Example questions need to be answered

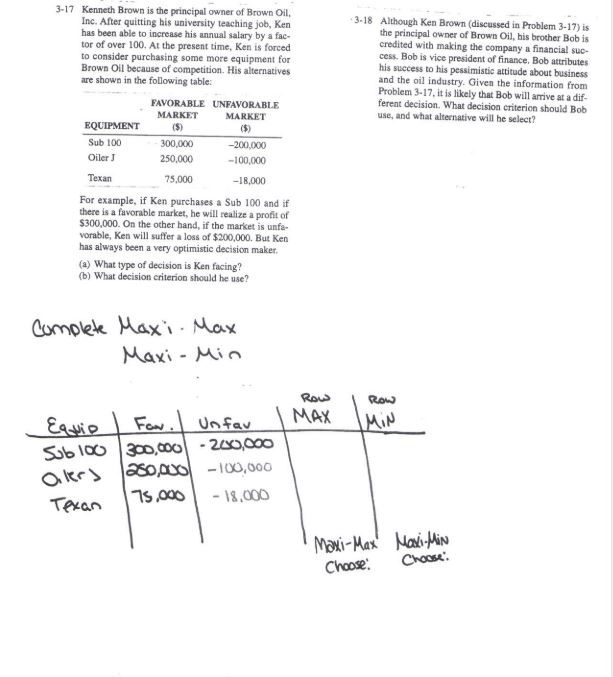

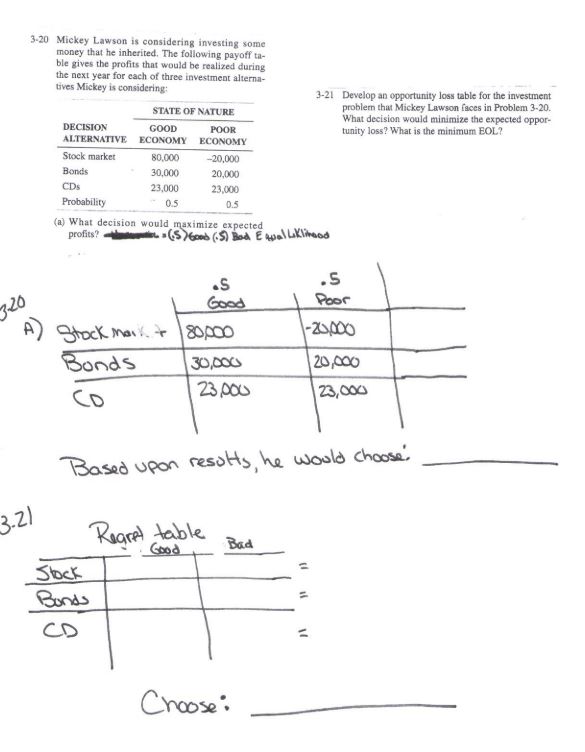

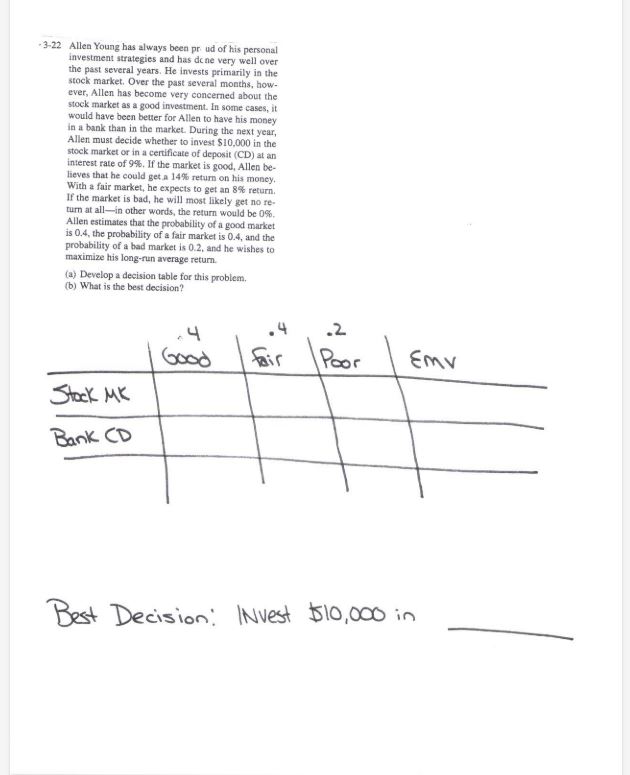

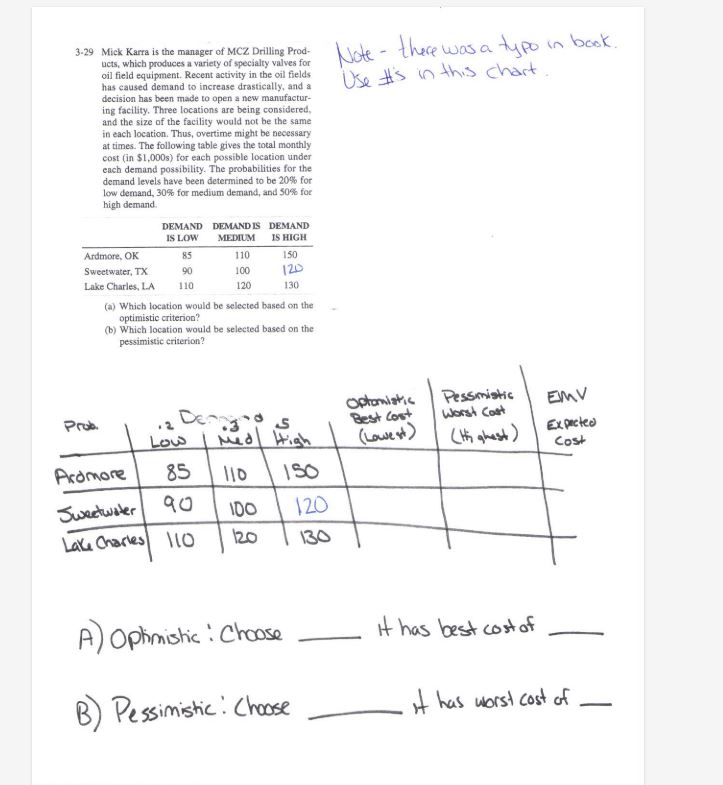

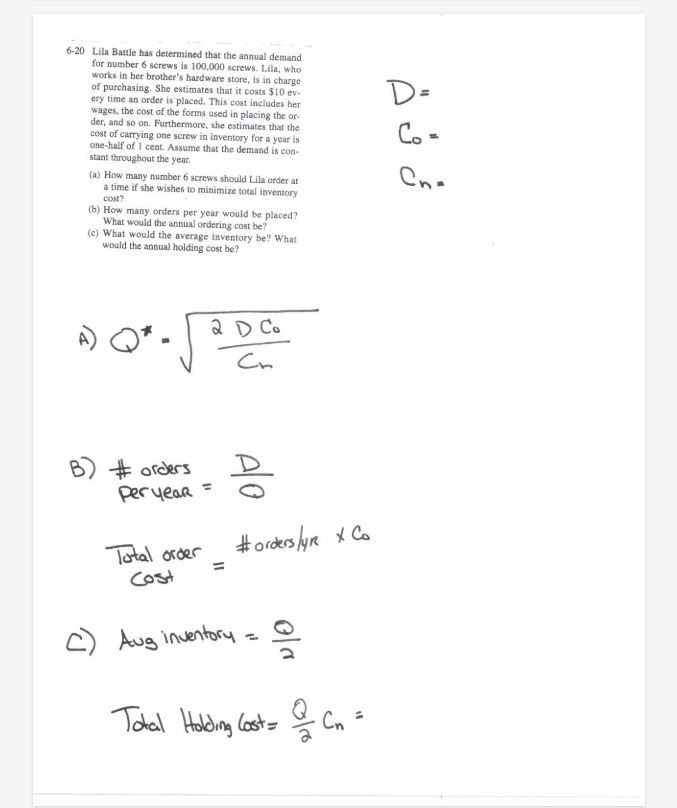

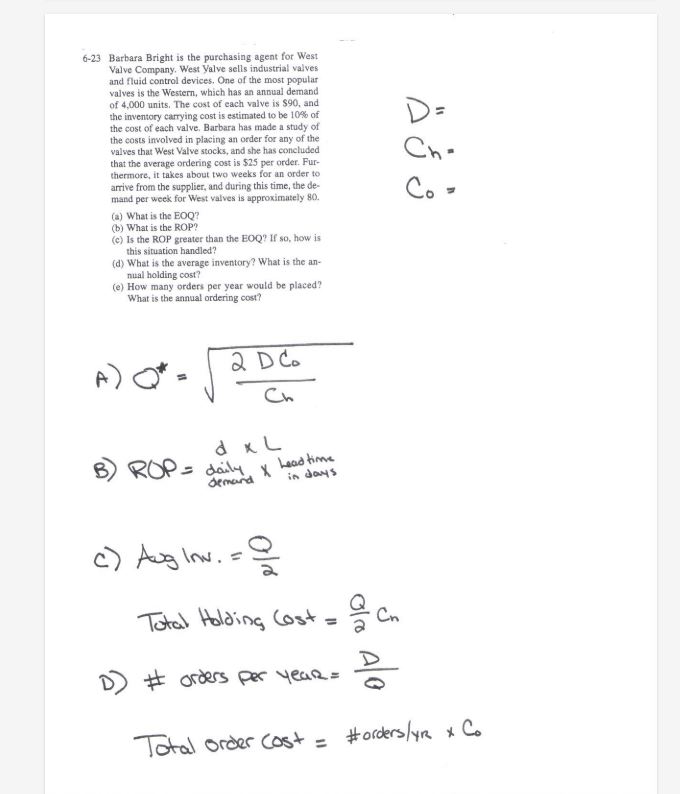

3-17 Kenneth Brown is the principal owner of Brown Oil, Inc. After quitting his university teaching job, Ken 3-18 Although Ken Brown (discussed in Problem 3-17) is has been able to increase his annual salary by a fac- the principal owner of Brown Oil, his brother Bob is tor of over 100. At the present time, Ken is forced credited with making the company a financial suc- to consider purchasing some more equipment for cess. Bob is vice president of finance, Bob attributes Brown Oil because of competition. His alternatives his success to his pessimistic attitude about business are shown in the following table: and the oil industry. Given the information from Problem 3-17, it is likely that Bob will arrive at a dif- FAVORABLE UNFAVORABLE ferent decision. What decision criterion should Bob MARKET MARKET use, and what alternative will he select? EQUIPMENT (5) Sub 100 300,000 -200,000 Oiler J 250,000 -100,000 Texan 75,000 -18,000 For example, if Ken purchases a Sub 100 and if there is a favorable market, he will realize a profit of $300,000. On the other hand, if the market is unfa- vorable, Ken will suffer a loss of $200,000, But Ken has always been a very optimistic decision maker. (a) What type of decision is Ken facing? (b) What decision criterion should he use? Complete Maxi . Max Maxi - Min ROU ROW For. Unfav MAX Equip MIN Sub 100 300,000 - 200,000 Oilers 250,200 -100,000 Texan 75, 000 - 18,000 Maxi-Max Maxi-Min Choose: Choose"3-20 