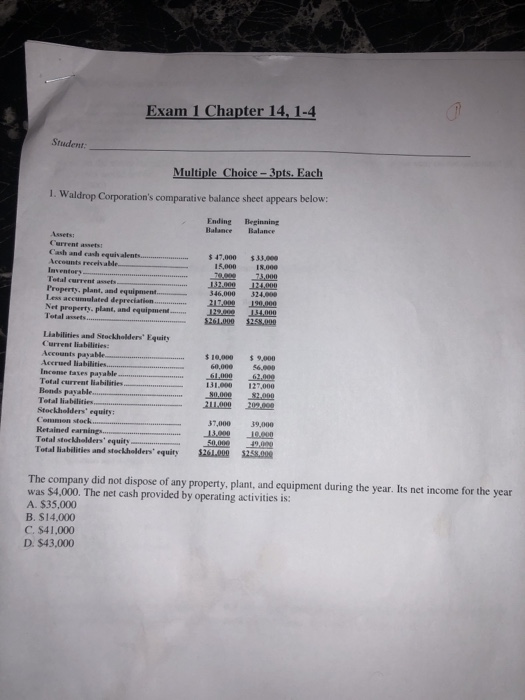

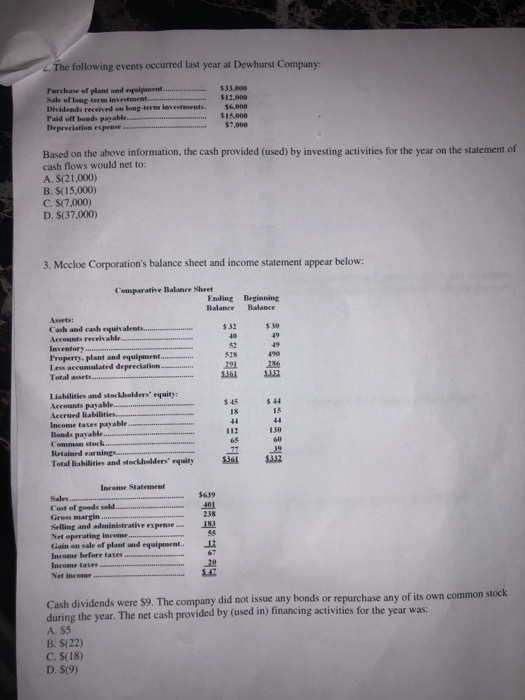

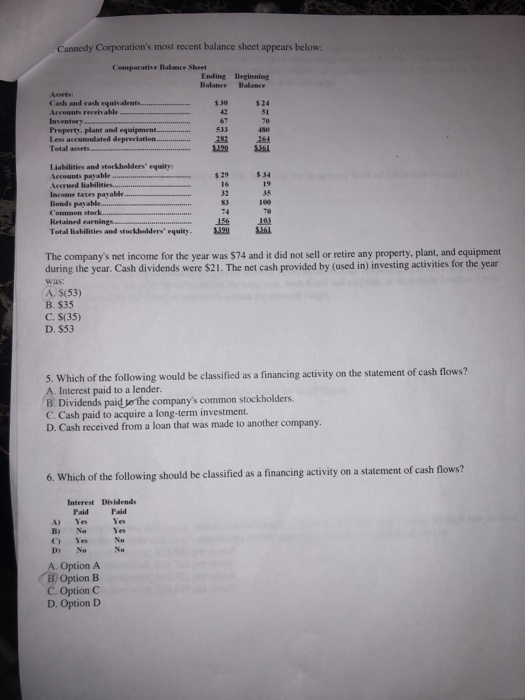

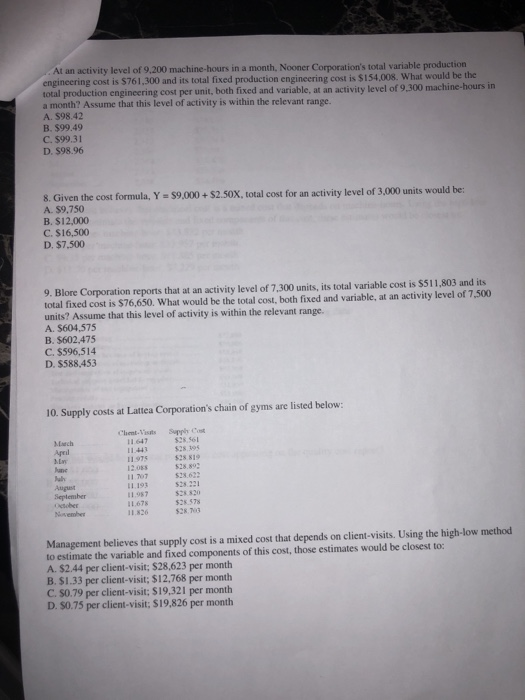

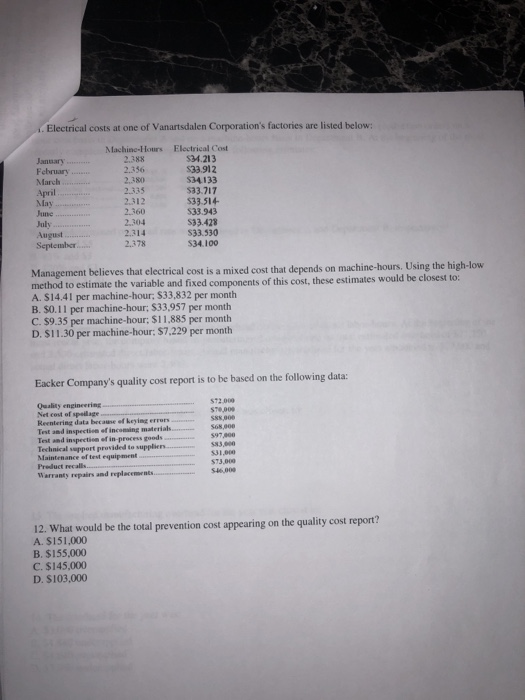

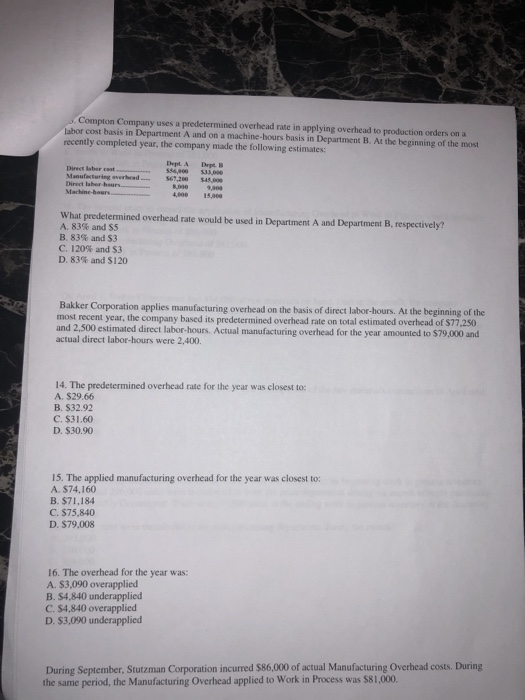

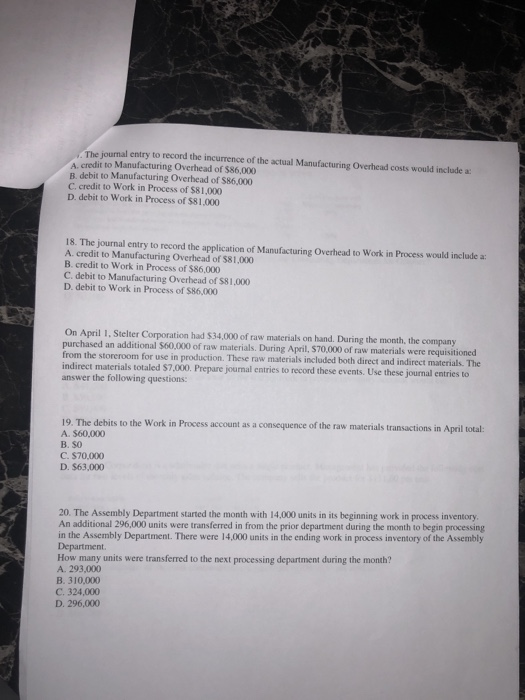

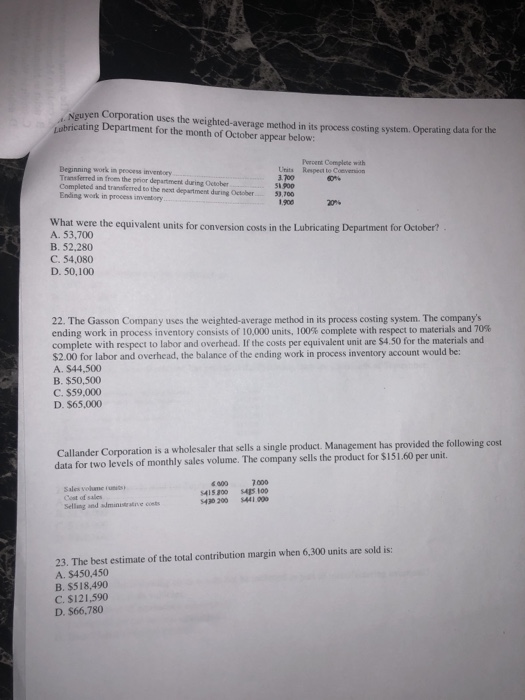

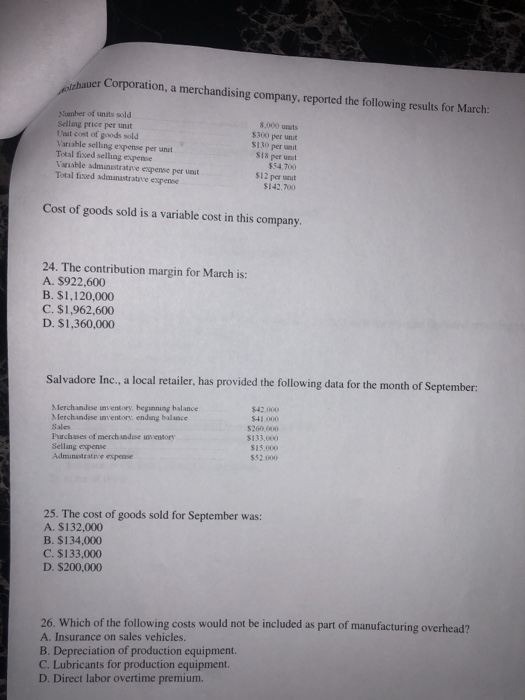

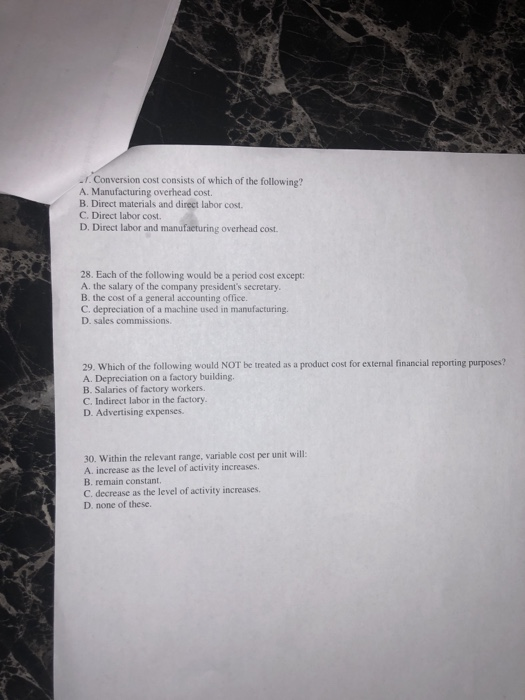

Exam 1 Chapter 14, 1-4 Student Multiple Choice -3pts. Each 1. Waldrop Corporation's comparative balance sheet appears below Ending Beginning Balance Balance Assets: Current asets Cash and eash equivalents $ 47.000 $ 33,000 15,00018.000 Accounts receivalle laventory Total current assets Property, plant, and equipment Less accumulated depreciation217.000 199 Net property, plant, and equipment 4Mm 546,000 324.00 5261.000 $258,000 Liabilities and Stockholders' Equity Current liabilities: Accounts paya Accrued liabilities Inconse taxes payable Total current liabiliries. Bonds paya Total liabilities Stockholders' equiry: Commen stock Retained earnings 10,000 $ 9,000 60,000 56,000 61.000 62.000 131.000 127,000 7,000 39,000 Total stockholders' equity Total liabilities and stockholder' equity 201000 5253.000 The company did not dispose of any property, plant, and equipment during the year. Its net income for the year was $4,000. The net cash provided by operating activities is: A. $35,000 B. $14.000 C. $41,000 D. $43,000 . The following events occurred last year at Dewhurst Company: Parchase of plant and equipment Sale of long-term investment Dividends received on long-terms investments. $6,000 Paid off bonds payable Depreciation espense 533,000 $12,000 $15,000 $7,000 Based on the above information, the cash provided (used) by investing activities for the year on the statement of cash flows would net to: A. $(21,000) B. S(15,000) C. $(7,000) D. $(37,000) 3. Mccloe Corporation's balance sheet and income statement appear below: Comparative Balance Sheet Ending Beginning Balance Halance Cash and cash equivalents Accounts receivable Inventory su $32 sa %30 ........