examine the company's statement of cash flows. Assume you work for this company and the CEO approached you and asked for advice on how to improve the cash position of the company. Provide at least two recommendations you would offer and discuss how these could directly impact cash flow. Participate further by responding to your peers, indicating whether you agree or disagree with the recommendations they have provided to management. Are there further recommendations you can offer? Participate in follow-up discussion by critiquing the posts provided by your peers or defending their challenges to your post.

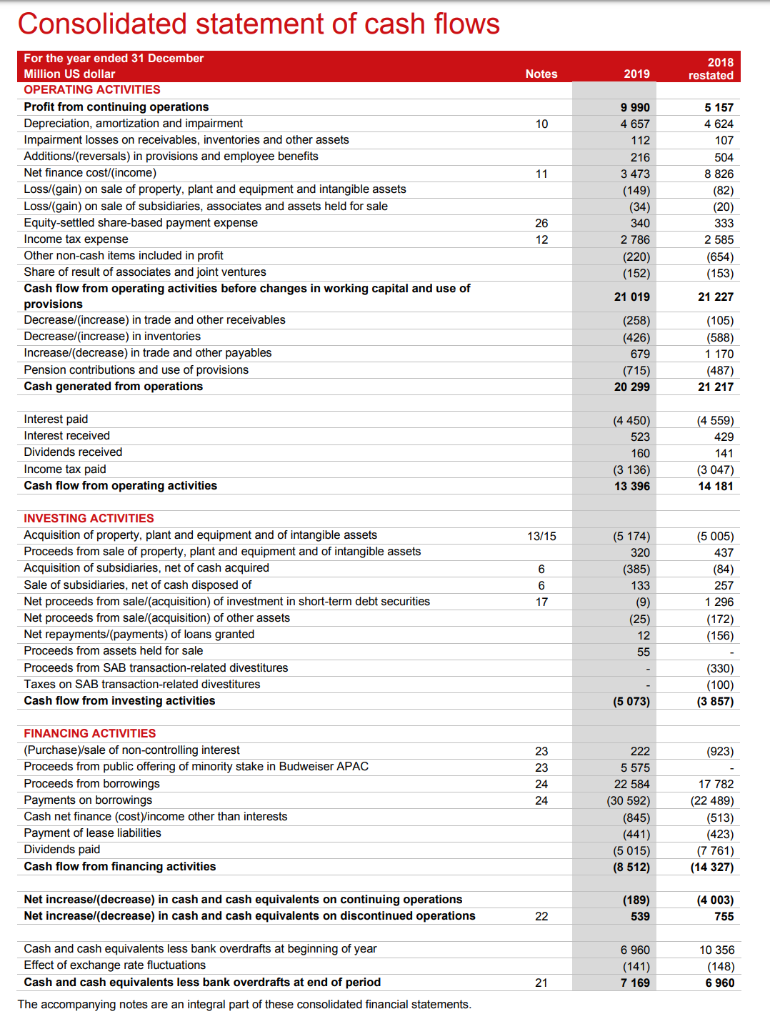

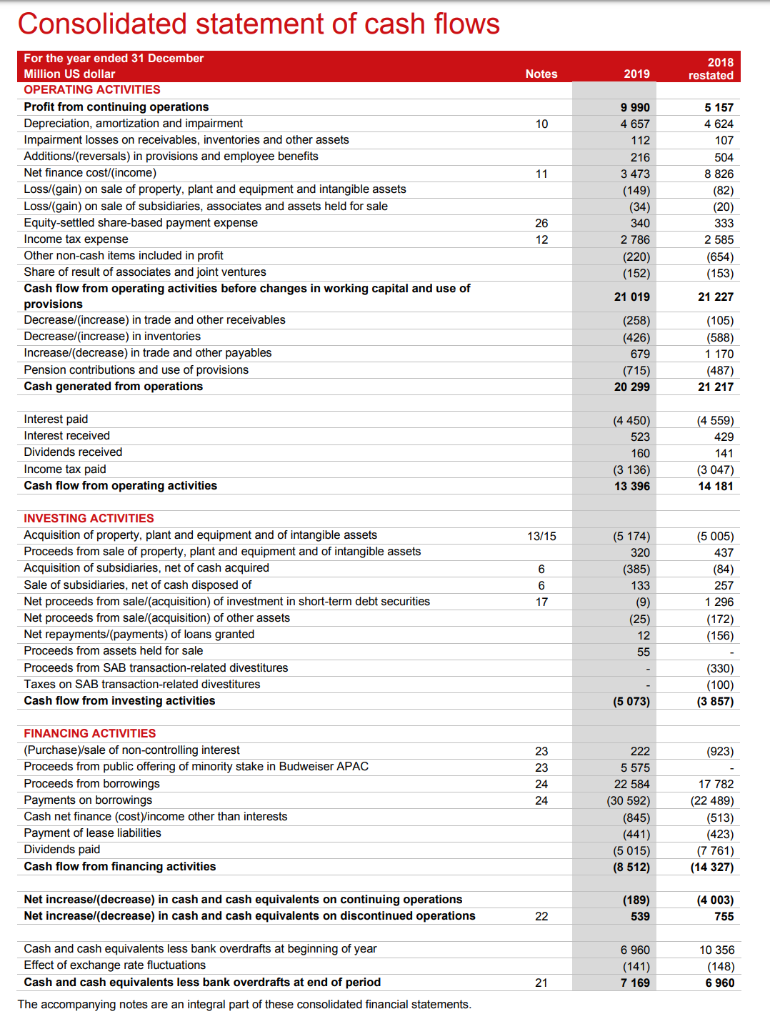

Consolidated statement of cash flows Notes 2019 2018 restated 10 11 For the year ended 31 December Million US dollar OPERATING ACTIVITIES Profit from continuing operations Depreciation, amortization and impairment Impairment losses on receivables, inventories and other assets Additions/(reversals) in provisions and employee benefits Net finance cost/income) Loss/(gain) on sale of property, plant and equipment and intangible assets Loss/gain) on sale of subsidiaries, associates and assets held for sale Equity-settled share-based payment expense Income tax expense Other non-cash items included in profit Share of result of associates and joint ventures Cash flow from operating activities before changes in working capital and use of provisions Decrease/(increase) in trade and other receivables Decrease/increase) in inventories Increase/(decrease) in trade and other payables Pension contributions and use of provisions Cash generated from operations 9 990 4 657 112 216 3 473 (149) (34) 340 2 786 (220) (152) 21 019 5 157 4 624 107 504 8 826 (82) (20) 333 2 585 (654) (153) 21 227 26 12 PEETERNUL 19881 para (258) (426) 679 (715) 20 299 (105) (588) 1 170 (487) 21 217 (4 559) 429 Interest paid Interest received Dividends received Income tax paid Cash flow from operating activities (4 450) 523 160 (3 136) 13 396 141 (3 047) 14 181 13/15 INVESTING ACTIVITIES Acquisition of property, plant and equipment and of intangible assets Proceeds from sale of property, plant and equipment and of intangible assets Acquisition of subsidiaries, net of cash acquired Sale of subsidiaries, net of cash disposed of Net proceeds from sale/(acquisition) of investment in short-term debt securities Net proceeds from sale/(acquisition) of other assets Net repayments/(payments) of loans granted Proceeds from assets held for sale Proceeds from SAB transaction-related divestitures Taxes on SAB transaction-related divestitures Cash flow from investing activities pagaegas" | (5174) 320 (385) 133 (9) (25) (5 005) 437 (84) 257 1 296 (172) (156) 12 (330) (100) (3 857) (5 073) (923) FINANCING ACTIVITIES (Purchase)sale of non-controlling interest Proceeds from public offering of minority stake in Budweiser APAC Proceeds from borrowings Payments on borrowings Cash net finance (costVincome other than interests Payment of lease liabilities Dividends paid Cash flow from financing activities 222 5 575 22 584 (30 592) (845) (441) (5015) (8 512) 17 782 (22 489) (513) (423) (7 761) (14 327) Net increase/(decrease) in cash and cash equivalents on continuing operations Net increase (decrease) in cash and cash equivalents on discontinued operations (189) 539 (4 003) 755 22 Cash and cash equivalents less bank overdrafts at beginning of year Effect of exchange rate fluctuations Cash and cash equivalents less bank overdrafts at end of period The accompanying notes are an integral part of these consolidated financial statements. 