note, similar to the one presented in Exhibit 4 b. Journalize the entries for the issuance of the note and the four annual note payments. c. Describe how the annual note payment would be reported in the Year 1 income statement. EX 14-13 Reporting bonds At the beginning of the current year, two bond issues (Simmons Industries 7% 20-year bonds and Hunter Corporation 896 10-year bonds) were outstanding. During the year, the Sim mons Industries bonds were redeemed and a significant loss on the redemption of bonds was reported as cost of merchandise sold on the income statement. At the end of the year, the Hunter Corporation bonds were reported as a noncurrent liability. The maturity date on the Hunter Corporation bonds was early in the following year OBJ. 5 Identify the flaws in the reporting practices related to the two bond issues. EX 14-14 Times interest earned The following data were taken from recent annual reports of Southwest Airlines, which OBJ. 6 rates a low-fare airline service to more than 50 cities in the United States: Year $147,000,000 685,000,000 Current Prior Year $194,000,000 323,000,000 Interest expense me tax