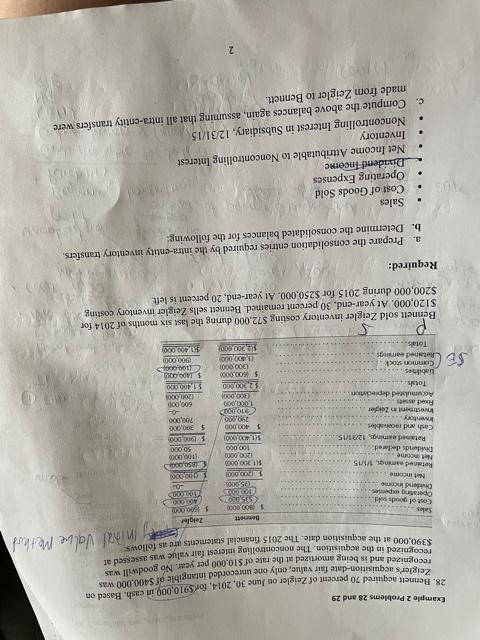

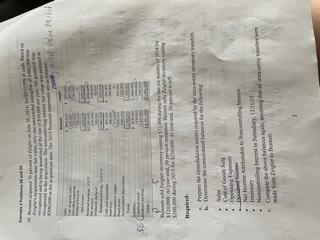

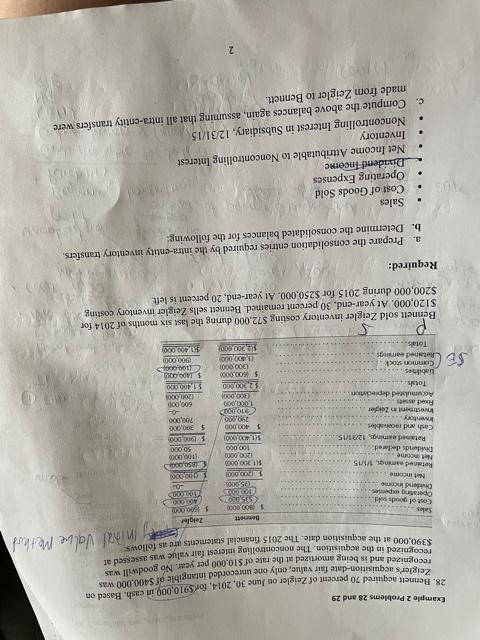

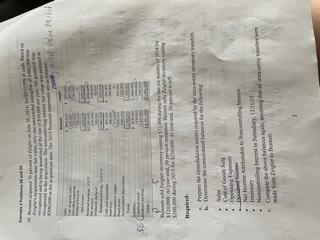

Example 2 Problems 28 and 29 28. Bennett acquired 70 percent of Zeigler on June 30, 2014, for 5910,000 in cash. Based on feceler's acquisition-date fair value, only one unrecorded intangible of 400,000 was at $390,000 at the acquisition date. The 2015 financial statements are as follows Inital Value Method recognized and is being amortized at the rate of $10.000 per year. No goodwill was Zeigler 500 AOOOOO GOOOOO Sales Cost of goods sold Operating expenses Owend income Mer income Retained wings, 11/15 Netcome Dividends deed Retainedomings, 1201/15 Cash and receivables Bennett $800.000 S. XOS 05.000 1200 DO 1.200,0000 1200,0001 100,000 5.400.000 3 900.000 290.000 10.000 1.000.000 20 000 $2,200.000 $500,000 000,000 1.100.000 2.300.000 Investment in Zeidler Ruedas Accumulated depreciation Totals. Liabilities Common stock (109.000 89, (109,000 50.000 5 200,000 $ 300,000 700,000 - 600,000 200.000 1.400.000 ADOBOKO 199.000 000 0001 0.400.000 SE Totals. Bennett sold Zeigler inventory costing $72,000 during the last six months of 2014 for $120,000. At year-end. 30 percent remained Bennett sells Zeigler inventory costing $200,000 during 2015 for $250,000. At year-end, 20 percent is left. Required: a. Prepare the consolidation entries required by the intra-entity inventory transfers. b. Determine the consolidated balances for the following: Sales Cost of Goods Sold Operating Expenses Dividend Fncerne Net Income Attributable to Noncontrolling Interest XOR Inventory Noncontrolling Interest in Subsidiary, 12/31/15 c. Compute the above balances again, assuming that all intra-entity transfers were made from Zeigler to Bennett. 2 3 M $ Zapew por wiele w Sorte Hry So FA Nels.com Now, Complete web al fine Example 2 Problems 28 and 29 28. Bennett acquired 70 percent of Zeigler on June 30, 2014, for 5910,000 in cash. Based on feceler's acquisition-date fair value, only one unrecorded intangible of 400,000 was at $390,000 at the acquisition date. The 2015 financial statements are as follows Inital Value Method recognized and is being amortized at the rate of $10.000 per year. No goodwill was Zeigler 500 AOOOOO GOOOOO Sales Cost of goods sold Operating expenses Owend income Mer income Retained wings, 11/15 Netcome Dividends deed Retainedomings, 1201/15 Cash and receivables Bennett $800.000 S. XOS 05.000 1200 DO 1.200,0000 1200,0001 100,000 5.400.000 3 900.000 290.000 10.000 1.000.000 20 000 $2,200.000 $500,000 000,000 1.100.000 2.300.000 Investment in Zeidler Ruedas Accumulated depreciation Totals. Liabilities Common stock (109.000 89, (109,000 50.000 5 200,000 $ 300,000 700,000 - 600,000 200.000 1.400.000 ADOBOKO 199.000 000 0001 0.400.000 SE Totals. Bennett sold Zeigler inventory costing $72,000 during the last six months of 2014 for $120,000. At year-end. 30 percent remained Bennett sells Zeigler inventory costing $200,000 during 2015 for $250,000. At year-end, 20 percent is left. Required: a. Prepare the consolidation entries required by the intra-entity inventory transfers. b. Determine the consolidated balances for the following: Sales Cost of Goods Sold Operating Expenses Dividend Fncerne Net Income Attributable to Noncontrolling Interest XOR Inventory Noncontrolling Interest in Subsidiary, 12/31/15 c. Compute the above balances again, assuming that all intra-entity transfers were made from Zeigler to Bennett. 2 3 M $ Zapew por wiele w Sorte Hry So FA Nels.com Now, Complete web al fine