Mickey Lawson is considering investing some money that he inherited. The following payoff ta- ble gives the profits that would be realized during the next year for each of three investment alterna- tives Mickey is considering: 3-21 Develop an opportunity loss table for the investment STATE OF NATURE problem that Mickey Lawson faces in Problem 3-20. What decision would minimize the expected oppor- DECISION GOOD POOR tunity loss? What is the minimum BOL? ALTERNATIVE ECONOMY ECONOMY Stock market 80.000 -20,000 Bonds 30,000 20,000 CDS 23,000 23,000 Probability 05 D.5 (a) What decision would maximize expected profits? 24 65)Good (.5) Bod Equal Likliread . S S 3-20 Good Poor A ) Stock mark. + 80 pop -23000 Bonds 30,000 20,000 CD 23,000 23,000 Based upon results , he would choose ! 3-21 Reared table Good Bad Stock Bonds CD Choose:3-22 Allen Young has always been pr ud of his personal investment strategies and has done very well over the past several years. He invests primarily in the stock market. Over the past several months, how- ever, Allen has become very concerned about the stock market as a good investment. In some cases, it would have been better for Allen to have his money in a bank than in the market. During the next year, Allen must decide whether to invest $10,000 in the stock market or in a certificate of deposit (CD) at an interest rate of 9%. If the market is good, Allen be- lieves that he could get a 14% return on his money With a fair market, he expects to get an 8% return. If the market is bad, he will most likely get no re- turn at all-in other words, the return would be 0%, Allen estimates that the probability of a good market is 0.4, the probability of a fair market is 0.4, and the probability of a bad market is 0.2, and he wishes to maximize his long-run average return. (a) Develop a decision table for this problem, (b) What is the best decision? 