Answered step by step

Verified Expert Solution

Question

1 Approved Answer

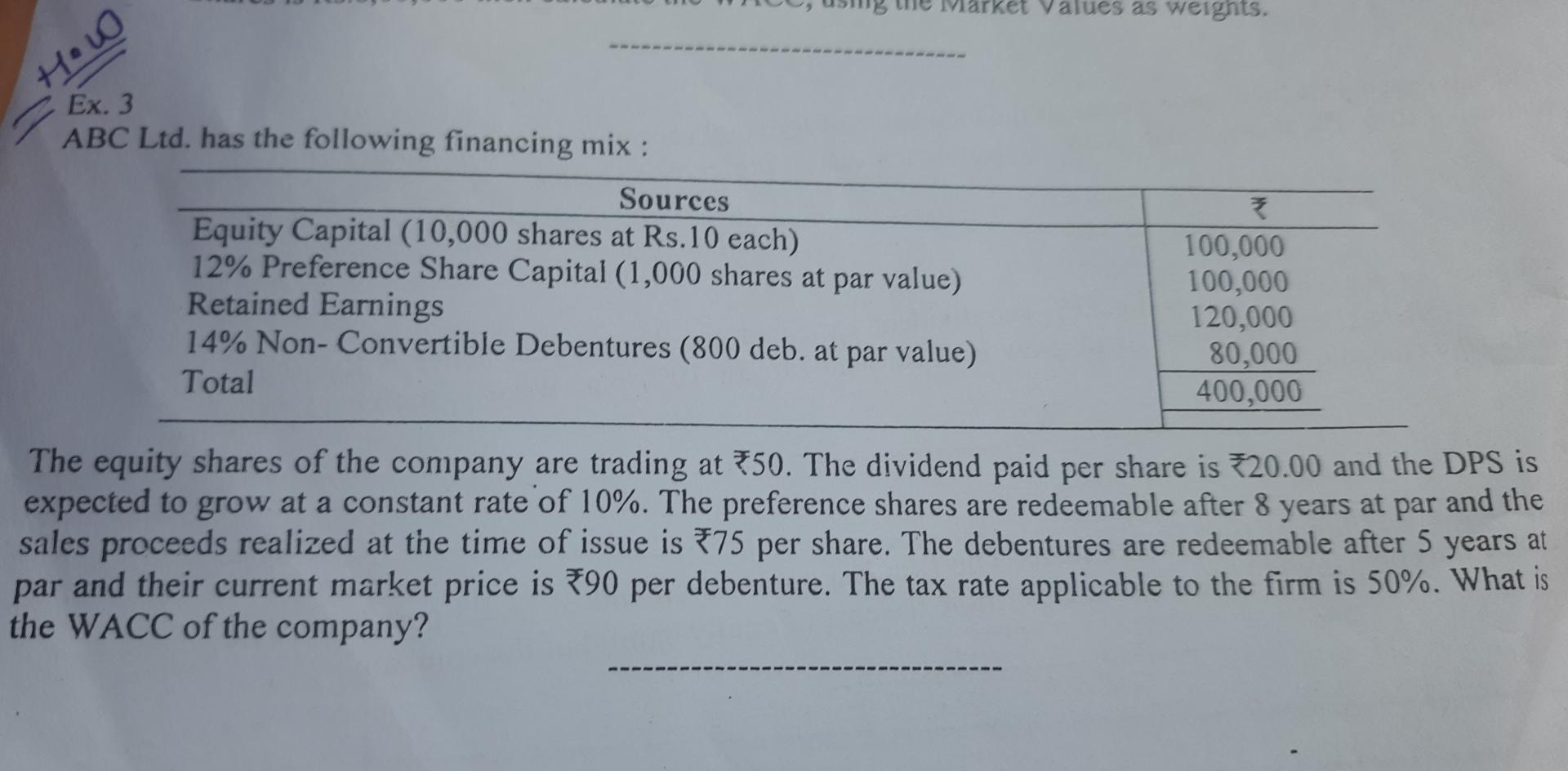

Ex . 3 ABC Ltd . has the following financing mix : table [ [ Sources , ] , [ Equity Capital ( 1

Ex

ABC Ltd has the following financing mix :

tableSourcesEquity Capital shares at Rs each Preference Share Capital shares at par valueRetained Earnings, Non Convertible Debentures deb. at par valueTotal

The equity shares of the company are trading at The dividend paid per share is and the DPS is expected to grow at a constant rate of The preference shares are redeemable after years at par and the sales proceeds realized at the time of issue is per share. The debentures are redeemable after years at par and their current market price is per debenture. The tax rate applicable to the firm is What is the WACC of the company?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started