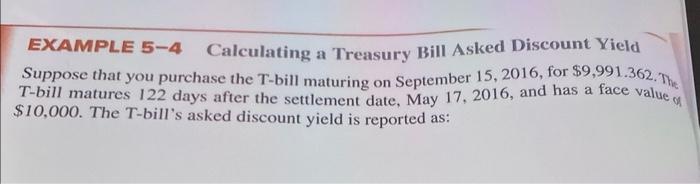

Question: EXAMPLE 5-4 Calculating a Treasury Bill Asked Discount Yield Suppose that you purchase the T-bill maturing on September 15, 2016, for $9,991.362. The T-bill matures

EXAMPLE 5-4 Calculating a Treasury Bill Asked Discount Yield Suppose that you purchase the T-bill maturing on September 15, 2016, for $9,991.362. The T-bill matures 122 days after the settlement date, May 17, 2016, and has a face value of $10,000. The T-bill's asked discount yield is reported as

Step by Step Solution

There are 3 Steps involved in it

To calculate the Tbills asked discount yield you can use the following formula ... View full answer

Get step-by-step solutions from verified subject matter experts