Answered step by step

Verified Expert Solution

Question

1 Approved Answer

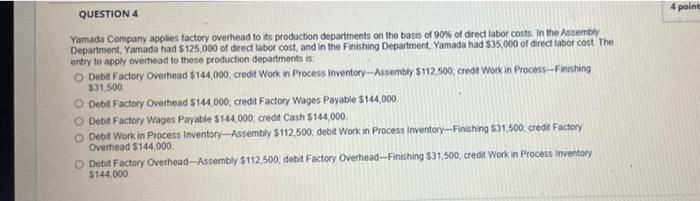

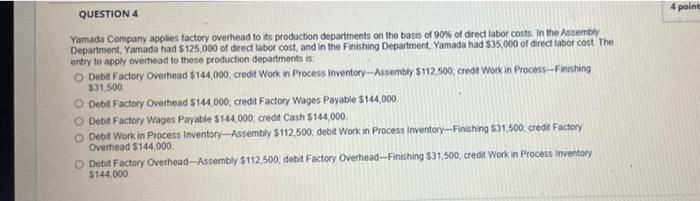

Exam 2 4 point QUESTION 4 Yamada Company applies factory overhead to its production departments on the basis of 90% of direct labor costs. In

Exam 2

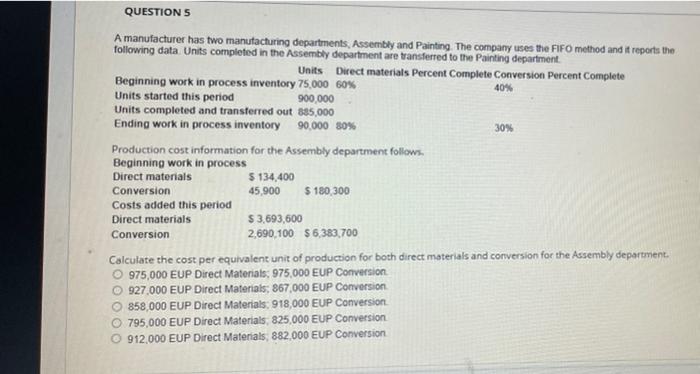

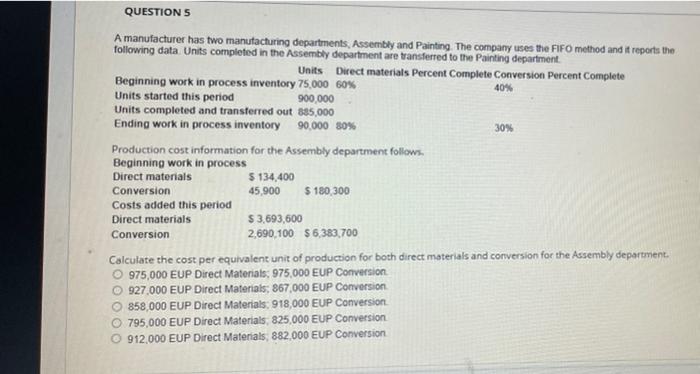

4 point QUESTION 4 Yamada Company applies factory overhead to its production departments on the basis of 90% of direct labor costs. In the Assembly Department, Yamada had $125,000 of direct labor cost, and in the Finishing Department, Yamada had $35,000 of direct labor cost. The entry to apply overhead to these production departments is Debt Factory Overhead 5144,000 credit Work in Process Inventory-Assembly 5112 500, credt Work in Process-Finishing $31.500 O Debit Factory Overhead $144,000 credt Factory Wages Payable $144,000 O Debit Factory Wages Payable $144,000 credit Cash $144,000. Debit Work in Process Inventory--Assembly $112.500, debit Work in Process Inventory---Finishing 531 500, credit Factory Overhead $144,000 Debit Factory Overhead-Assembly $112.500, debit Factory Overhead--Finishing $31,500, credit Work in Process Inventory $144,000 QUESTIONS A manufacturer has two manufacturing departments, Assembly and Painting. The company uses the FIFO method and it reports the following data Units completed in the Assembly department are transferred to the Painting department Units Direct materials Percent Complete Conversion Percent Complete Beginning work in process inventory 75,000 60% 40% Units started this period 900,000 Units completed and transferred out 185,000 Ending work in process inventory 90.000 80% 30% Production cost information for the Assembly department follows. Beginning work in process Direct materials 5 134.400 Conversion 45,900 $ 180,300 Costs added this period Direct materials $ 3,693,600 Conversion 2,690,100 $6,383,700 Calculate the cost per equivalent unit of production for both direct materials and conversion for the Assembly department 975,000 EUP Direct Materials: 975,000 EUP Conversion 927.000 EUP Direct Materials; 867,000 EUP Conversion 858,000 EUP Direct Materials: 918,000 EUP Conversion 795,000 EUP Direct Materials 825,000 EUP Conversion 912.000 EUP Direct Materials, 882,000 EUP Conversion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started