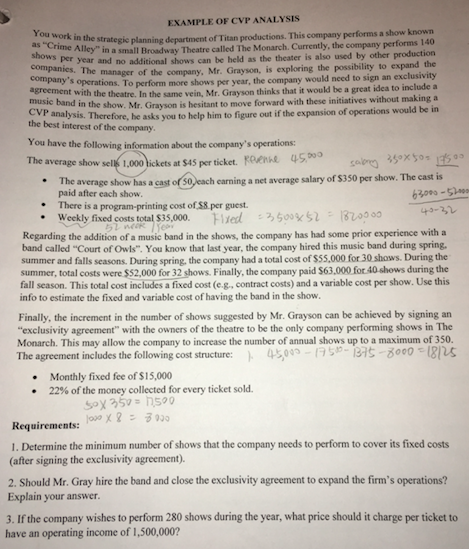

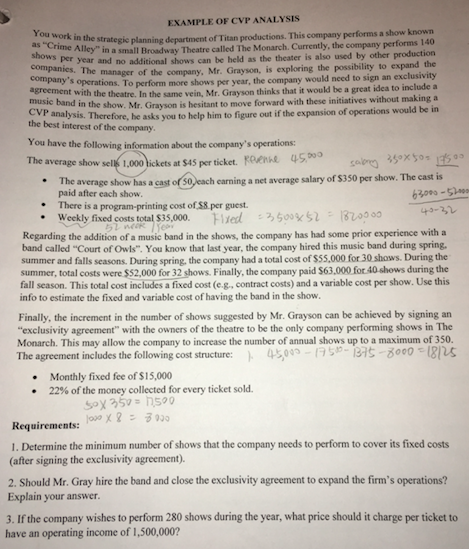

EXAMPLE OF CVP ANALYSIS e strategic planning department of Titan productions. This company performs a show known in a small Broadway Theatre called The Monarch. Currently, the company performs 140 ear and no additional shows can be held as the theater is also used by other production ger of the company, Mr. Grayson, is exploring the possibility to expand the ons. To perform more shows per year, the company would need to sign an exclusivity e theatre. In the same vein, Mr. Grayson thinks that it would be a great idea to include a w. Mr. Grayson is hesitant to move forward with these initiatives without making a You work in the companics. The agreement with the music band in the sho analysis. Therefore, he asks you to help him to figure out if the expansion of operations w the best interest of the company You have the following information about the company's operations The average show sell 1000.ickets at S45 per ticket.romu 45ga00 X5, * The average show has a cast oSoeach eaming a net average salary of $350 per show. The cast is paid after each show. There is a program-printing cost of $8 per guest. 63000-53 * Weekly fixed costs total $35,000 Regarding the addition of a music band in the shows, the company has had some prior experience with a band called "Court of Ols". You know that last year, the company hired this music band during spring summer and falls seasons. During spring, the company had a total cost of $55,000 for 30 shows. During the summer, total costs were $52,000 for 32 shows. Finally, the company paid $63,000 for 40 shows during the fall season. This total cost includes a fixed cost (e.g., contract costs) and a variable cost per show. Use this info to estimate the fixed and variable cost of having the band in the show Finally, the increment in the number of shows suggested by Mr. Grayson can be achieved by signing an exclusivity agreement" with the owners of the theatre to be the only company performing shows in The Monarch. This may allow the company to increase the number of annual shows up to a maximum of 350. The agreement includes the following cost structure: )-4S01.Se-BS-3000-18125 Monthly fixed fee of $15,000 22% of the money collected for every ticket sold. Requirements: ooox2 1. Determine the minimum number of shows that the company needs to perform to cover its fixed costs (after signing the exclusivity agreement) 2. Should Mr. Gray hire the band and close the exclusivity agreement to expand the firm's operations? Explain your answer. 3. If the company wishes to perform 280 shows during the year, what price should it charge per ticket to have an operating income of 1,500,000? EXAMPLE OF CVP ANALYSIS e strategic planning department of Titan productions. This company performs a show known in a small Broadway Theatre called The Monarch. Currently, the company performs 140 ear and no additional shows can be held as the theater is also used by other production ger of the company, Mr. Grayson, is exploring the possibility to expand the ons. To perform more shows per year, the company would need to sign an exclusivity e theatre. In the same vein, Mr. Grayson thinks that it would be a great idea to include a w. Mr. Grayson is hesitant to move forward with these initiatives without making a You work in the companics. The agreement with the music band in the sho analysis. Therefore, he asks you to help him to figure out if the expansion of operations w the best interest of the company You have the following information about the company's operations The average show sell 1000.ickets at S45 per ticket.romu 45ga00 X5, * The average show has a cast oSoeach eaming a net average salary of $350 per show. The cast is paid after each show. There is a program-printing cost of $8 per guest. 63000-53 * Weekly fixed costs total $35,000 Regarding the addition of a music band in the shows, the company has had some prior experience with a band called "Court of Ols". You know that last year, the company hired this music band during spring summer and falls seasons. During spring, the company had a total cost of $55,000 for 30 shows. During the summer, total costs were $52,000 for 32 shows. Finally, the company paid $63,000 for 40 shows during the fall season. This total cost includes a fixed cost (e.g., contract costs) and a variable cost per show. Use this info to estimate the fixed and variable cost of having the band in the show Finally, the increment in the number of shows suggested by Mr. Grayson can be achieved by signing an exclusivity agreement" with the owners of the theatre to be the only company performing shows in The Monarch. This may allow the company to increase the number of annual shows up to a maximum of 350. The agreement includes the following cost structure: )-4S01.Se-BS-3000-18125 Monthly fixed fee of $15,000 22% of the money collected for every ticket sold. Requirements: ooox2 1. Determine the minimum number of shows that the company needs to perform to cover its fixed costs (after signing the exclusivity agreement) 2. Should Mr. Gray hire the band and close the exclusivity agreement to expand the firm's operations? Explain your answer. 3. If the company wishes to perform 280 shows during the year, what price should it charge per ticket to have an operating income of 1,500,000