Answered step by step

Verified Expert Solution

Question

1 Approved Answer

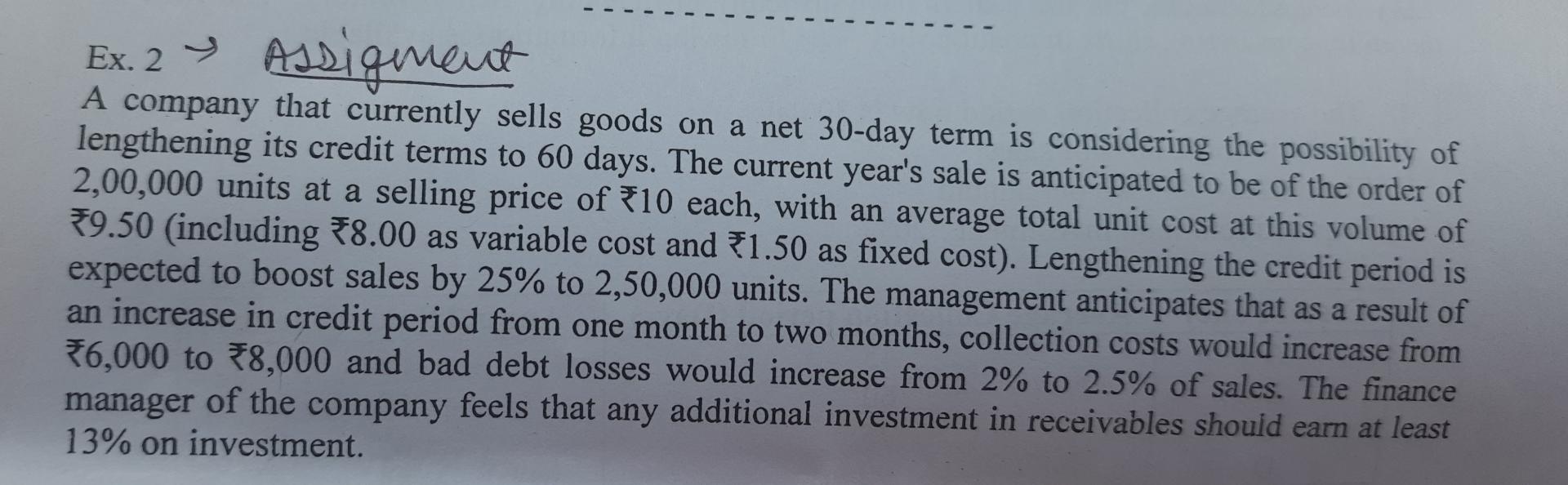

Ex . 2 Assigment A company that currently sells goods on a net 3 0 - day term is considering the possibility of lengthening its

Ex Assigment

A company that currently sells goods on a net day term is considering the possibility of lengthening its credit terms to days. The current year's sale is anticipated to be of the order of units at a selling price of each, with an average total unit cost at this volume of including as variable cost and as fixed cost Lengthening the credit period is expected to boost sales by to units. The management anticipates that as a result of an increase in credit period from one month to two months, collection costs would increase from to and bad debt losses would increase from to of sales. The finance manager of the company feels that any additional investment in receivables should earn at least on investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started