- 52 528 Property plant and equipent Less accummulated depreciation... Total assets 490 Liabilities and steckholders' equity: Accounts payable Aecrued liabilities Income tases payable Bonds payable $45$44 15 112 65 130 Common steck Total liabilities and stockholders equity $361 $332 Income Statement 5639 Cost of goeds seld Gress margin Selling and administrative exprase.185 Net operating inco . Gain on sale of plant and equipmemt.. 238 Income before taxes Income tases Net inceme $47 Cash dividends were $9. The company did not issue any bonds or repurchase any of its own common stock during the year. The net cash provided by (used in) financing activities for the year was: A. $5 B. S(22) C. S(18) D. $(9) Cannedy Corporation's most recent balance sheet appears below Comparative lalance Sheet Ending Beginning Balance Balance $ 30 $2 Cash and cash equivalents Accounts receiable Inventory Preperty, plant and equipmen. Less accunsulated depreciation..22 Tetal 42 Liabilities and stockholders equity Accounts payable Accrued liabilities Income taves payable Bonds payable Common stock Retained earnin Total liabilities and stockholders' equity $29 16 32 83 74 $34 19 35 15610 120 The company's net income for the year was $74 and it did not sell or retire any property, plant, and equipment during the year. Cash dividends were $21. The net cash provided by (used in) investing activities for the year was A. S(53) B. $35 C. $(35) D. S53 5. Which of the following would be classified as a financing activity on the statement of eash flows? Interest paid to a lender. B. Dividends paid jo the company's common stockholders. C. Cash paid to acquire a long-term investment. D. Cash received from a loan that was made to another company. 