Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 - What are the most important features of the salary tax system and the tax of free professions in the country that you

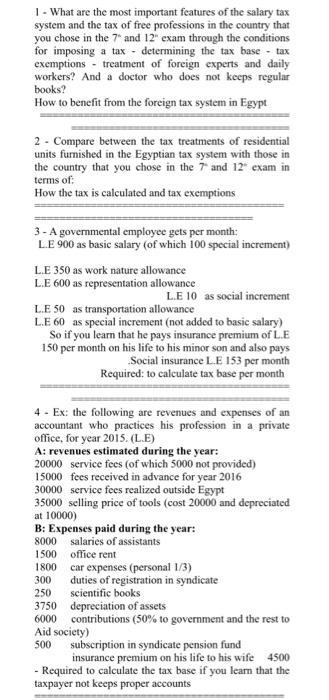

1 - What are the most important features of the salary tax system and the tax of free professions in the country that you chose in the 7 and 12" exam through the conditions for imposing a tax determining the tax base - tax exemptions - treatment of foreign experts and daily workers? And a doctor who does not keeps regular books? - How to benefit from the foreign tax system in Egypt 2 - Compare between the tax treatments of residential units furnished in the Egyptian tax system with those in the country that you chose in the 7 and 12" exam in terms of: How the tax is calculated and tax exemptions 3- A governmental employee gets per month: L.E 900 as basic salary (of which 100 special increment) L.E 350 as work nature allowance L.E 600 as representation allowance L.E 10 as social increment L.E 50 as transportation allowance L.E 60 as special increment (not added to basic salary) So if you learn that he pays insurance premium of L.E 150 per month on his life to his minor son and also pays Social insurance L.E 153 per month Required: to calculate tax base per month 4 - Ex: the following are revenues and expenses of an accountant who practices his profession in a private office, for year 2015. (L.E) A: revenues estimated during the year: 20000 service fees (of which 5000 not provided) 15000 fees received in advance for year 2016 30000 service fees realized outside Egypt 35000 selling price of tools (cost 20000 and depreciated at 10000) B: Expenses paid during the year: 8000 salaries of assistants 1500 office rent 1800 car expenses (personal 1/3) 300 250 duties of registration in syndicate scientific books 3750 depreciation of assets 6000 contributions (50% to government and the rest to Aid society) 500 subscription in syndicate pension fund insurance premium on his life to his wife 4500 - Required to calculate the tax base if you learn that the taxpayer not keeps proper accounts

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Features of Salary Tax System and Tax of Free Professions in Egypt Conditions for Imposing a Tax In Egypt the salary tax system applies to individuals earning a salary or wage income The tax on free p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started