6 960 (141) 7 169 10 356 (148) 6 960 21 Consolidated statement of cash flows Notes 2019 2018 restated 10 11 For the year ended 31 December Million US dollar OPERATING ACTIVITIES Profit from continuing operations Depreciation, amortization and impairment Impairment losses on receivables, inventories and other assets Additions/(reversals) in provisions and employee benefits Net finance cost/income) Loss/(gain) on sale of property, plant and equipment and intangible assets Loss/gain) on sale of subsidiaries, associates and assets held for sale Equity-settled share-based payment expense Income tax expense Other non-cash items included in profit Share of result of associates and joint ventures Cash flow from operating activities before changes in working capital and use of provisions Decrease/(increase) in trade and other receivables Decrease/increase) in inventories Increase/(decrease) in trade and other payables Pension contributions and use of provisions Cash generated from operations 9 990 4 657 112 216 3 473 (149) (34) 340 2 786 (220) (152) 21 019 5 157 4 624 107 504 8 826 (82) (20) 333 2 585 (654) (153) 21 227 26 12 PEETERNUL 19881 para (258) (426) 679 (715) 20 299 (105) (588) 1 170 (487) 21 217 (4 559) 429 Interest paid Interest received Dividends received Income tax paid Cash flow from operating activities (4 450) 523 160 (3 136) 13 396 141 (3 047) 14 181 13/15 INVESTING ACTIVITIES Acquisition of property, plant and equipment and of intangible assets Proceeds from sale of property, plant and equipment and of intangible assets Acquisition of subsidiaries, net of cash acquired Sale of subsidiaries, net of cash disposed of Net proceeds from sale/(acquisition) of investment in short-term debt securities Net proceeds from sale/(acquisition) of other assets Net repayments/(payments) of loans granted Proceeds from assets held for sale Proceeds from SAB transaction-related divestitures Taxes on SAB transaction-related divestitures Cash flow from investing activities pagaegas" | (5174) 320 (385) 133 (9) (25) (5 005) 437 (84) 257 1 296 (172) (156) 12 (330) (100) (3 857) (5 073) (923) FINANCING ACTIVITIES (Purchase)sale of non-controlling interest Proceeds from public offering of minority stake in Budweiser APAC Proceeds from borrowings Payments on borrowings Cash net finance (costVincome other than interests Payment of lease liabilities Dividends paid Cash flow from financing activities 222 5 575 22 584 (30 592) (845) (441) (5015) (8 512) 17 782 (22 489) (513) (423) (7 761) (14 327) Net increase/(decrease) in cash and cash equivalents on continuing operations Net increase (decrease) in cash and cash equivalents on discontinued operations (189) 539 (4 003) 755 22 Cash and cash equivalents less bank overdrafts at beginning of year Effect of exchange rate fluctuations Cash and cash equivalents less bank overdrafts at end of period The accompanying notes are an integral part of these consolidated financial statements. 6 960 (141) 7 169 10 356 (148) 6 960 21