6. Which of the following should be classified as a financing activity on a statement of cash flows? Interest Dividends Paid Paid A) Yes Yes B) No Yes ) Yes No D) No A. Option A B OptionB C. Option C D. Option D At an activity level of 9,200 machine-hours in a month, Nooner Corporation's total variable production engineering cost is $761,300 and its total fixed production engineering cost is $154,008. What would be the total production engineering cost per unit, both fixed and variable, at an activity level of 9.300 machine-hours in a month? Assume that this level of activity is within the relevant range. A. $98.42 B. $99.49 C. S9931 D. $98.96 8. Given the cost formula, Y- $9,000+ $2.50x, total cost for an activity level of 3,000 units would be: A. $9,750 B. $12,000 C. $16,500 D. $7,500 9. Blore Corporation reports that at an activity level of 7.300 units, its total variable cost is $511,803 and its total fixed cost is $76,650. What would be the total units? Assume that this level of activity is within the relevant range. A. $604,575 B. $602,475 C. $596,514 D. $588,453 cost, both fixed and variable, at an activity level of 7,500 10. Supply costs at Lattea Corporation's chain of gyms are listed below: 11 647 28.561 $28.395 11975 $28819 12.08s$28.802 528.62 August 1.193 1.987 11,678 11.826 528221 $28.820 $28.57 28.703 ocsober Nxember Management believes that supply cost is a mixed cost that depends on client-visits. Using the high-low method to estimate the variable and fixed components of this cost, those estimates would be closest to: A. $2.44 per client-visit: $28,623 per month B. $1.33 per client-visit; S12,768 per month C. S0.79 per client-visit; $19,321 per month D. S0.75 per client-visit, $19,826 per month . Electrical costs at one of Vanartsdalen Corporation's factories are listed below: Machine-Hours Electrical Cost Jannary February March April May June July August 2.388 2.336 2.380 2.335 2.312 34.213 S33.912 34133 $33.717 33.514 2.304 2.314 2.378 S33.428 S33.530 34.100 Management believes that electrical cost is a mixed cost that depends on machine-hours. Using the high method to estimate the variable and fixed components of this cost, these estimates A. $14.41 per machine-hour: $33,832 per month B. $0.11 per machine-hour $33,957 