Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Example Ltd manufactures two products, Product A and Product B. It applies departmental overhead rates based on machine hours for its machining department and

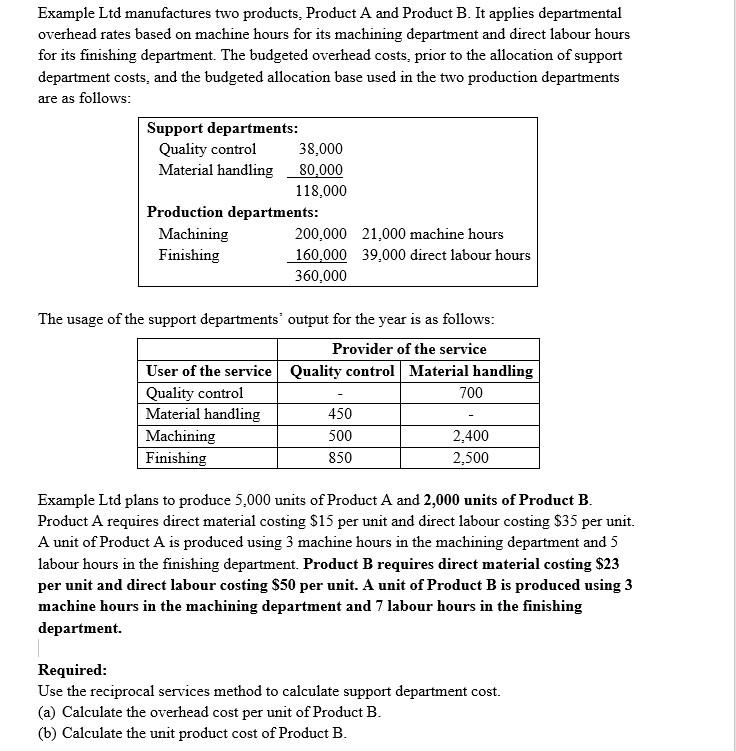

Example Ltd manufactures two products, Product A and Product B. It applies departmental overhead rates based on machine hours for its machining department and direct labour hours for its finishing department. The budgeted overhead costs, prior to the allocation of support department costs, and the budgeted allocation base used in the two production departments are as follows: Support departments: Quality control 38,000 Material handling 80,000 118,000 Production departments: Machining Finishing 200,000 21,000 machine hours 160,000 39,000 direct labour hours 360,000 The usage of the support departments output for the year is as follows: Provider of the service Quality control Material handling User of the service Quality control Material handling Machining Finishing 700 450 - 500 2,400 850 2,500 Example Ltd plans to produce 5,000 units of Product A and 2,000 units of Product B. Product A requires direct material costing $15 per unit and direct labour costing $35 per unit. A unit of Product A is produced using 3 machine hours in the machining department and 5 labour hours in the finishing department. Product B requires direct material costing $23 per unit and direct labour costing $50 per unit. A unit of Product B is produced using 3 machine hours in the machining department and 7 labour hours in the finishing department. Required: Use the reciprocal services method to calculate support department cost. (a) Calculate the overhead cost per unit of Product B. (b) Calculate the unit product cost of Product B.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the overhead cost per unit of Product B using the reciprocal services method we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started