Answered step by step

Verified Expert Solution

Question

1 Approved Answer

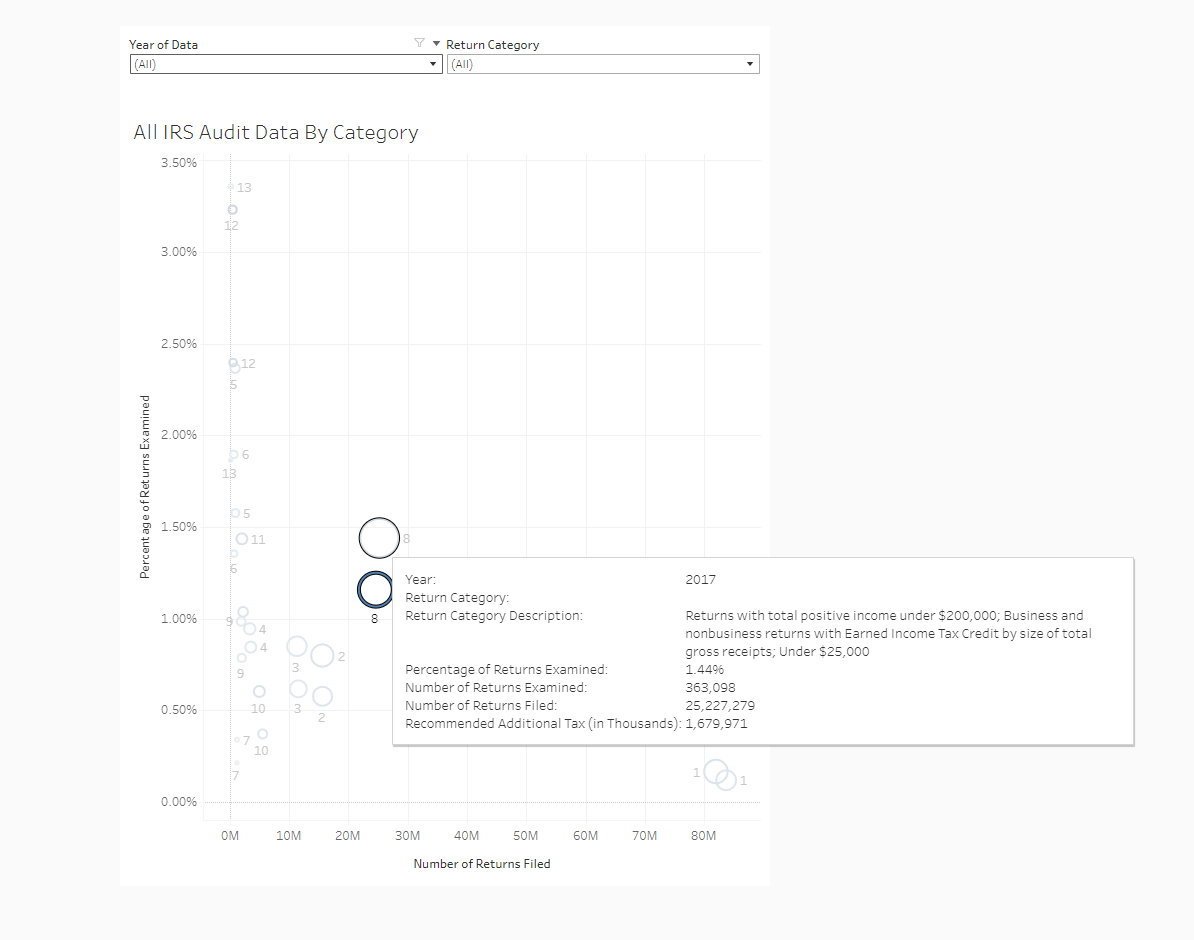

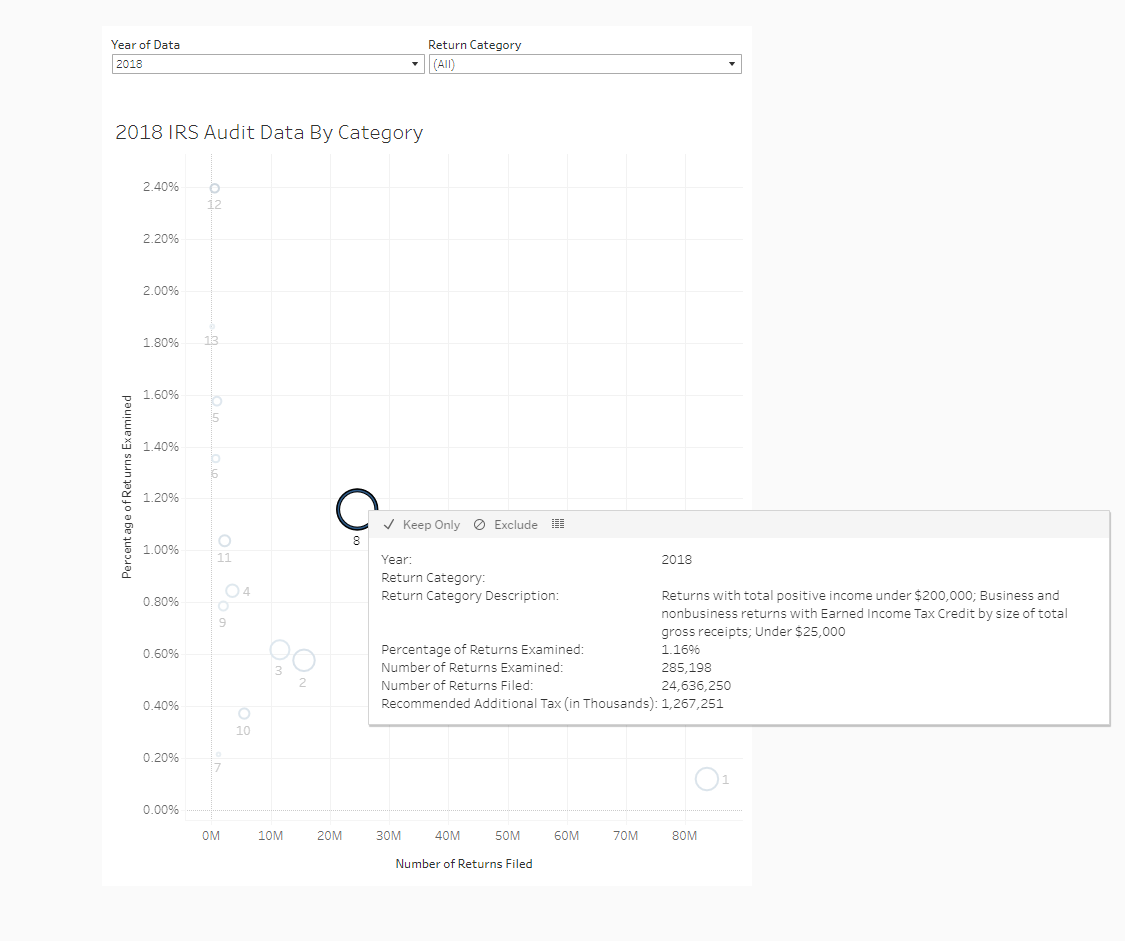

Examination Coverage - Part 3 (Static) Please Compare and contrast the year-to-year difference in IRS examination for the category 8. Discuss what factors may have

Examination Coverage - Part 3 (Static)

Please Compare and contrast the year-to-year difference in IRS examination for the category 8. Discuss what factors may have impacted a change in the IRS examination data.

Year of Data (ANI) Y Return Category (A1) ALLIRS Audit Data By Category 3.50% 13 12 3.00% 2.50% 312 5 2.0096 2.00% 13 Percentage of Returns Examined 05 1.50% 11 6 O 1.00% 284 8 04 Year: 2017 Return Category: Return Category Description: Returns with total positive income under $200,000; Business and nonbusiness returns with Earned Income Tax Credit by size of total gross receipts; Under $25,000 Percentage of Returns Examined: 1.4496 Number of Returns Examined: 363,098 Number of Returns Filed: 25,227,279 Recommended Additional Tax (in Thousands): 1,679,971 3 9 0.50% 10 3 70 7 10 0.00% OM 10M 20M 30M 40M 50M 60M 70M 80M Number of Returns Filed Year of Data 2018 Return Category (AMI) 2018 IRS Audit Data By Category 2.40% 12 2.20% 2.00% 1.80% 112 1.60% o un 1.40% Percent age of Returns Examined 1.20% Keep Only Exclude 8 1.00% 04 0.80% 9 Year: 2018 Return Category: Return Category Description: Returns with total positive income under $200,000; Business and nonbusiness returns with Earned Income Tax Credit by size of total gross receipts, Under $25,000 Percentage of