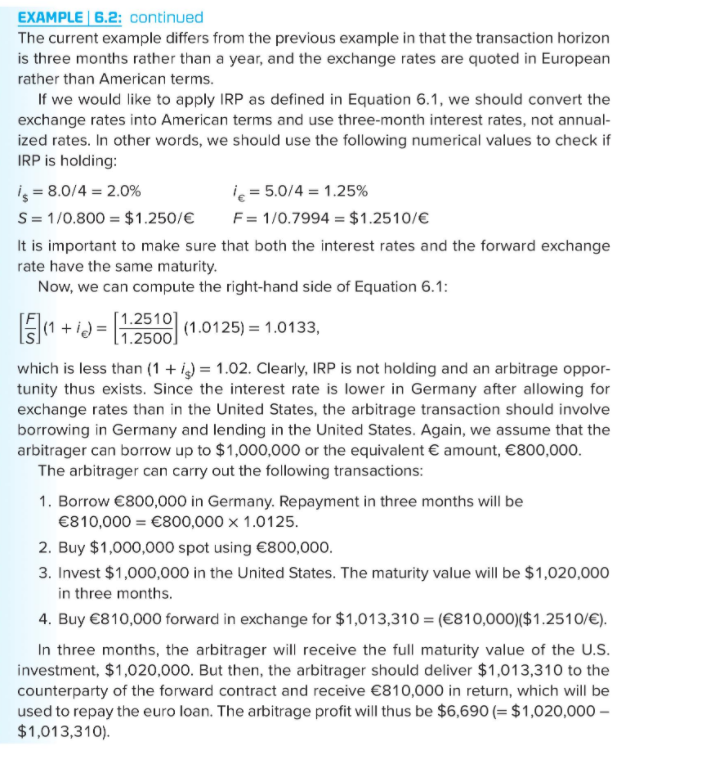

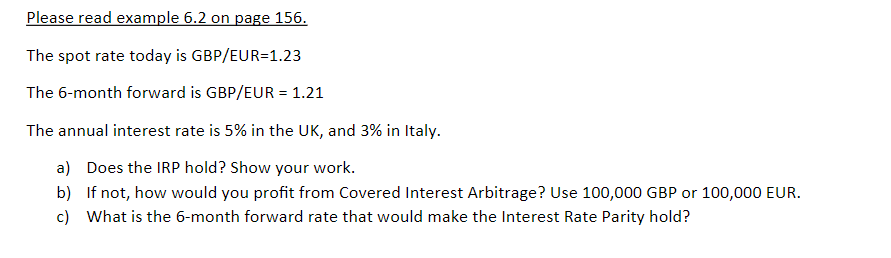

EXAMPLE 6.2: continued The current example differs from the previous example in that the transaction horizon is three months rather than a year, and the exchange rates are quoted in European rather than American terms. If we would like to apply IRP as defined in Equation 6.1, we should convert the exchange rates into American terms and use three-month interest rates, not annual- ized rates. In other words, we should use the following numerical values to check if IRP is holding: is = 8.0/4 = 2.0% le=5.0/4 = 1.25% S= 1/0.800 = $1.250/ F= 1/0.7994 = $1.2510/ It is important to make sure that both the interest rates and the forward exchange rate have the same maturity. Now, we can compute the right-hand side of Equation 6.1: [1.2510] 1(1+i) = , 1.2500) which is less than (1 + is) = 1.02. Clearly, IRP is not holding and an arbitrage oppor- tunity thus exists. Since the interest rate is lower in Germany after allowing for exchange rates than in the United States, the arbitrage transaction should involve borrowing in Germany and lending in the United States. Again, we assume that the arbitrager can borrow up to $1,000,000 or the equivalent amount, 800,000. The arbitrager can carry out the following transactions: 1. Borrow 800,000 in Germany. Repayment in three months will be 810,000 = 800,000 x 1.0125. 2. Buy $1,000,000 spot using 800,000. 3. Invest $1,000,000 in the United States. The maturity value will be $1,020,000 in three months. 4. Buy 810,000 forward in exchange for $1,013,310 = (810,000)($1.2510/). In three months, the arbitrager will receive the full maturity value of the U.S. investment, $1,020,000. But then, the arbitrager should deliver $1,013,310 to the counterparty of the forward contract and receive 810,000 in return, which will be used to repay the euro loan. The arbitrage profit will thus be $6,690 (= $1,020,000 - $1,013,310). Please read example 6.2 on page 156. The spot rate today is GBP/EUR=1.23 The 6-month forward is GBP/EUR = 1.21 The annual interest rate is 5% in the UK, and 3% in Italy. a) Does the IRP hold? Show your work. b) If not, how would you profit from Covered Interest Arbitrage? Use 100,000 GBP or 100,000 EUR. c) What is the 6-month forward rate that would make the Interest Rate Parity hold? EXAMPLE 6.2: continued The current example differs from the previous example in that the transaction horizon is three months rather than a year, and the exchange rates are quoted in European rather than American terms. If we would like to apply IRP as defined in Equation 6.1, we should convert the exchange rates into American terms and use three-month interest rates, not annual- ized rates. In other words, we should use the following numerical values to check if IRP is holding: is = 8.0/4 = 2.0% le=5.0/4 = 1.25% S= 1/0.800 = $1.250/ F= 1/0.7994 = $1.2510/ It is important to make sure that both the interest rates and the forward exchange rate have the same maturity. Now, we can compute the right-hand side of Equation 6.1: [1.2510] 1(1+i) = , 1.2500) which is less than (1 + is) = 1.02. Clearly, IRP is not holding and an arbitrage oppor- tunity thus exists. Since the interest rate is lower in Germany after allowing for exchange rates than in the United States, the arbitrage transaction should involve borrowing in Germany and lending in the United States. Again, we assume that the arbitrager can borrow up to $1,000,000 or the equivalent amount, 800,000. The arbitrager can carry out the following transactions: 1. Borrow 800,000 in Germany. Repayment in three months will be 810,000 = 800,000 x 1.0125. 2. Buy $1,000,000 spot using 800,000. 3. Invest $1,000,000 in the United States. The maturity value will be $1,020,000 in three months. 4. Buy 810,000 forward in exchange for $1,013,310 = (810,000)($1.2510/). In three months, the arbitrager will receive the full maturity value of the U.S. investment, $1,020,000. But then, the arbitrager should deliver $1,013,310 to the counterparty of the forward contract and receive 810,000 in return, which will be used to repay the euro loan. The arbitrage profit will thus be $6,690 (= $1,020,000 - $1,013,310). Please read example 6.2 on page 156. The spot rate today is GBP/EUR=1.23 The 6-month forward is GBP/EUR = 1.21 The annual interest rate is 5% in the UK, and 3% in Italy. a) Does the IRP hold? Show your work. b) If not, how would you profit from Covered Interest Arbitrage? Use 100,000 GBP or 100,000 EUR. c) What is the 6-month forward rate that would make the Interest Rate Parity hold