per month C. $9.35 per machine-hour; $11,885 per month D. $11.30 per machine-hour:$7,229 per month ow would be closest to: Eacker Company's quality cost report is to be based on the following data: $72.000 $78,000 Quality engineering Net cost of spellage Reentering data becaunse of keying errors$88,000 Test and inspecticn of incomsing materi Test and inspection of in-process goods 597800 Technical sepport provided to suppliers Maintenance of test equipment Preduct recalls Warranty repairs and replacemarnts 568,000 83,000 31,00 $73,000 12. What would be the total prevention cost appearing on the quality cost report? A. $151,000 B. $155,000 C. $145,000 D. $103,000 Compton Company uses a predetermined overhead rate in applying overhead to production orders on a labor cost basis in Department A and on a machine-hours basis in Department B. At the beginning of the most recently completed year, the company made the following estimates: Direct labor cest Manufacturing sverhead67,200 $4500 Dept. A Dept 56800 $330 Direct laber hours 4000 9 What predetermined overhead rate would be used in Department A and Department B, respectively? A. 83% and S5 B. 83% and S3 C. I 20% and S3 D. 83% and S 120 kker Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $77.250 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $79,000 and actual direct labor-hours were 2,400. 14. The predetermined overhead rate for the year was closest to: A. $29.66 B. $32.92 C. $31.60 D. $30.90 15. The applied manufacturing overhead for the year was closest to: A. $74,160 B. $71,184 C. $75,840 D. $79,008 16. The overhead for the year was: A. $3,090 overapplied B. $4,840 underapplied C. $4,840 overapplied D. $3,090 underapplied During September, Stutzman Corporation incurred $86,000 of actual Manufacturing Overhead costs. During the same period, the Manufacturing Overhead applied to Work in Process was $81,000. Nguyen Corporation uses the weighted-average method in its process costin system. Operating data for the ting Department for the month