Question

Example 3-1 At Gleeson Brewing Company, office workers are employed for a 40-hour workweek; each individual's salary is quote on either an annual or a

Example 3-1

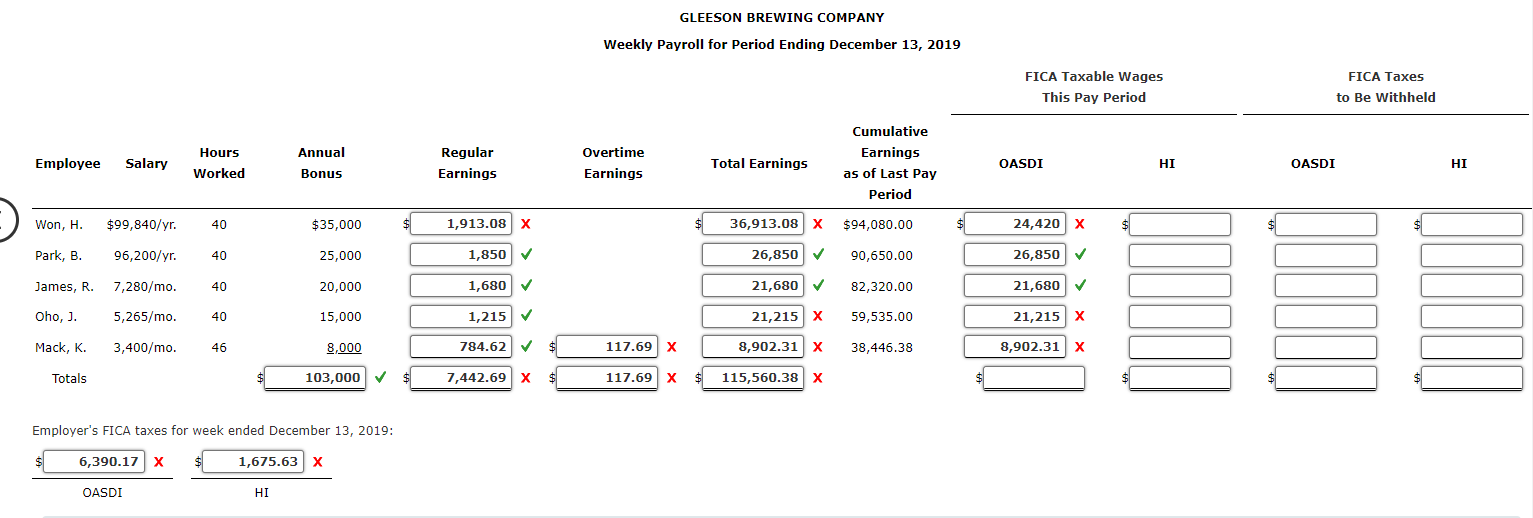

At Gleeson Brewing Company, office workers are employed for a 40-hour workweek; each individual's salary is quote on either an annual or a monthly basis.

Given on the form below are the current annual and monthly salary rates for five office workers for the week ended December 13, 2019 (50th payday of the year). In addition, with this pay, these employees are paid their sliding-scale annual bonuses. The bonuses are listed on the register.

****Please note that the ones marked green are right and the ones marked with a red X are wrong hence they ARE THE ONES NEEDING FIXING****

For each worker, compute the following. Round your answers to the nearest cent.

- Regular earnings for the weekly payroll ended December 13, 2019.

- Overtime earnings (if applicable).

- Total regular, overtime earnings, and bonus.

- FICA taxable wages for this pay period.

- FICA taxes to be withheld for this pay period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started