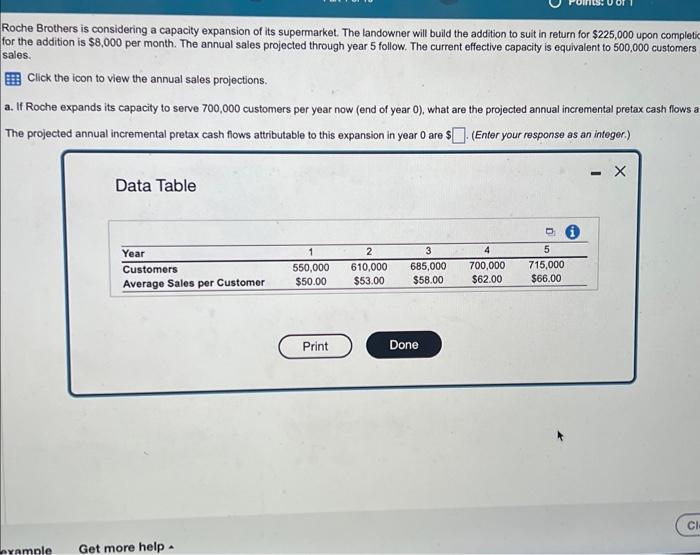

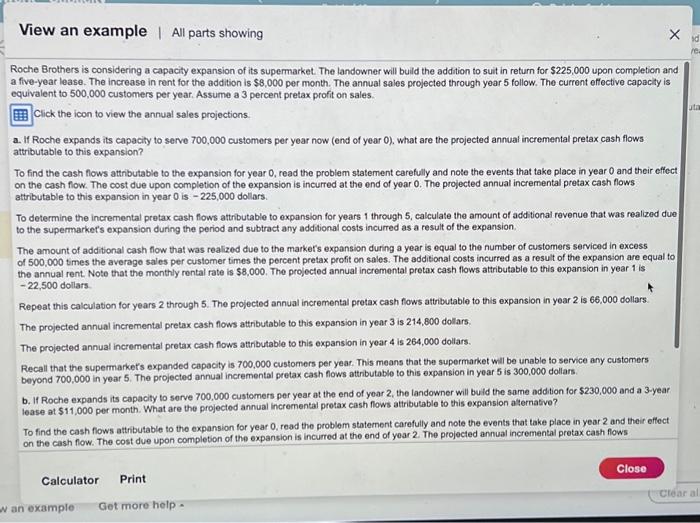

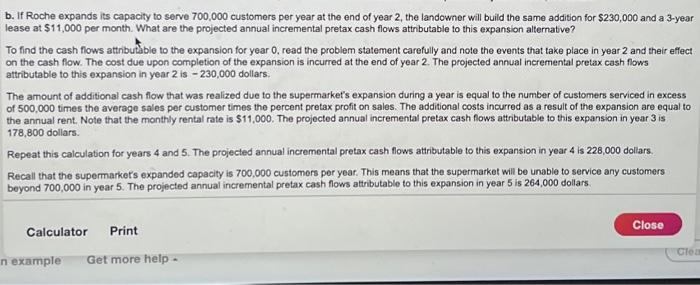

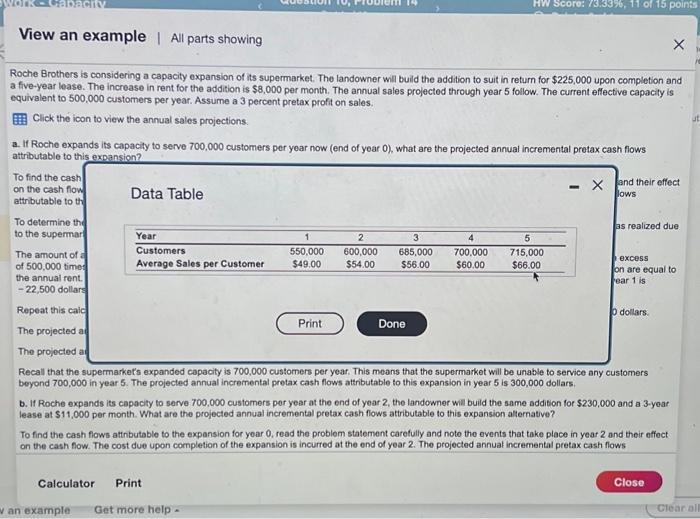

b. If Roche expands its capacity to serve 700,000 customers per year at the end of year 2 , the landowner will build the same addition for $230,000 and a 3 -year lease at $11,000 per month. What are the projected annual incremental pretax cash flows attributable to this expansion alternative? To find the cash flows attributable to the expansion for year 0 , read the problem statement carefully and note the events that take place in year 2 and their effect on the cash flow. The cost due upon completion of the expansion is incurred at the end of year 2 . The projected annual incremental pretax cash flows attributable to this expansion in year 2 is 230,000 dollars. The amount of additional cash flow that was realized due to the supermarket's expansion during a year is equal to the number of customers serviced in excess of 500,000 times the average sales per customer times the percent pretax profit on sales. The additional costs incurred as a result of the expansion are equal to the annual rent. Note that the monthly rental rate is $11,000. The projected annual incremental pretax cash fows attributable to this expansion in year 3 is 178,800 dollars. Repeat this calculation for years 4 and 5 . The projected annual incremental pretax cash flows attributable to this expansion in year 4 is 228,000 dollars. Recall that the supermarket's expanded capacity is 700,000 customers per year. This means that the supermarket will be unable to service any customers beyond 700,000 in year 5 . The projected annual incremental pretax cash flows attributable to this expansion in year 5 is 264,000 dollars. Roche Brothers is considering a capacity expansion of its supermarket. The landowner will build the addition to suit in return for $225,000 upon complete for the addition is $8,000 per month. The annual sales projected through year 5 follow. The current effective capacity is equivalent to 500,000 customers sales. Click the icon to view the annual sales projections. a. If Roche expands its capacity to serve 700,000 customers per year now (end of year 0 ), what are the projected annual incremental pretax cash flows a The projected annual incremental pretax cash flows attributable to this expansion in year 0 are $ (Enter your response as an integer.) Data Table Roche Brothers is considering a capacity expansion of its supermarket. The landowner will build the addition to suit in return for $225,000 upon completion and a five-year lease. The increase in rent for the addition is $8,000 per month. The annual sales projected through year 5 follow. The current effective capacily is equivalent to 500,000 customers per year. Assume a 3 percent pretax profit on sales. Click the icon to view the annual sales projections. a. If Roche expands its capacily to serve 700,000 customers per year now (end of year 0 ), what are the projected annual incremental pretax cash flows attributable to this expansion? To find the cash on the cash flow attributable to th Data Table To determine th to the supermar The amount of of 500,000 times the annual rent. 22,500 dollars Repeat this caic The projected af The projected a Recall that the supermarket's expanded capacity is 700,000 customers per year. This means that the supermarket will be unable to service any customers beyond 700,000 in year 5 . The projected annual incremental protax cash flows attributable to this expansion in year 5 is 300,000 dollars. b. If Roche expands its capocity to serve 700,000 customers per year at the end of year 2 , the landowner will build the same addition for $230,000 and a 3 -year lease at $11,000 per month. What are the projected annual incremental pretax cash flows attributable to this expansion alternative? To find the cash flows atthbutable to the