Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exactly two years ago, you were contemplating a new project. To execute it, you bought land for 1 million, built a building (instantaneously) for

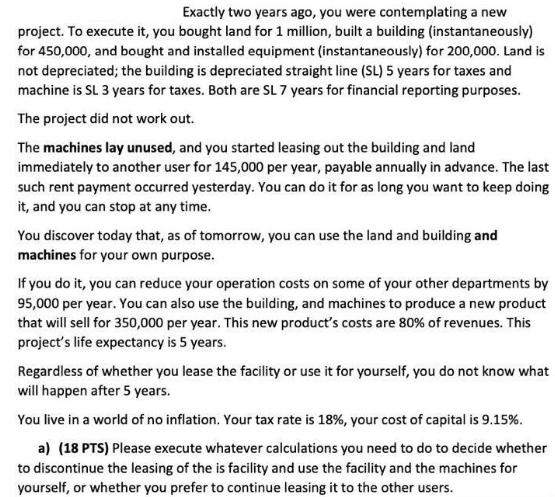

Exactly two years ago, you were contemplating a new project. To execute it, you bought land for 1 million, built a building (instantaneously) for 450,000, and bought and installed equipment (instantaneously) for 200,000. Land is not depreciated; the building is depreciated straight line (SL) 5 years for taxes and machine is SL 3 years for taxes. Both are SL 7 years for financial reporting purposes. The project did not work out. The machines lay unused, and you started leasing out the building and land immediately to another user for 145,000 per year, payable annually in advance. The last such rent payment occurred yesterday. You can do it for as long you want to keep doing it, and you can stop at any time. You discover today that, as of tomorrow, you can use the land and building and machines for your own purpose. If you do it, you can reduce your operation costs on some of your other departments by 95,000 per year. You can also use the building, and machines to produce a new product that will sell for 350,000 per year. This new product's costs are 80% of revenues. This project's life expectancy is 5 years. Regardless of whether you lease the facility or use it for yourself, you do not know what will happen after 5 years. You live in a world of no inflation. Your tax rate is 18%, your cost of capital is 9.15%. a) (18 PTS) Please execute whatever calculations you need to do to decide whether to discontinue the leasing of the is facility and use the facility and the machines for yourself, or whether you prefer to continue leasing it to the other users.

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To decide whether to discontinue leasing the facility and use it for yourself or continue leasing it ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started