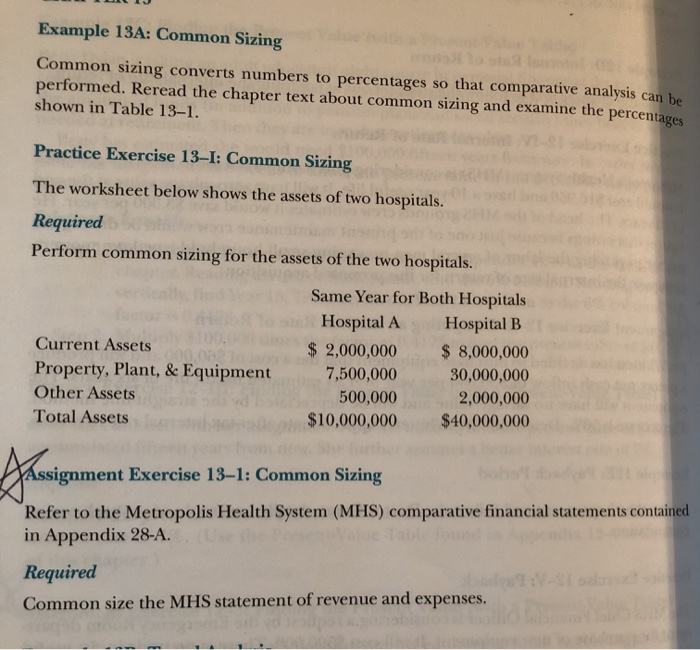

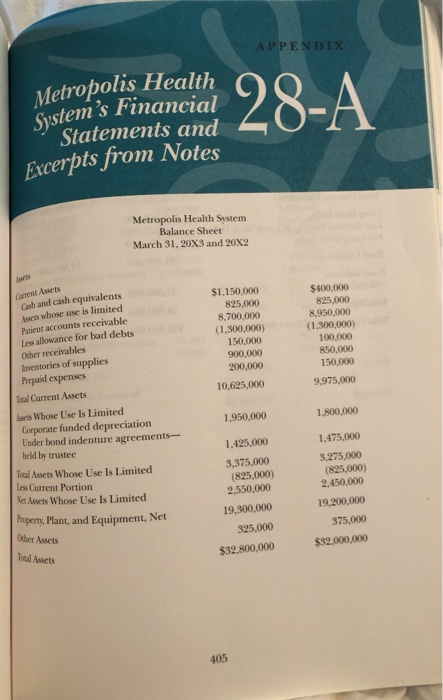

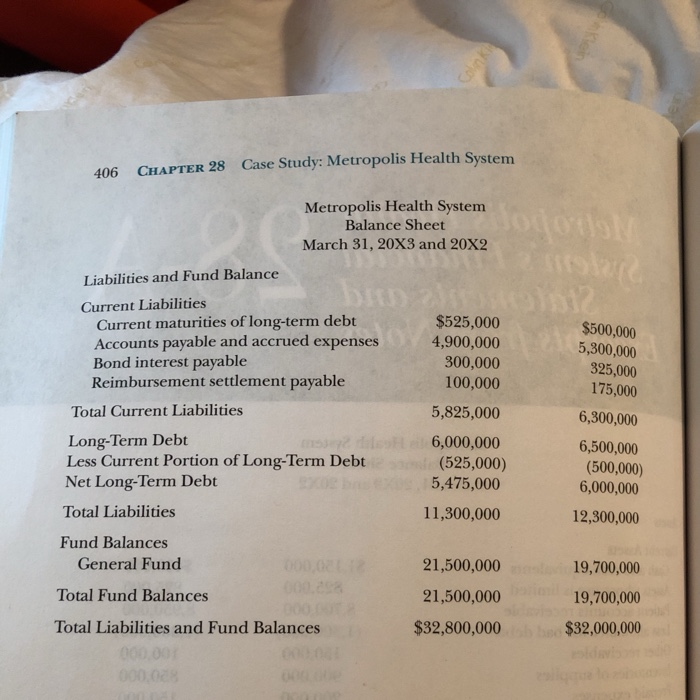

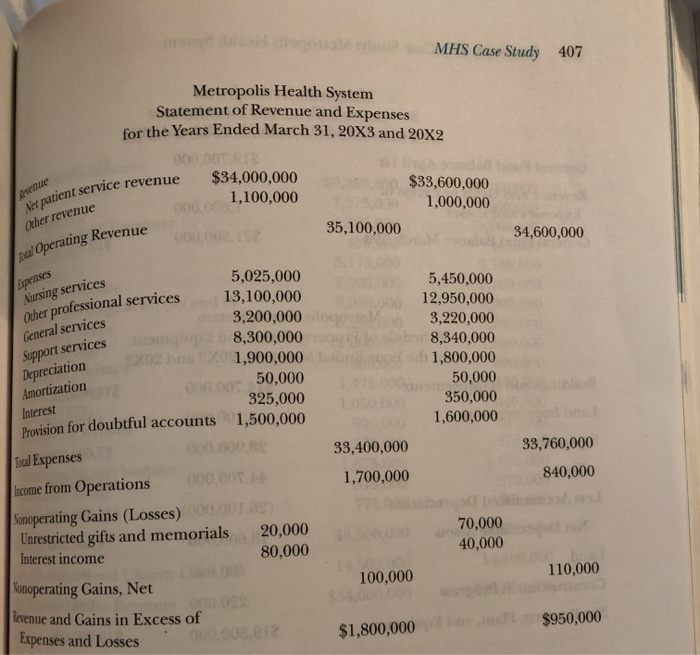

Example 13A: Common Sizing Common sizing performed. Reread the chapter shown in Table 13-1. converts numbers to percentages that comparative analysis can be text about common sizing and examine the percentages SO Practice Exercise 13-I: Common Sizing The worksheet below shows the assets of two hospitals. Required Perform common sizing for the assets of the two hospitals. Same Year for Both Hospitals Hospital A Hospital B Current Assets $ 8,000,000 2,000,000 Property, Plant, & Equipment 7,500,000 30,000,000 Other Assets 2,000,000 500,000 $40,000,000 $10,000,000 Total Assets signment Exercise 13-1: Common Sizing Refer to the Metropolis Health System (MHS) comparative financial statements contained in Appendix 28-A. Hable fou 8T ab2on Required Common size the MHS statement of revenue and expenses. APPENDIX Metropolis Health System's Financial Statements and 28-A Excerpts from Notes Metropolis Health System alance Sheet March 31, 20X3 and 20X2 ts Garrent Assets Cash and cash equivalents Auets whose use is limited $1.150,000 $400,000 825,000 8,950,000 (1,300,000) 100,000 850,000 150,000 825,000 8,700,000 (1,300,000) 150,000 Pacient accounts receivable Les allowance for bad debts Other receivables Iventories of supplies Prepaid expenses 900,000 200,000 10,625,000 9,975,000 al Carrent Assets Asets Whose Use Is Limited Corporate funded depreciation Under bond indenture agreements held by trustee 1,950,000 1,800,000 1,475,000 1,425,000 3,275,000 (825,000) 2,450,000 Tocal Assets Whose Use Is Limited Less Current Portion 3,375,000 (825,000) 2,550,000 Net Assets Whose Use Is Limited Property, Plant, and Equipment, Net 19.200.000 