Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exam Corp. is in need of cash. On 1/1/2023 Exam Corp. issues bonds with a $350,000 face value. The bonds have an 7.50% coupon rate.

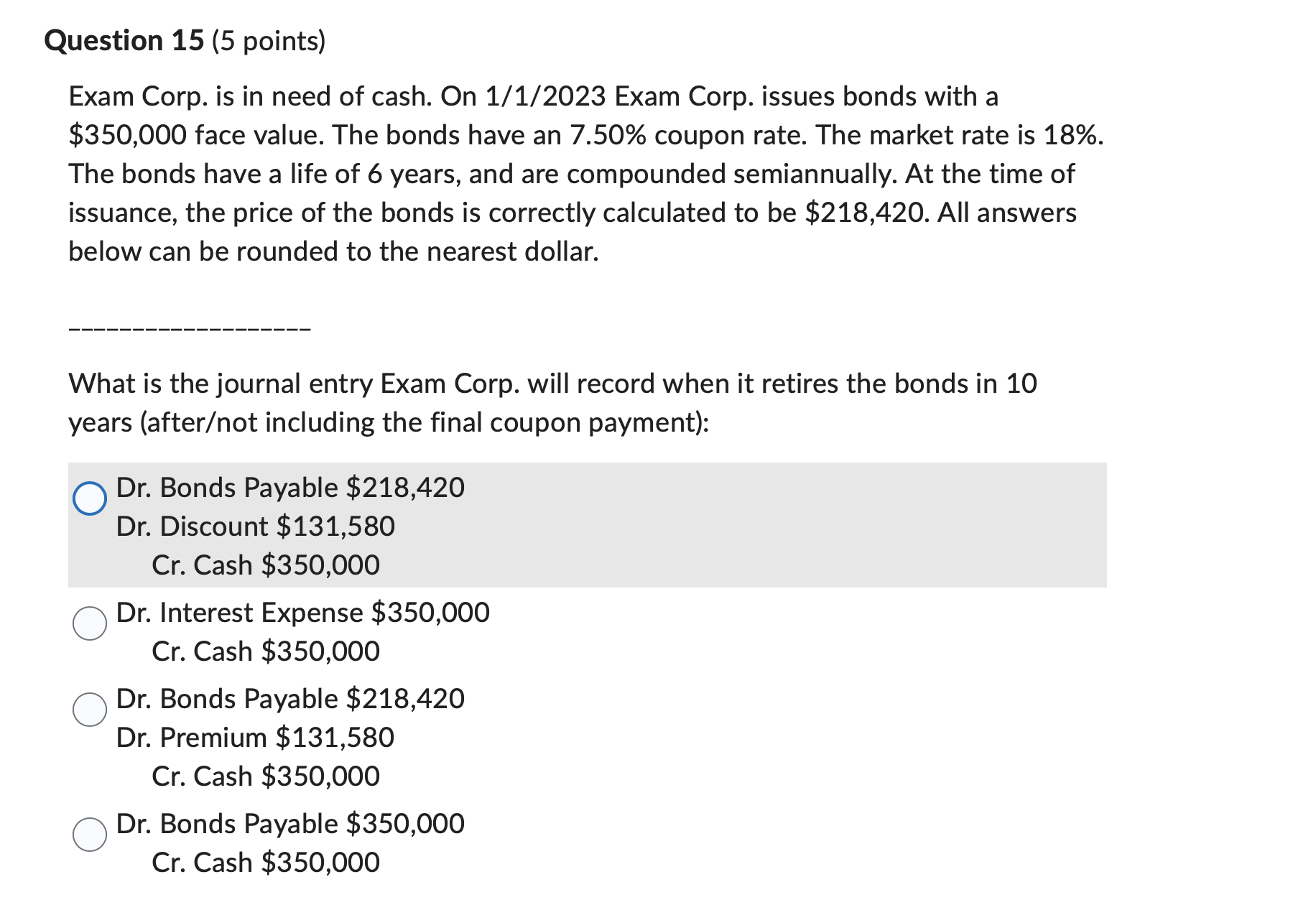

Exam Corp. is in need of cash. On 1/1/2023 Exam Corp. issues bonds with a $350,000 face value. The bonds have an 7.50% coupon rate. The market rate is 18%. The bonds have a life of 6 years, and are compounded semiannually. At the time of issuance, the price of the bonds is correctly calculated to be $218,420. All answers below can be rounded to the nearest dollar. What is the journal entry Exam Corp. will record when it retires the bonds in 10 years (afterot including the final coupon payment): Dr. Bonds Payable $218,420 Dr. Discount $131,580 Cr. Cash $350,000 Dr. Interest Expense $350,000 Cr. Cash $350,000 Dr. Bonds Payable $218,420 Dr. Premium $131,580 Cr. Cash $350,000 Dr. Bonds Payable $350,000 Cr. Cash $350,000

Exam Corp. is in need of cash. On 1/1/2023 Exam Corp. issues bonds with a $350,000 face value. The bonds have an 7.50% coupon rate. The market rate is 18%. The bonds have a life of 6 years, and are compounded semiannually. At the time of issuance, the price of the bonds is correctly calculated to be $218,420. All answers below can be rounded to the nearest dollar. What is the journal entry Exam Corp. will record when it retires the bonds in 10 years (afterot including the final coupon payment): Dr. Bonds Payable $218,420 Dr. Discount $131,580 Cr. Cash $350,000 Dr. Interest Expense $350,000 Cr. Cash $350,000 Dr. Bonds Payable $218,420 Dr. Premium $131,580 Cr. Cash $350,000 Dr. Bonds Payable $350,000 Cr. Cash $350,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started