Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ex.06.148 Ex.06.165 The following data regarding purchases and sales of a commodity were taken from the related perpetual inventory account: Ex.06.166 Ex.06.169 Ex.06.173 b I

Ex.06.148

Ex.06.165

The following data regarding purchases and sales of a commodity were taken from the related perpetual inventory account:

Ex.06.166

Ex.06.169

Ex.06.173

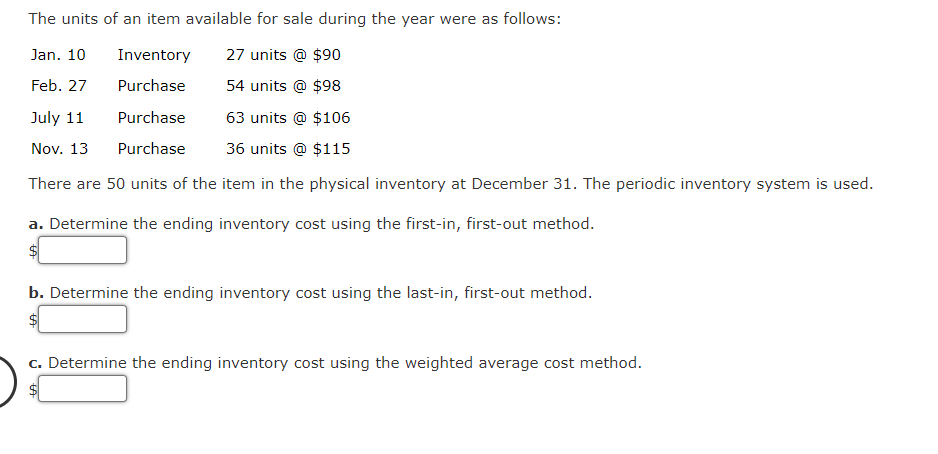

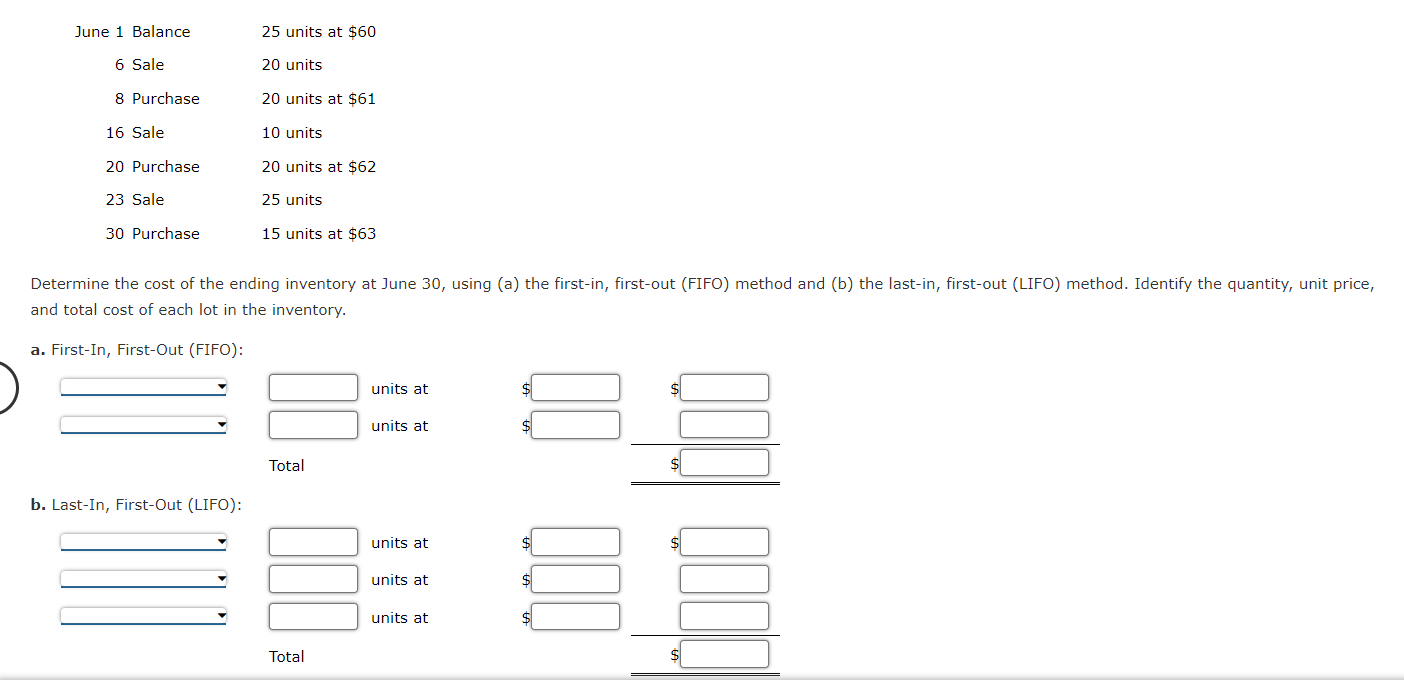

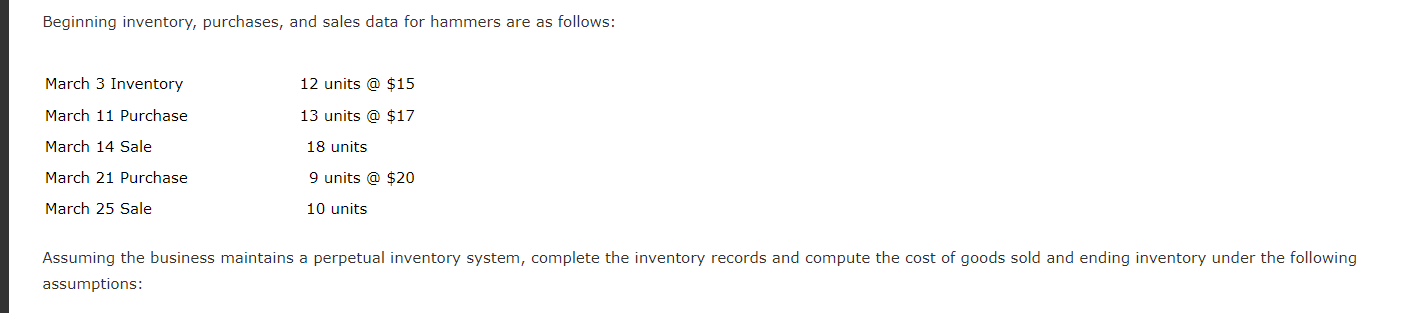

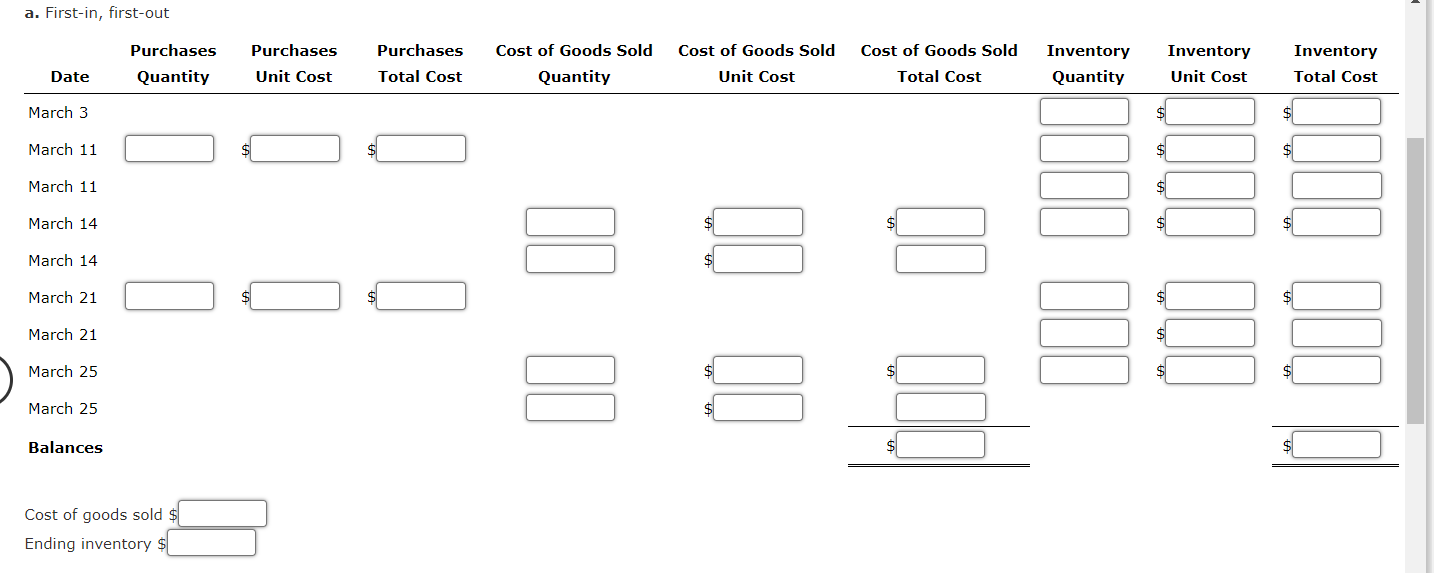

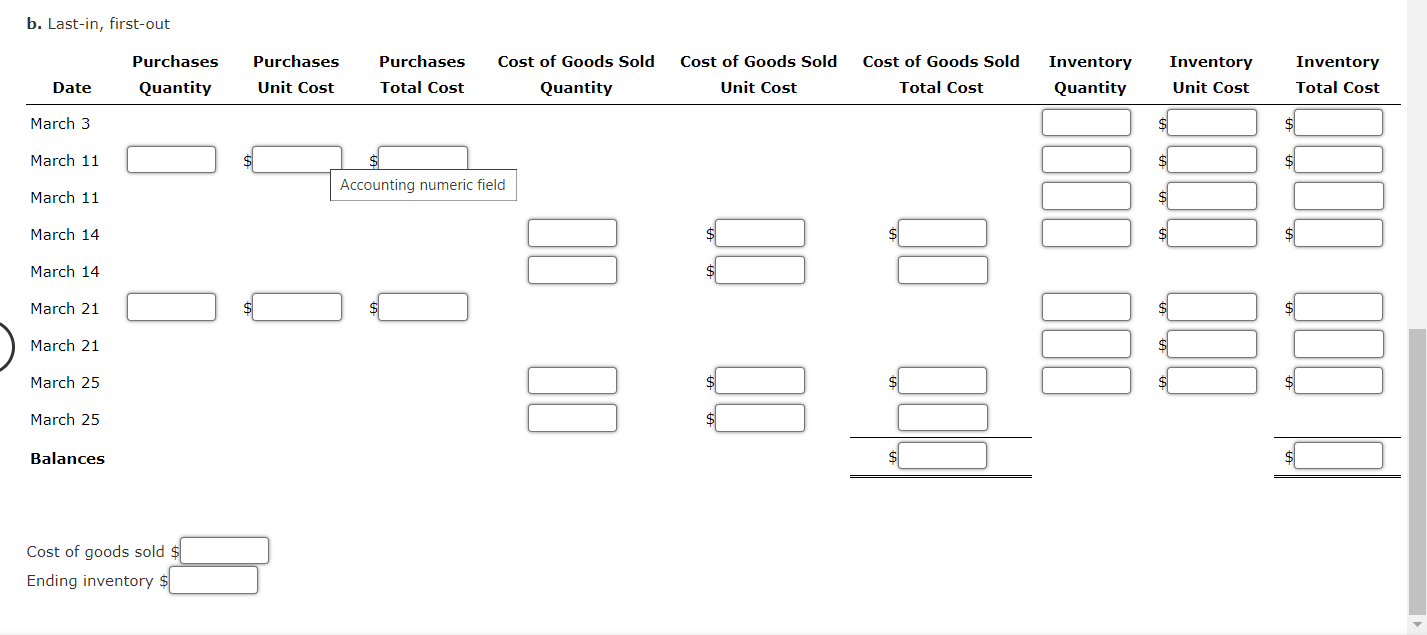

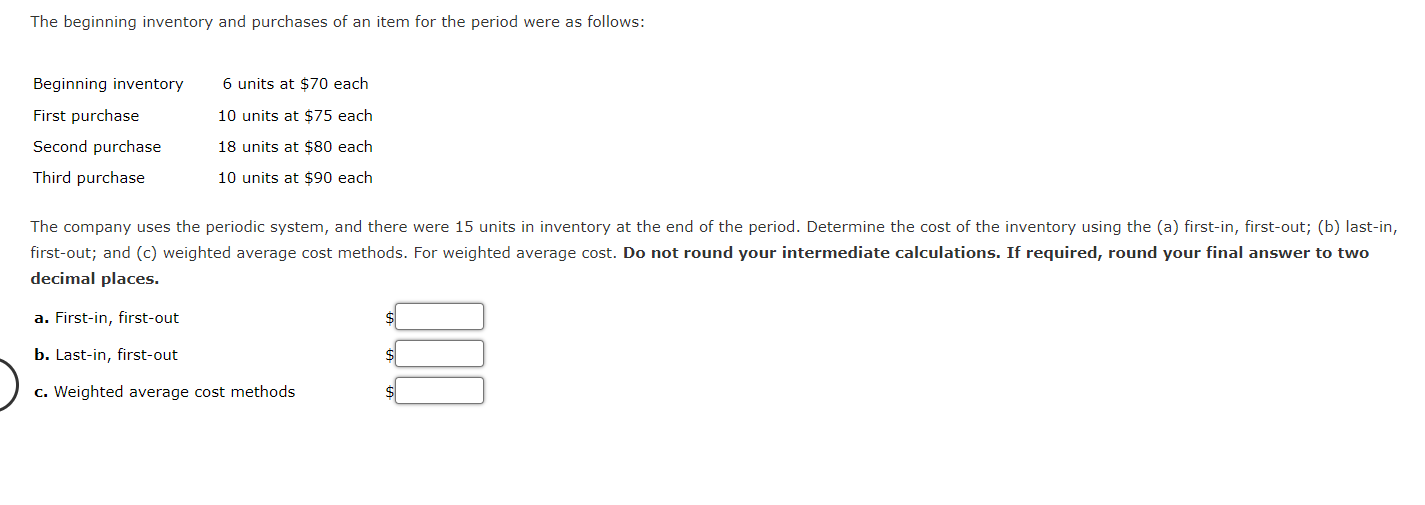

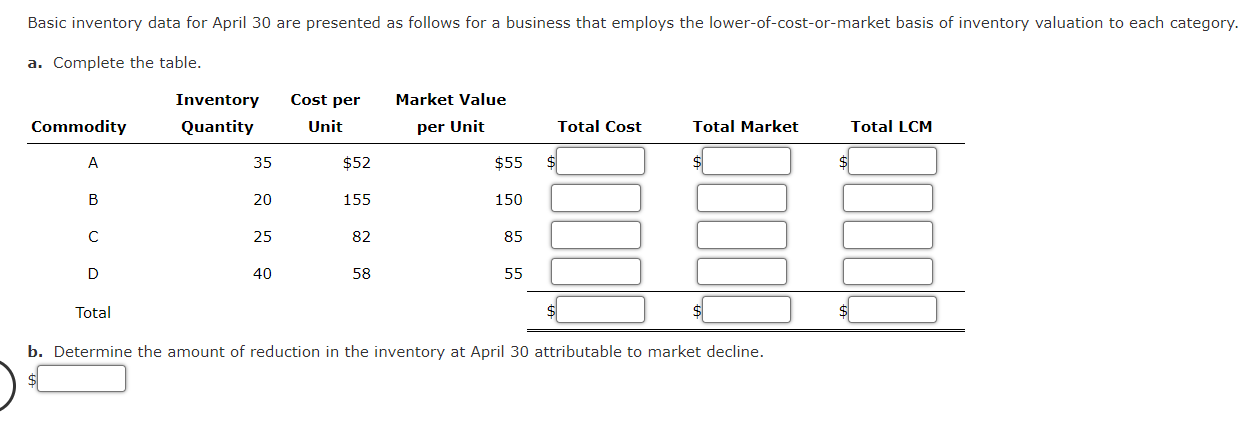

b I sot_in firct_nit The beginning inventory and purchases of an item for the period were as follows: The company uses the periodic system, and there were 15 units in inventory at the end of the period. Determine the cost of the inventory using the (a) first-in, first-out; (b) last-in, first-out; and (c) weighted average cost