of October appear below: Percent Complete wth Beginning work in process inventory Transferred in fromm the prior department during October Completed and tranferred to the next department during October$3,0 Ending work in process imventory Urits Respect to Coevenion 3.700 900 1.900 What were the equivalent units for conversion costs in the Lubricating Department for October? A. 53,700 B. 52.280 C. 54,080 D. 50,100 22. The Gasson Company uses the weighted-average method in its process costing system. The company's ending work in process inventory consists of 10.000 units 100% complete with respect to materials and 70% complete with respect to labor and overhead. If the costs per equivalent unit are $4.50 for the materials and $2.00 for labor and overhead, the balance of the ending work in process inventory account would be: A. $44,500 B. $50,500 C. $59,000 D. S65,000 Callander Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $151.60 per unit. Sales vehane uts Cost of sales 0007000 S415800 100 5430 205441000 Selling and adminstratin e cont 23. The best estimate of the total contribution margin when 6,300 units are sold is: A. $450,450 B. $518,490 C. $121,590 D. $66,780 .Conversion cost consists of which of the following? A. Manufacturing overhead cost B. Direct materials and direct labor cost C. Direct labor cost. D. Direct labor and manufacturing overhead cost. 28. Each of the following would be a period cost except: A. the salary of the company president's secretary B. the cost of a general accounting office C. depreciation of a machine used in manufacturing. D. sales commissions. 29. Which of the following would NOT be treated as a product cost for external financial reporting purposes? A. Depreciation on a factory building B. Salaries of factory workers. C. Indirect labor in the factory D. Advertising expenses. 30. Within the relevant range, variable cost per unit will: A. increase as the level of activity increases. B. remain constant. C. decrease as the level of activity increases D. none of these