4 4 .2 Good fair Poor Emv Stock MK Bank CD Best Decision : Invest $510,000 in3-29 Mick Karra is the manager of MCZ Drilling Prod- Note - there was a typo in book ucts, which produces a variety of specialty valves for oil field equipment. Recent activity in the oil fields has caused demand to increase drastically, and a Use #s in this chart decision has been made to open a new manufacture ing facility. Three locations are being considered, and the size of the facility would not be the same in each location. Thus, overtime might be necessary at times. The following table gives the total monthly cost (in $1,000s) for each possible location under each demand possibility. The probabilities for the demand levels have been determined to be 20% for low demand, 30% for medium demand, and 50% for high demand DEMAND DEMANDIS DEMAND IS LOW MEDIUM IS HIGH Ardmore, OK 85 110 150 Sweetwater, TX 100 Lake Charles, LA 110 120 130 () Which location would be selected based on the optimistic criterion? (b) Which location would be selected based on the pessimistic criterion? Optoistic Pessimistic EMV Prob Best Cost worst Cast Expected LOU Med High ( Lowest ) ( Highest ) Cost Ardmore 85 110 150 Sweetwater 90 1DO 120 Lake Charles 110 120 130 A ) Optimistic : choose It has best cost of B) Pessimistic: Choose it has worst cost of.6-20 Lila Battle has determined that the annual demand for number 6 screws is 100,000 screws. Lila, who works in her brother's hardware store, is in charge of purchasing. She estimates that it costs $10 ev- ery time an order is placed, This cost includes her