expansion for year 0 , read the problem statement carefully and noto the events that take place in year 2 and their effect: on the cash fow. The cost due upon completion of the expansion is incurred at the end of year 2 . The projected annual incremental pretax cash flows Roche Brothers is considering a capacity expansion of its supermarket. The landowner will build the addition to suit in return for $225,000 upon completion and a five-year lease. The increase in rent for the addition is $8,000 per month. The annual sales projected through year 5 follow. The current effective capacity is equivalent to 500,000 customers per year. Assume a 3 percent pretax profit on sales. Click the icon to view the annual sales projections. a. If Roche expands its capacity to serve 700,000 customers per year now (end of year 0 ). what are the projected annual incremental pretax cash flows attributable to this expansion? To find the cash flows attributable to the expansion for year 0 , read the problem statement carefully and note the events that take place in year 0 and their effec on the cash flow. The cost due upon completion of the expansion is incurred at the end of yoar 0 . The projected annual incremental pretax cash flows attributable to this expansion in year 0 is 225,000 dollars. To determine the incremental pretax cash flows attributable to expansion for years 1 through 5 , calculate the amount of additional revenue that was realized due to the supermarket's expansion during the period and subtract any additional costs incurred as a result of the expansion. The amount of additional cash flow that was realized due to the markers expansion during a year is equal to the number of customers serviced in excess of 500,000 times the average sales per customer times the percent pretax profit on sales. The additional costs incurred as a result of the expansion are equal to the annual rent. Note that the monthly rental rate is $8,000. The projected annual incremental pretax cash flows attributable to this expansion in year 1 is 22,500 dollars. Repeat this calculation for years 2 through 5 . The projected annual incremental protax cash fows attributable to this expansion in year 2 is 66,000 dollars. The projected annual incremental pretax cash flows attributable to this expansion in year 3 is 214,800 dollars The projected annual incremental pretax cash flows attributable to this expansion in year 4 is 264,000 dollars. Recall that the supermarket's expanded capacity is 700,000 customers per year. This means that the supermarket will be unable to service any customers beyond 700,000 in year 5 . The projected annual incremental pretax cash flows attributable to this expansion in year 5 is 300,000 dollars. b. If Roche expands its capacity to serve 700,000 customers per year at the end of yoar 2 , the landowner will buld the same addition for $230,000 and a 3 -year lease at $11,000 per month. What are the projectod annual incremental protax cash flows attributable to this expansion atternative? To find the cash flows attributable to the expansion for year 0 , read the problem statement carefully and note the events that take place in year 2 and their effect on the cash flow. The cost due upon completion of the expansion is incurred at the end of year 2 . The projected annual incremental pretax cash flows Roche Brothers is considering a capacily expansion of is supermarket. The landowner will buld the addition to suit in retarn for $225,000 uppon completion and a freve year lease. The increase in rer for the addition is $5,000 per month. The annual sales projected through year 5 folow. The current effective capacty is equvalent to 500,000 customers per year. Assume a 2 percent pretax proft 0 sales Click the icon to view the annual sales projections. The projected annual incremental pretax cash fows attroulable to this expansion in year 0 are : (Enter your responsto as an inleger.)