19,300,000 Ouber Assets 375,000 325,000 Tucal Assets $32,000,000 $32,800,000 405 406 CHAPTER 28 Case Study: Metropolis Health System Metropolis Health System Balance Sheet Nogods March 31, 20X3 and 20X2 Liabilities and Fund Balance bro hlttpteniz hso s Current Liabilities Current maturities of long-term debt Accounts payable and accrued expenses Bond interest payable Reimbursement settlement payable $525,000 4,900,000 $500,000 5,300,000 325,000 175,000 300,000 100,000 Total Current Liabilities 5,825,000 6,300,000 Long-Term Debt Less Current Portion of Long-Term Debt Net Long-Term Debt 6,000,000 (525,000) 5,475,000 6,500,000 (500,000) 6,000,000 902 Total Liabilities 11,300,000 12,300,000 Fund Balances 000,021 2 General Fund 21,500,000 19,700,000 600.298 Total Fund Balances 21,500,000 19,700,000 Total Liabilities and Fund Balances $32,800,000 $32,000,000 000 001 600 000.028 Klein Coln K MHS Case Study 407 Metropolis Health System Statement of Revenue and Expenses for the Years Ended March 31, 20X3 and 20X2 Revenue Vet patient service revenue $34,000,000 $33,600,000 1,000,000 1,100,000 Other revenue 251 5,025,000 35,100,000 ocal Operating Revenue 34,600,000 Expenses Narsing services Other professional services 5,450,000 13,100,000 3,200,000 i 8,300,000 b X01,900,000 12,950,000 General services 3,220,000 Support services Depreciation Amortization 8,340,000 1,800,000 50,000 000.0050,000 325,000 Interest Provision for doubtful accounts 1.0 350,000 1,600,000 1,500,000 000.000 8 Total Expenses Iacome from Operations Nonoperating Gains (Losses)000 Unrestricted gifts and memorials Interest income 33,400,000 33,760,000 000,005.4 1,700,000 840,000 20,000 70,000 80,000 40,000 Nonoperating Gains, Net 100,000 110,000 Revenue and Gains in Excess of Expenses and Losses e12 $1,800,000 $950,000