methods. For weighted average cost. Do not round your intermediate calculations. If required, round your final answer to two decimal places. a. First-in. first-out The units of an item available for sale during the year were as follows: There are 50 units of the item in the physical inventory at December 31 . The periodic inventory system is used. a. Determine the ending inventory cost using the first-in, first-out method. $ b. Determine the ending inventory cost using the last-in, first-out method. $ c. Determine the ending inventory cost using the weighted average cost method. $ Beginning inventory, purchases, and sales data for hammers are as follows: Assuming the business maintains a perpetual inventory system, complete the inventory records and compute the cost of goods sold and ending inventory under the following assumptions: Basic inventory data for April 30 are presented as follows for a business that employs the lower-of-cost-or-market basis of inventory valuation to each category. a. Complete the table. b. Determine the amount of reduction in the inventory at April 30 attributable to market decline. Determine the cost of the ending inventory at June 30, using (a) the first-in, first-out (FIFO) method and (b) the last-in, first-out (LIFO) method. Identify the quantity, unit price, and total cost of each lot in the inventory

b I sot_in firct_nit The beginning inventory and purchases of an item for the period were as follows: The company uses the periodic system, and there were 15 units in inventory at the end of the period. Determine the cost of the inventory using the (a) first-in, first-out; (b) last-in, first-out; and (c) weighted average cost methods. For weighted average cost. Do not round your intermediate calculations. If required, round your final answer to two decimal places. a. First-in. first-out The units of an item available for sale during the year were as follows: There are 50 units of the item in the physical inventory at December 31 . The periodic inventory system is used. a. Determine the ending inventory cost using the first-in, first-out method. $ b. Determine the ending inventory cost using the last-in, first-out method. $ c. Determine the ending inventory cost using the weighted average cost method. $ Beginning inventory, purchases, and sales data for hammers are as follows: Assuming the business maintains a perpetual inventory system, complete the inventory records and compute the cost of goods sold and ending inventory under the following assumptions: Basic inventory data for April 30 are presented as follows for a business that employs the lower-of-cost-or-market basis of inventory valuation to each category. a. Complete the table. b. Determine the amount of reduction in the inventory at April 30 attributable to market decline. Determine the cost of the ending inventory at June 30, using (a) the first-in, first-out (FIFO) method and (b) the last-in, first-out (LIFO) method. Identify the quantity, unit price, and total cost of each lot in the inventory Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started