Returns Examined: 1.1696 Number of Returns Examined: 285,198 Number of Returns Filed: 24,636,250 Recommended Additional Tax (in Thousands): 1,267,251 0.60% 0.40% 10 0.20% 0.00% OM OM 10M 20M 30M 40M 50M 60M 70M 80M Number of Returns Filed Year of Data (ANI) Y Return Category (A1) ALLIRS Audit Data By Category 3.50% 13 12 3.00% 2.50% 312 5 2.0096 2.00% 13 Percentage of Returns Examined 05 1.50% 11 6 O 1.00% 284 8 04 Year: 2017 Return Category: Return Category Description: Returns with total positive income under $200,000; Business and nonbusiness returns with Earned Income Tax Credit by size of total gross receipts; Under $25,000 Percentage of Returns Examined: 1.4496 Number of Returns Examined: 363,098 Number of Returns Filed: 25,227,279 Recommended Additional Tax (in Thousands): 1,679,971 3 9 0.50% 10 3 70 7 10 0.00% OM 10M 20M 30M 40M 50M 60M 70M 80M Number of Returns Filed Year of Data 2018 Return Category (AMI) 2018 IRS Audit Data By Category 2.40% 12 2.20% 2.00% 1.80% 112 1.60% o un 1.40% Percent age of Returns Examined 1.20% Keep Only Exclude 8 1.00% 04 0.80% 9 Year: 2018 Return Category: Return Category Description: Returns with total positive income under $200,000; Business and nonbusiness returns with Earned Income Tax Credit by size of total gross receipts, Under $25,000 Percentage of Returns Examined: 1.1696 Number of Returns Examined: 285,198 Number of Returns Filed: 24,636,250 Recommended Additional Tax (in Thousands): 1,267,251 0.60% 0.40% 10 0.20% 0.00% OM OM 10M 20M 30M 40M 50M 60M 70M 80M Number of Returns FiledStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started