Answered step by step

Verified Expert Solution

Question

1 Approved Answer

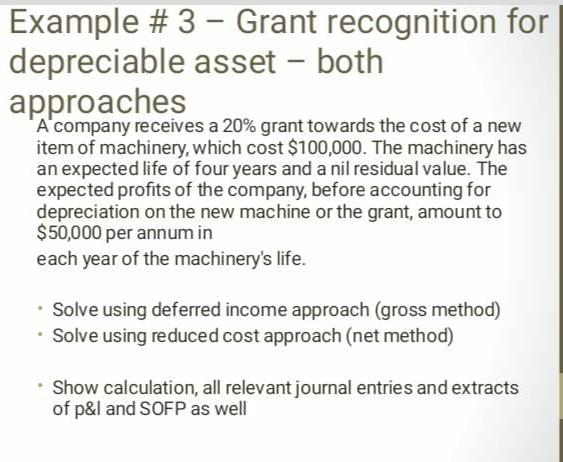

Example #3 - Grant recognition for depreciable asset - both approaches A company receives a 20% grant towards the cost of a new item of

Example #3 - Grant recognition for depreciable asset - both approaches A company receives a 20% grant towards the cost of a new item of machinery, which cost $100,000. The machinery has an expected life of four years and a nil residual value. The expected profits of the company, before accounting for depreciation on the new machine or the grant, amount to $50,000 per annum in each year of the machinery's life. Solve using deferred income approach (gross method) Solve using reduced cost approach (net method) Show calculation, all relevant journal entries and extracts of p&l and SOFP as well

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started