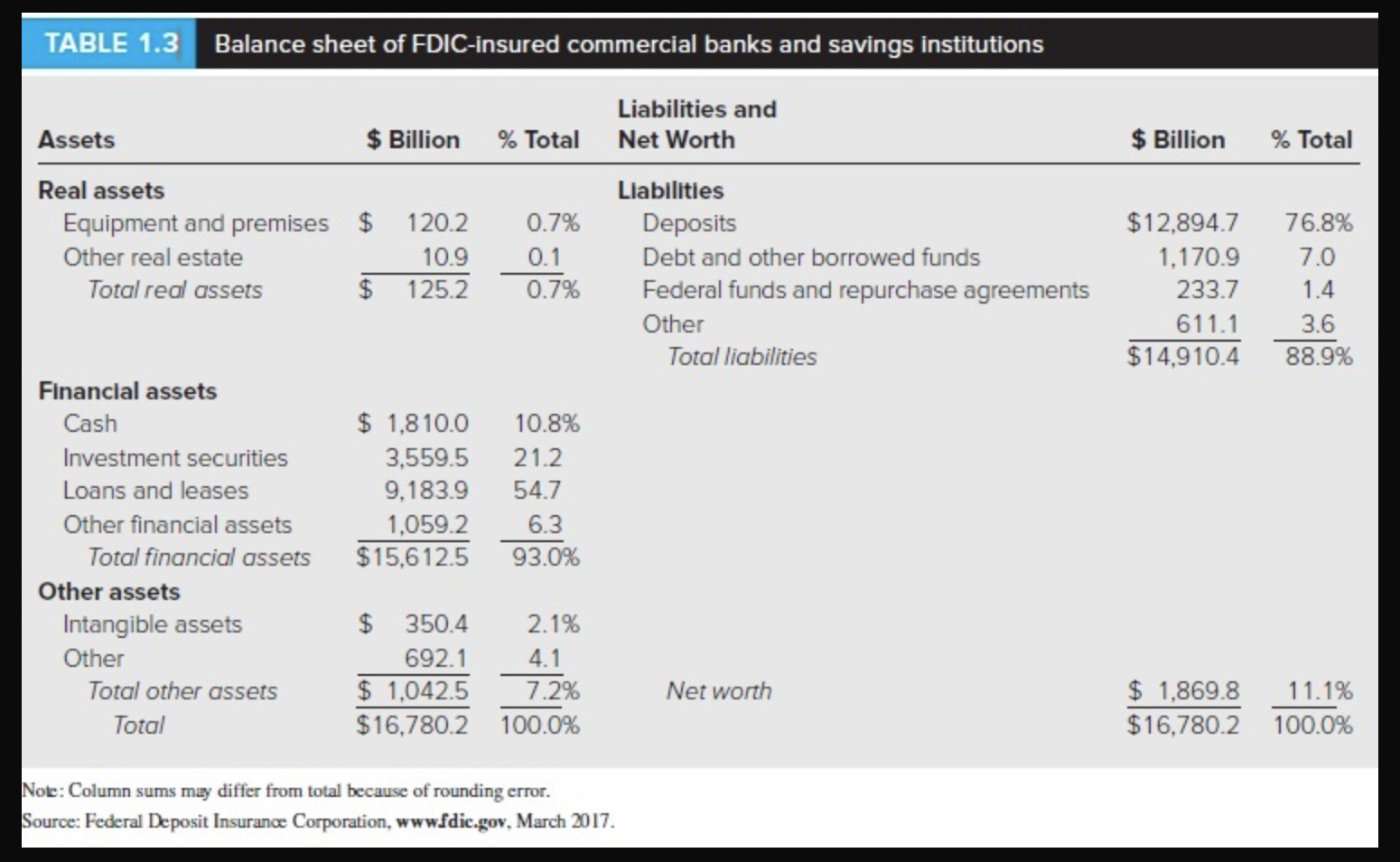

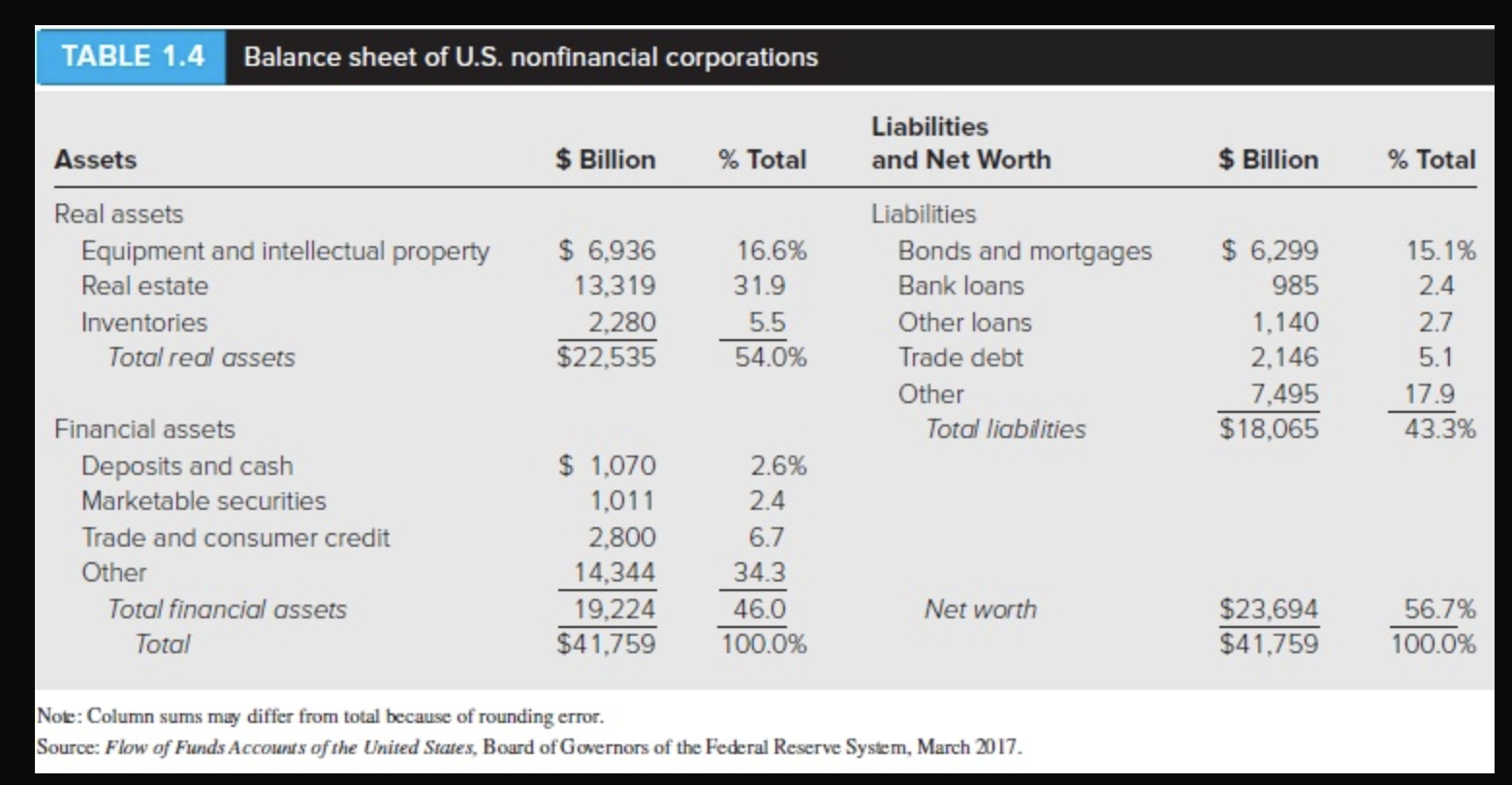

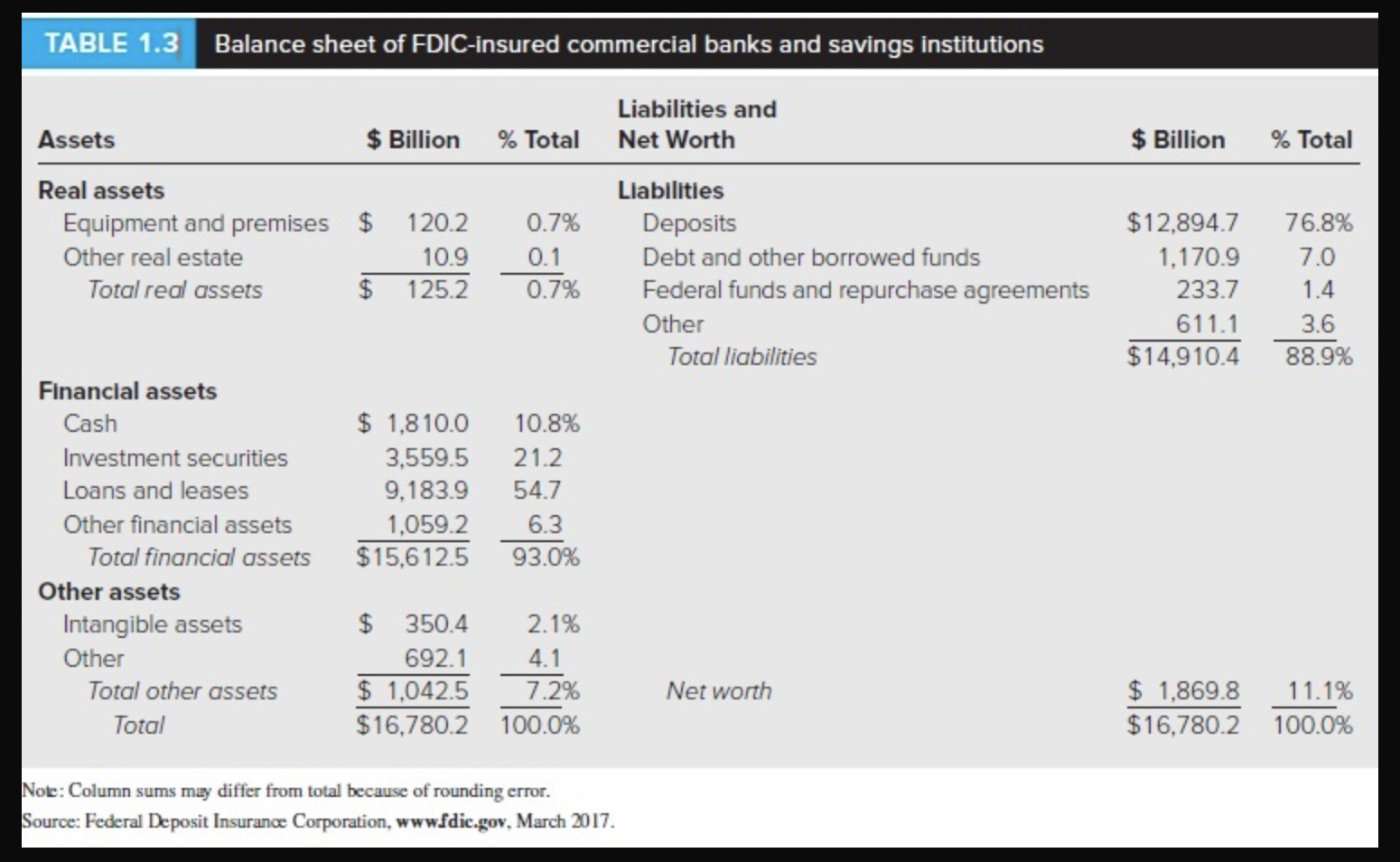

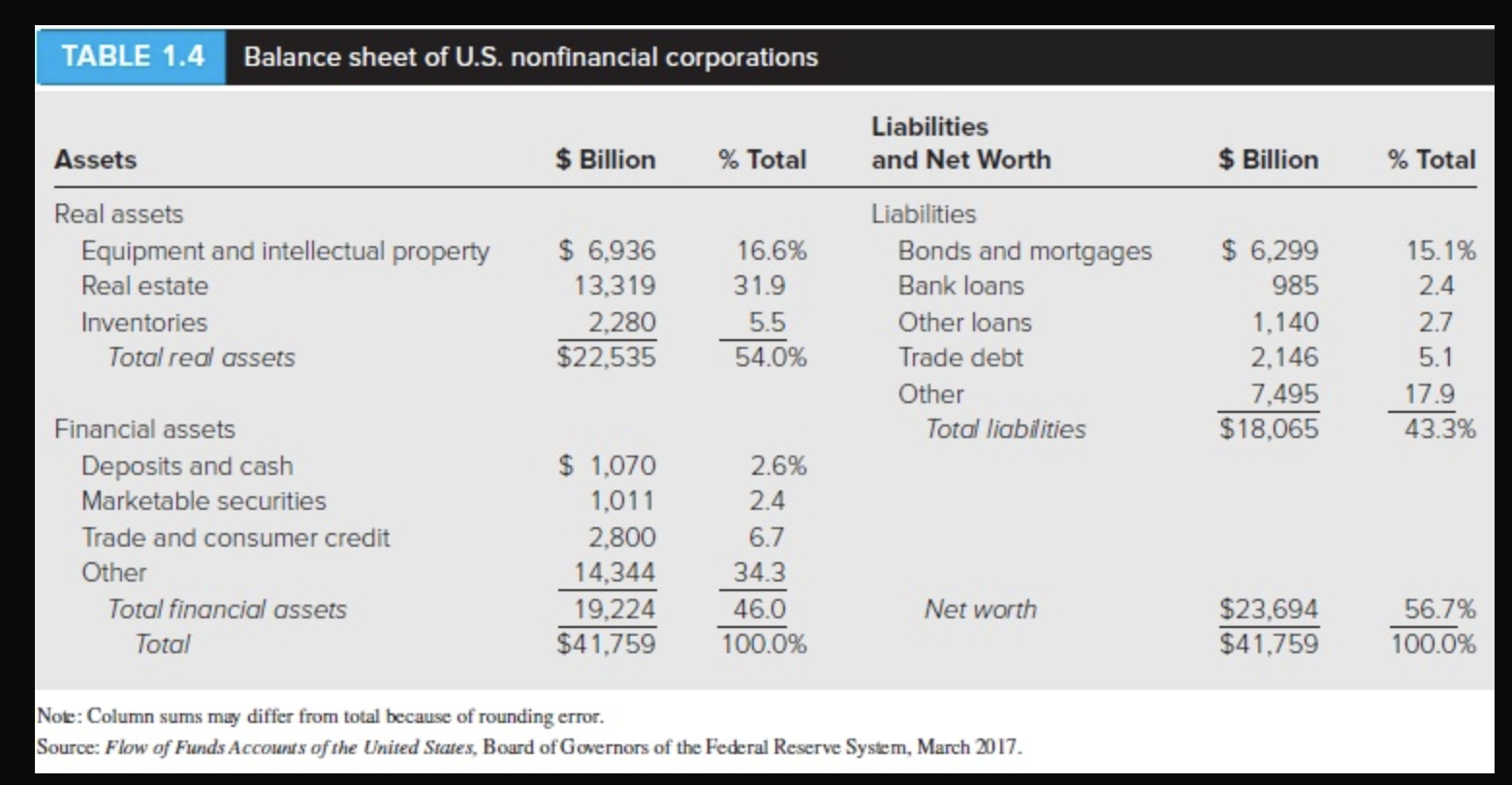

Examine the balance sheets given in Table 1.3. a. What is the ratio of real assets to total assets for commercial banks? (Round your answer to 4 decimal places.) Ratio of real to total assets b. What is that ratio for nonfinancial firms? (Table 1.4). (Round your answer to 4 decimal places.) The ratio for nonfinancial firms TABLE 1.3 Balance sheet of FDIC-insured commercial banks and savings