Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Examine the effect of the actions below on the current ratio. Assume that the prevailing current ratio is higher than 1.0. (i) Use cash to

Examine the effect of the actions below on the current ratio. Assume that the prevailing current ratio is higher than 1.0.

(i) Use cash to pay off current liability of $10,000

(ii) Purchase raw materials amounting to $10,000 on credit

(iii) Sale of inventory

(iv) Paying a dividend

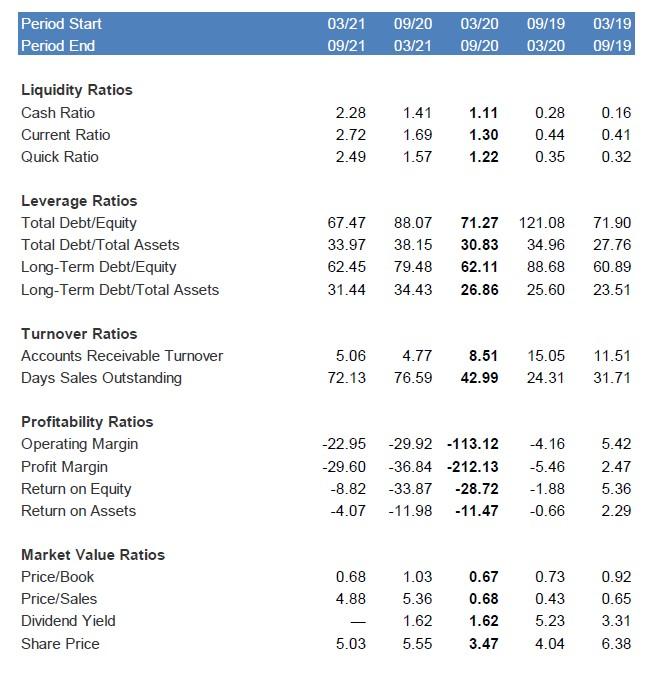

Period Start Period End Liquidity Ratios Cash Ratio Current Ratio Quick Ratio Leverage Ratios Total Debt/Equity Total Debt/Total Assets Long-Term Debt/Equity Long-Term Debt/Total Assets Turnover Ratios Accounts Receivable Turnover Days Sales Outstanding Profitability Ratios Operating Margin Profit Margin Return on Equity Return on Assets Market Value Ratios Price/Book Price/Sales Dividend Yield Share Price 03/21 09/20 09/21 03/21 09/20 03/20 2.28 2.72 2.49 5.06 72.13 03/20 09/19 03/19 09/19 1.41 1.69 1.57 0.68 4.88 67.47 88.07 71.27 121.08 33.97 38.15 30.83 34.96 62.45 79.48 62.11 88.68 34.43 26.86 31.44 25.60 5.03 1.11 1.30 1.22 -22.95 -29.92 -113.12 -29.60 -36.84 -212.13 -8.82 -33.87 -28.72 -4.07 -11.98 -11.47 0.28 0.44 0.35 4.77 8.51 15.05 76.59 42.99 24.31 0.16 0.41 0.32 1.03 0.67 0.73 5.36 0.68 0.43 1.62 1.62 5.23 5.55 3.47 4.04 71.90 27.76 60.89 23.51 11.51 31.71 -4.16 5.42 -5.46 2.47 -1.88 5.36 -0.66 2.29 0.92 0.65 3.31 6.38

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

The current ratio is calculated by dividing a companys current assets by its current liabilities It is a financial metric that shows a companys abilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started