Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ex6.9 Exercise 6.9 CURRENT AND DEFERRED TAX WITH TAX RATE CHANGE You have been asked by the accountant of Fennel Ltd to prepare the tax-effect

Ex6.9

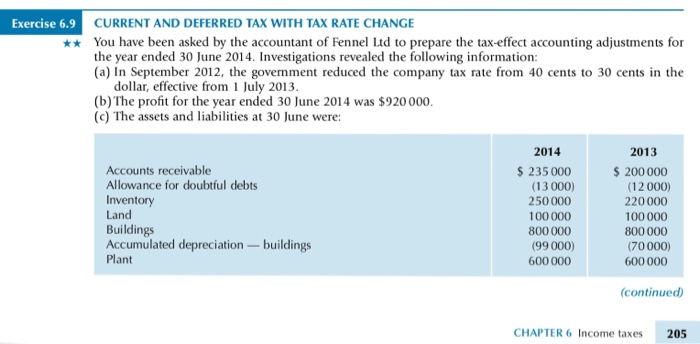

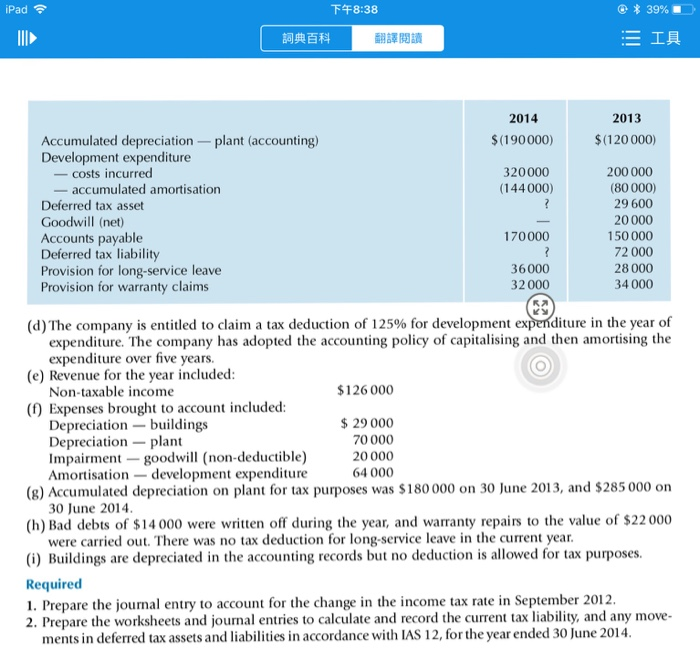

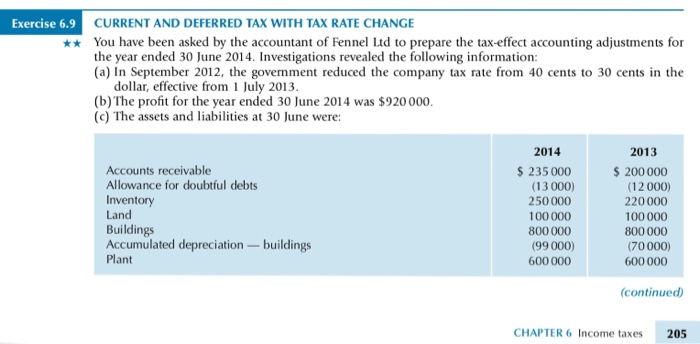

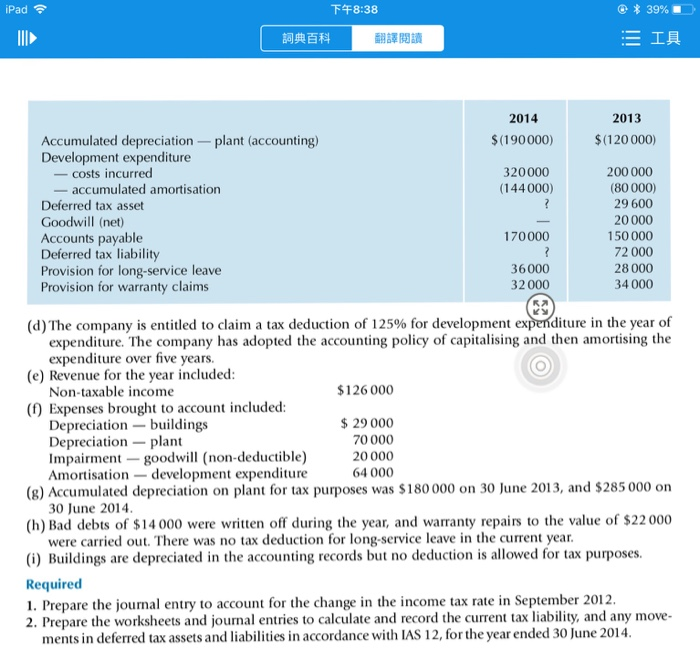

Exercise 6.9 CURRENT AND DEFERRED TAX WITH TAX RATE CHANGE You have been asked by the accountant of Fennel Ltd to prepare the tax-effect accounting adjustments for the year ended 30 June 2014. Investigations revealed the following information (a) In September 2012, the government reduced the company tax rate from 40 cents to 30 cents in the dollar, effective from 1 July 2013 (b)The profit for the year ended 30 June 2014 was $920000 (c) The assets and liabilities at 30 June were 2014 2013 Accounts receivable Allowance for doubtful debts Inventory Land Buildings Accumulated depreciation buildings Plant $ 235 000 $ 200000 (13 000) 250000 100000 800000 (99000) 600000 (12 000) 220000 100000 800000 (70000) 600000 (continued) CHAPTER 6 Income taxes205

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started