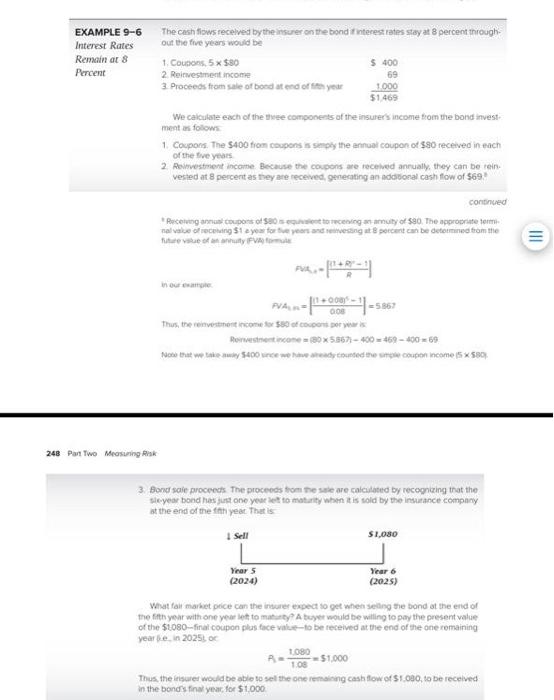

EXAMPLE 9-6 Interest Rates Remain at 8 Percent The cash flows received by the insurer on the bond if interest rates stay at 8 percent inrough- out the five years would be 1. Coupons 5* $30 $400 2 Reinvestment income 69 3 Proceeds from sale of bed at end of the you 1000 $1469 We calculate each of the three components of the insurer's income from the band invest ments flow 1 Coupons. The 5400 from coupons is simply the annual caupon of $80 received in each of the five years 2 Reinvestment income. Because the coupons we received annually, they can be rein vested at 8 percent as they are received, generating an additional cash flow of $69 continued Receiving a coupons of S80 stoc muty of $80. The appropriate sal value ofrecen $1 year for the years and resting at percent can be determined from the of PVA 110-11 008 -5867 Thus, the reinvestment income for $50 of consis Rosincome 80x58673-100=459-100=69 Note that we w $400 de metrounded the coupon Income 5530, 248 Part Two Measuring 3. Bond sale proceeds The proceeds from these are calculated by recognizing that the sleyear bond has just one year ze to maturity when it is sold by the insurance company at the end of the year. That is Sell $1,080 Year 5 (2024) Year 6 (2025) What fall market price on the insurer expect to get when seting the bond at the end of the fifth year with one year letto matty Abuyer would be willing to pay the present value of the $1080-final coupon plus face value-to be received at the end of the one romaining yearbe in 2025 1080 A- 1.00 51.000 Thus the insures would be able to sell the one remaining cash flow of $1.030, to be received in the bonds in year for $1.000 EXAMPLE 9-6 Interest Rates Remain at 8 Percent The cash flows received by the insurer on the bond if interest rates stay at 8 percent inrough- out the five years would be 1. Coupons 5* $30 $400 2 Reinvestment income 69 3 Proceeds from sale of bed at end of the you 1000 $1469 We calculate each of the three components of the insurer's income from the band invest ments flow 1 Coupons. The 5400 from coupons is simply the annual caupon of $80 received in each of the five years 2 Reinvestment income. Because the coupons we received annually, they can be rein vested at 8 percent as they are received, generating an additional cash flow of $69 continued Receiving a coupons of S80 stoc muty of $80. The appropriate sal value ofrecen $1 year for the years and resting at percent can be determined from the of PVA 110-11 008 -5867 Thus, the reinvestment income for $50 of consis Rosincome 80x58673-100=459-100=69 Note that we w $400 de metrounded the coupon Income 5530, 248 Part Two Measuring 3. Bond sale proceeds The proceeds from these are calculated by recognizing that the sleyear bond has just one year ze to maturity when it is sold by the insurance company at the end of the year. That is Sell $1,080 Year 5 (2024) Year 6 (2025) What fall market price on the insurer expect to get when seting the bond at the end of the fifth year with one year letto matty Abuyer would be willing to pay the present value of the $1080-final coupon plus face value-to be received at the end of the one romaining yearbe in 2025 1080 A- 1.00 51.000 Thus the insures would be able to sell the one remaining cash flow of $1.030, to be received in the bonds in year for $1.000