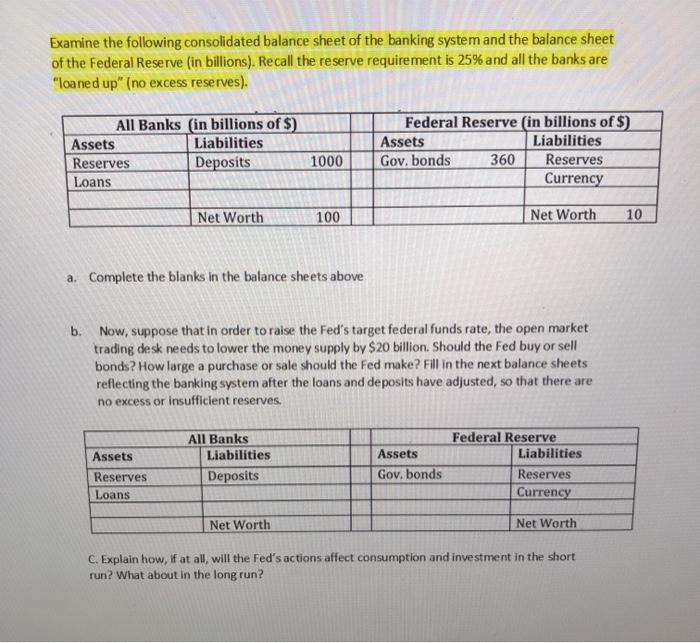

Examine the following consolidated balance sheet of the banking system and the balance sheet of the Federal Reserve (in billions). Recall the reserve requirement is 25% and all the banks are "loaned up" (no excess reserves). All Banks (in billions of $) Assets Liabilities Reserves Deposits Loans Federal Reserve (in billions of $) Assets Liabilities Gov. bonds 360 Reserves Currency 1000 Net Worth 100 Net Worth 10 a. Complete the blanks in the balance sheets above b. Now, suppose that in order to raise the Fed's target federal funds rate, the open market trading desk needs to lower the money supply by $20 billion. Should the Fed buy or sell bonds? How large a purchase or sale should the Fed make? Fill in the next balance sheets reflecting the banking system after the loans and deposits have adjusted, so that there are no excess or insufficient reserves. Assets All Banks Liabilities Deposits Assets Gov, bonds Federal Reserve Liabilities Reserves Currency Reserves Loans Net Worth Net Worth C. Explain how, if at all, will the Fed's actions affect consumption and investment in the short run? What about in the long run? Examine the following consolidated balance sheet of the banking system and the balance sheet of the Federal Reserve (in billions). Recall the reserve requirement is 25% and all the banks are "loaned up" (no excess reserves). All Banks (in billions of $) Assets Liabilities Reserves Deposits Loans Federal Reserve (in billions of $) Assets Liabilities Gov. bonds 360 Reserves Currency 1000 Net Worth 100 Net Worth 10 a. Complete the blanks in the balance sheets above b. Now, suppose that in order to raise the Fed's target federal funds rate, the open market trading desk needs to lower the money supply by $20 billion. Should the Fed buy or sell bonds? How large a purchase or sale should the Fed make? Fill in the next balance sheets reflecting the banking system after the loans and deposits have adjusted, so that there are no excess or insufficient reserves. Assets All Banks Liabilities Deposits Assets Gov, bonds Federal Reserve Liabilities Reserves Currency Reserves Loans Net Worth Net Worth C. Explain how, if at all, will the Fed's actions affect consumption and investment in the short run? What about in the long run