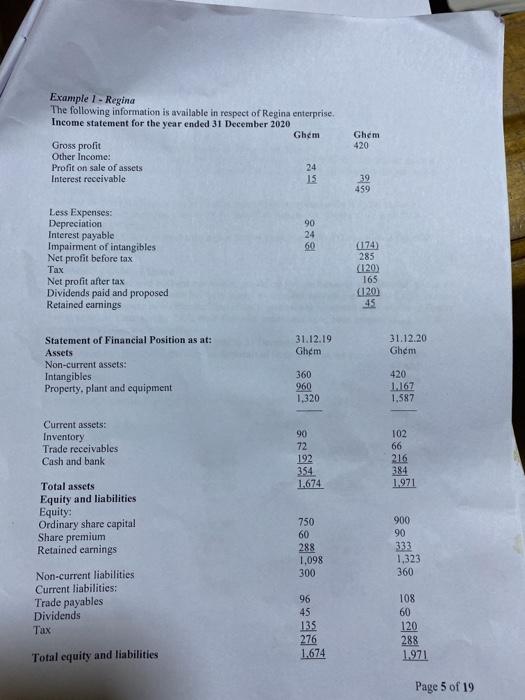

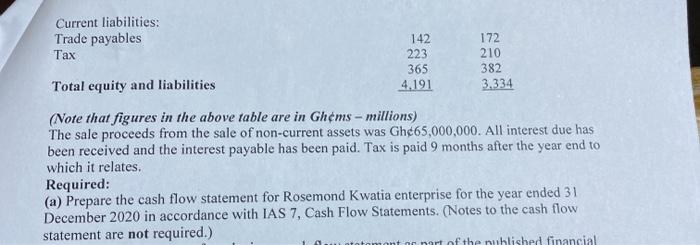

Example 1 - Regina The following information is available in respect of Regina enterprise. Income statement for the year ended 31 December 2020 Ghem Gross profit Other Income: Profit on sale of assets 24 Interest receivable 15 Ghem 420 39 459 90 24 60 Less Expenses Deprecintion Interest payable Impairment of intangibles Net profit before tax Tax Net profit after tax Dividends paid and proposed Retained earnings (174) 285 (120) 165 (120) 31.12.19 Ghem 31.12.20 Ghem Statement of Financial Position as at: Assets Non-current assets: Intangibles Property, plant and equipment 360 960 1.320 420 1.167 1.587 Current assets: Inventory Trade receivables Cash and bank 90 72 192 354 1.674 102 66 216 384 1.971 Total assets Equity and liabilities Equity Ordinary share capital Share premium Retained earnings 750 60 288 1,098 300 900 90 333 1,323 360 Non-current liabilities Current liabilities: Trade payables Dividends Tax 96 45 135 276 1.674 108 60 120 288 1971 Total equity and liabilities Page 5 of 19 Current liabilities: Trade payables 142 172 Tax 223 210 365 382 Total equity and liabilities 4.191 3,334 (Note that figures in the above table are in Ghems - millions) The sale proceeds from the sale of non-current assets was Gh65,000,000. All interest due has been received and the interest payable has been paid. Tax is paid 9 months after the year end to which it relates. Required: (a) Prepare the cash flow statement for Rosemond Kwatia enterprise for the year ended 31 December 2020 in accordance with IAS 7, Cash Flow Statements. (Notes to the cash flow statement are not required.) ont on nart of the nuhlished financial Example 1 - Regina The following information is available in respect of Regina enterprise. Income statement for the year ended 31 December 2020 Ghem Gross profit Other Income: Profit on sale of assets 24 Interest receivable 15 Ghem 420 39 459 90 24 60 Less Expenses Deprecintion Interest payable Impairment of intangibles Net profit before tax Tax Net profit after tax Dividends paid and proposed Retained earnings (174) 285 (120) 165 (120) 31.12.19 Ghem 31.12.20 Ghem Statement of Financial Position as at: Assets Non-current assets: Intangibles Property, plant and equipment 360 960 1.320 420 1.167 1.587 Current assets: Inventory Trade receivables Cash and bank 90 72 192 354 1.674 102 66 216 384 1.971 Total assets Equity and liabilities Equity Ordinary share capital Share premium Retained earnings 750 60 288 1,098 300 900 90 333 1,323 360 Non-current liabilities Current liabilities: Trade payables Dividends Tax 96 45 135 276 1.674 108 60 120 288 1971 Total equity and liabilities Page 5 of 19 Current liabilities: Trade payables 142 172 Tax 223 210 365 382 Total equity and liabilities 4.191 3,334 (Note that figures in the above table are in Ghems - millions) The sale proceeds from the sale of non-current assets was Gh65,000,000. All interest due has been received and the interest payable has been paid. Tax is paid 9 months after the year end to which it relates. Required: (a) Prepare the cash flow statement for Rosemond Kwatia enterprise for the year ended 31 December 2020 in accordance with IAS 7, Cash Flow Statements. (Notes to the cash flow statement are not required.) ont on nart of the nuhlished financial