D= wages, the cost of the forms used in placing the or- der, and so on. Furthermore, she estimates that the cost of carrying one screw in inventory for a year is Co - one-half of 1 cent. Assume that the demand is con- stant throughout the year. (a) How many number 6 screws should Lila order at a time if she wishes to minimize total inventory cost? (b) How many orders per year would be placed? What would the annual ordering cost be? (c) What would the average inventory be? What would the annual holding cost be? a D Co A) Cn B ) # orders peryear = Total order # orders/ yr * Co = Cost ( ) Aug inventory = Total Holding Cost = & Cn =6-23 Barbara Bright is the purchasing agent for West Valve Company. West Valve sells industrial valves and fluid control devices, One of the most popular valves is the Western, which has an annual demand of 4,000 units. The cost of each valve is $90, and the inventory carrying cost is estimated to be 10% of the cost of each valve. Barbara has made a study of D= the costs involved in placing an order for any of the valves that West Valve stocks, and she has concluded that the average ordering cost is $25 per order. Fur- thermore, it takes about two weeks for an order to arrive from the supplier, and during this time, the de- mand per week for West valves is approximately 80. (a) What is the EOQ? (b) What is the ROP? (c) Is the ROP greater than the EQQ" If so, how is this situation handled? (d) What is the average inventory? What is the an- nual holding cost? (e) How many orders per year would be placed? What is the annual ordering cost? A ) Q* 2. D Co Ch d XL B ) ROP = daily y Leadtime demand in days ( ) Auglow . = Total Holding Cost = Cn D ) # orders per year = Total order cost = #orders/ yr x Co