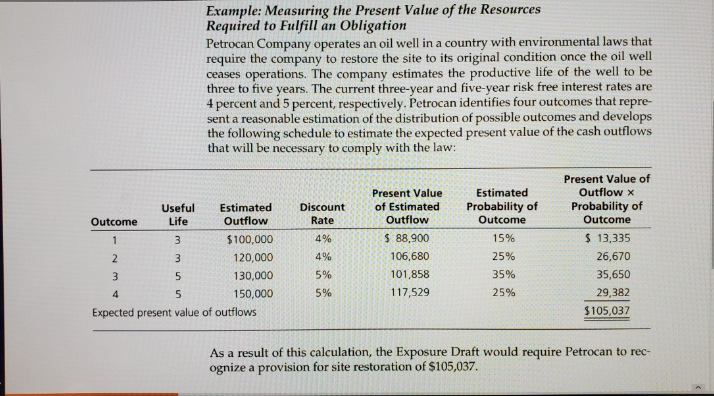

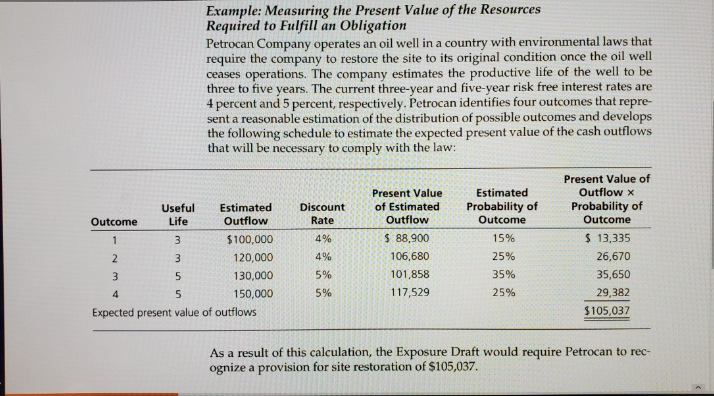

Example: Measuring the Present Value of the Resources Required to fulfill an Obligation Petrocan Company operates an oil well in a country with environmental laws that require the company to restore the site to its original condition once the oil well ceases operations. The company estimates the productive life of the well to be three to five years. The current three-year and five-year risk free interest rates are 4 percent and 5 percent, respectively. Petrocan identifies four outcomes that repre- sent a reasonable estimation of the distribution of possible outcomes and develops the following schedule to estimate the expected present value of the cash outflows that will be necessary to comply with the law: Discount Rate Life Useful Estimated Outcome Outflow $100,000 120,000 130,000 150,000 Expected present value of outflows Present Value of Estimated Outflow $ 88,900 106,680 101,858 117,529 Estimated Probability of Outcome 15% 25% 35% 25% Present Value of Outflow X Probability of Outcome $ 13,335 26,670 35,650 29,382 $105,037 As a result of this calculation, the Exposure Draft would require Petrocan to rec ognize a provision for site restoration of $105,037. Example: Measuring the Present Value of the Resources Required to fulfill an Obligation Petrocan Company operates an oil well in a country with environmental laws that require the company to restore the site to its original condition once the oil well ceases operations. The company estimates the productive life of the well to be three to five years. The current three-year and five-year risk free interest rates are 4 percent and 5 percent, respectively. Petrocan identifies four outcomes that repre- sent a reasonable estimation of the distribution of possible outcomes and develops the following schedule to estimate the expected present value of the cash outflows that will be necessary to comply with the law: Discount Rate Life Useful Estimated Outcome Outflow $100,000 120,000 130,000 150,000 Expected present value of outflows Present Value of Estimated Outflow $ 88,900 106,680 101,858 117,529 Estimated Probability of Outcome 15% 25% 35% 25% Present Value of Outflow X Probability of Outcome $ 13,335 26,670 35,650 29,382 $105,037 As a result of this calculation, the Exposure Draft would require Petrocan to rec ognize a provision for site restoration of $105,037