Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Example 2 and Example 3. Please, need to calculate allocations. estimated amount of the allocation base b. MOH allocated to a job predetermined MOH rate

Example 2 and Example 3. Please, need to calculate allocations.

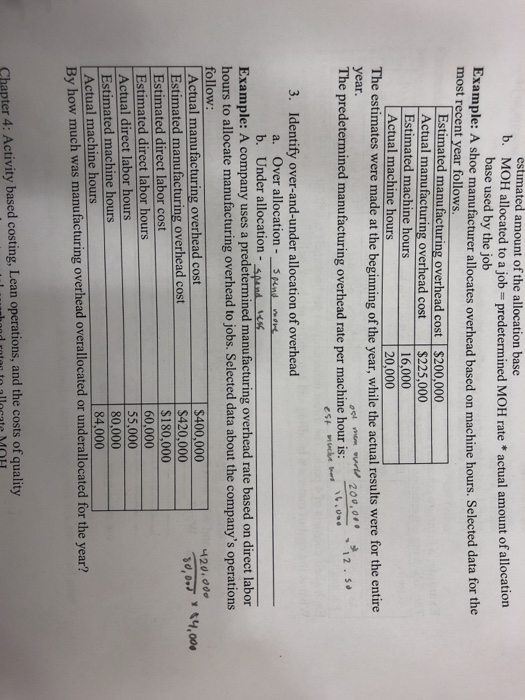

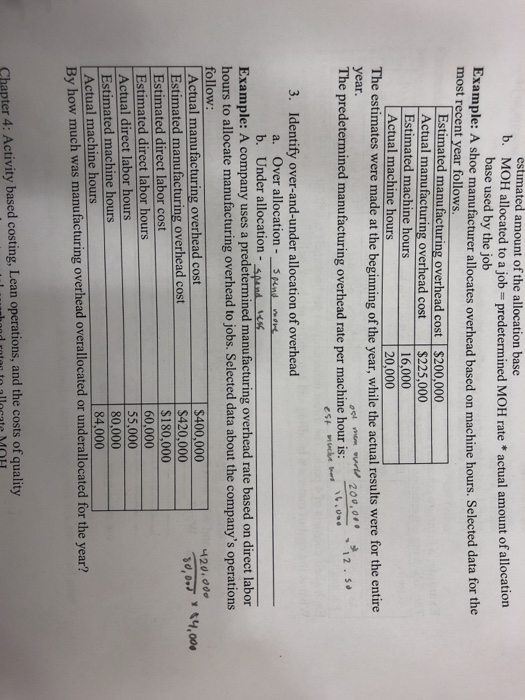

estimated amount of the allocation base b. MOH allocated to a job predetermined MOH rate actual amount of allocation base used by the job xample: A shoe manufacturer allocates overhead based on machine hours. Selected data for the most recent year follows Estimated manufacturing overhead cost $200,000 Actual manufacturing overhead cost $225,000 Estimated machine hours Actual machine hours 16,000 20,000 The estimates were made at the beginning of the year, while the actual results were for the entire year. The predetermined manufacturing overhead rate per machine hour is: -" Identify over-and-under allocation of overhead Over allocation -5nd ons Under allocation - spAnA 3. a. b. Example: A company uses a predetermined manufacturing overhead rate based on direct labor hours to allocate manufacturing overhead to jobs. Selected data about the company's operations follow: Actual manufacturing overhead cost Estimated manufacturing overhead cost Estimated direct labor cost $400,000 420, odo $420,00030,O.7 $180,000 60,000 55,000 80,000 84,000 Estimated direct labor hours Actual direct labor hours Estimated machine hours Actual machine hours By how much was manufacturing overhead overallocated or underallocated for th e year? Chapter 4: Activity based costing, Lean operations, and the costs of qualit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started