Question

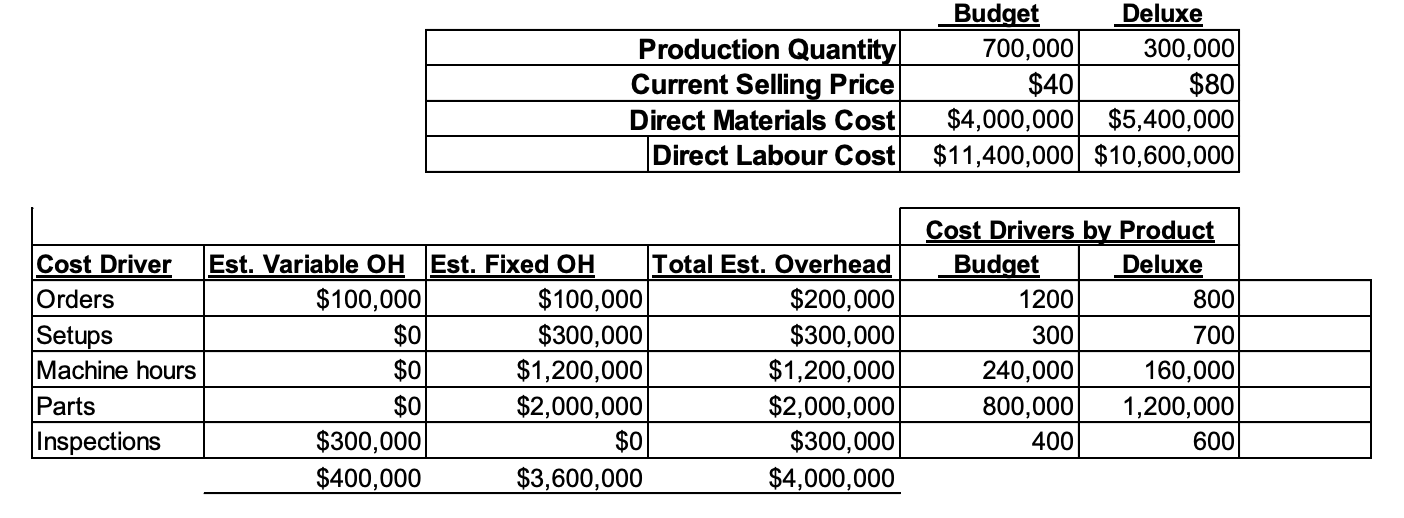

Exam Manufacturing has five activity cost pools and two products (a budget type vacuum and a deluxe type vacuum). Information is presented below: Required: A)

Exam Manufacturing has five activity cost pools and two products (a budget type vacuum and a deluxe type vacuum).

Information is presented below:

Required:

A) Compute the overhead cost per unit using a single plant wide overhead rate, assuming total overhead is allocated based on machine hours.

B) Compute the overhead cost per unit for each product where overhead costs are allocated using activity based costing. Round your answer to the nearest cent. C) Comment on the cost differences between the two costing systems in A) and B).

D) How might management use the activity based costing information to make better decisions?

Production Quantity Current Selling Price Direct Materials Cost Direct Labour Cost Budget Deluxe 700,000 300,000 $40 $80 $4,000,000 $5,400,000 $11,400,000 $10,600,000 Cost Drivers by Product Budget Deluxe 1200 800 700 240,000 160,000| 800,000 1,200,000 400 600 Cost Driver Est. Variable OH Est. Fixed OH Total Est. Overhead Orders $100.000 $100,000 $200,000 Setups $0 $300.000 $300,000 Machine hours $0 $1,200,000 $1,200,000 Parts $0 $2,000,000 $2,000,000 Inspections $300,000 $0 $300,000 $400,000 $3,600.000 $4,000,000 300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started