Answered step by step

Verified Expert Solution

Question

1 Approved Answer

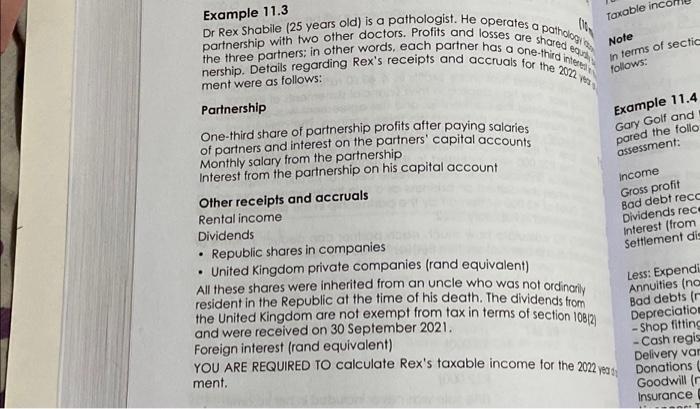

Example 11.3 pathology Dr Rex Shabile (25 years old) is a pathologist. He operates ap partnership with two other doctors. Profits and losses are shared

Example 11.3 pathology Dr Rex Shabile (25 years old) is a pathologist. He operates ap partnership with two other doctors. Profits and losses are shared equally the three partners; in other words, each partner has a one-third interest in nership. Details regarding Rex's receipts and accruals for the 2022 year o ment were as follows: Partnership One-third share of partnership profits after paying salaries of partners and interest on the partners' capital accounts Monthly salary from the partnership Interest from the partnership on his capital account Other receipts and accruals Rental income Dividends dos Republic shares in companies United Kingdom private companies (rand equivalent) All these shares were inherited from an uncle who was not ordinarily resident in the Republic at the time of his death. The dividends from the United Kingdom are not exempt from tax in terms of section 108(2) and were received on 30 September 2021. Foreign interest (rand equivalent) Taxable inco Note In terms of sectic follows: Example 11.4 Gary Golf and pared the follo assessment: Income Gross profit Bad debt recc Dividends rece Interest (from Settlement dis YOU ARE REQUIRED TO calculate Rex's taxable income for the 2022 yea dy ment. Less: Expendi Annuities (na Bad debts (r Depreciation -Shop fitting -Cash regis Delivery var Donations Goodwill (r Insurance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started