Answered step by step

Verified Expert Solution

Question

1 Approved Answer

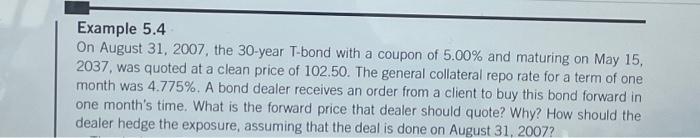

Example 5.4 On August 31, 2007, the 30-year T-bond with a coupon of 5.00% and maturing on May 15, 2037, was quoted at a clean

Example 5.4 On August 31, 2007, the 30-year T-bond with a coupon of 5.00% and maturing on May 15, 2037, was quoted at a clean price of 102.50. The general collateral repo rate for a term of one month was 4.775%. A bond dealer receives an order from a client to buy this bond forward in one month's time. What is the forward price that dealer should quote? Why? How should the dealer hedge the exposure, assuming that the deal is done on August 31, 2007?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started