institutions $ Billion % Total $12,894.7 1,170.9 233.7 611.1 $14,910.4 76.8% 7.0 1.4 3.6 88.9% Liabilities and Assets $ Billion % Total Net Worth Real assets Liabilities Equipment and premises $ 120.2 0.7% Deposits Other real estate 10.9 0.1 Debt and other borrowed funds Total real assets $ 125.2 0.7% Federal funds and repurchase agreements Other Total liabilities Financial assets Cash $ 1,810.0 10.8% Investment securities 3,559.5 21.2 Loans and leases 9,183.9 54.7 Other financial assets 1,059.2 6.3 Total financial assets $15,612.5 93.0% Other assets Intangible assets $ 350.4 2.1% Other 692.1 4.1 Total other assets $ 1,042.5 7.2% Net worth Total $16,780.2 100.0% $ 1,869.8 11.1% $16.780.2 100.0% Note: Column sums may diffe from total because of rounding error. Source: Federal Deposit Insurance Corporation, www.fdic.gov, March 2017. TABLE 1.4 Balance sheet of U.S. nonfinancial corporations Liabilities and Net Worth Assets $ Billion % Total $ Billion % Total Real assets Equipment and intellectual property Real estate Inventories Total real assets $ 6,936 13,319 2,280 $22,535 16.6% 31.9 5.5 54.0% Liabilities Bonds and mortgages Bank loans Other loans Trade debt Other Total liabilities $ 6,299 985 1,140 2,146 7,495 $18,065 15.1% 2.4 2.7 5.1 17.9 43.3% Financial assets Deposits and cash Marketable securities Trade and consumer credit Other Total financial assets Total $ 1,070 1,011 2,800 14,344 19,224 $41,759 2.6% 2.4 6.7 34.3 46.0 100.0% Net worth $23,694 $41,759 56.7% 100.0% Note: Column sums may differ from total because of rounding error. Source: Flow of Funds Accounts of the United States, Board of Governors of the Federal Reserve System, March 2017