Answered step by step

Verified Expert Solution

Question

1 Approved Answer

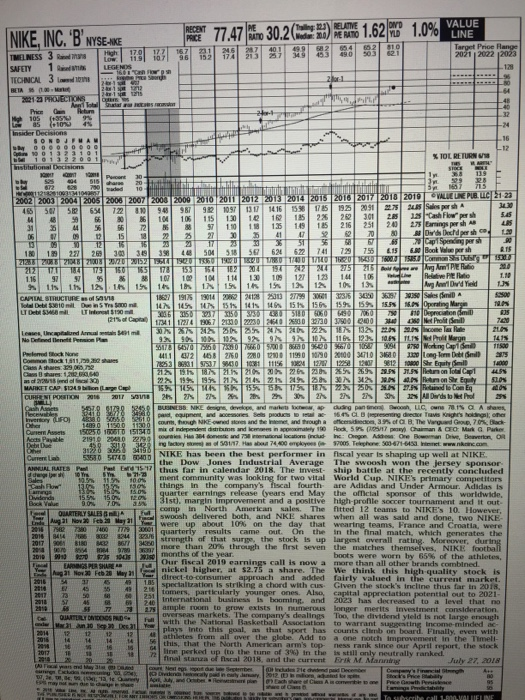

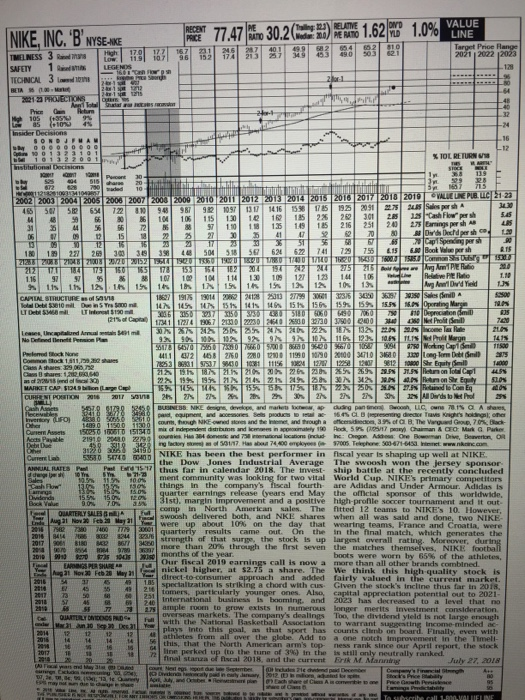

Example Updated valueline 1. Using the Valueline survery for NIKE (NKE), evaluate the company using Warren Buffet's 15 percent rule. Nike Price EPS P/E 57.65

Example

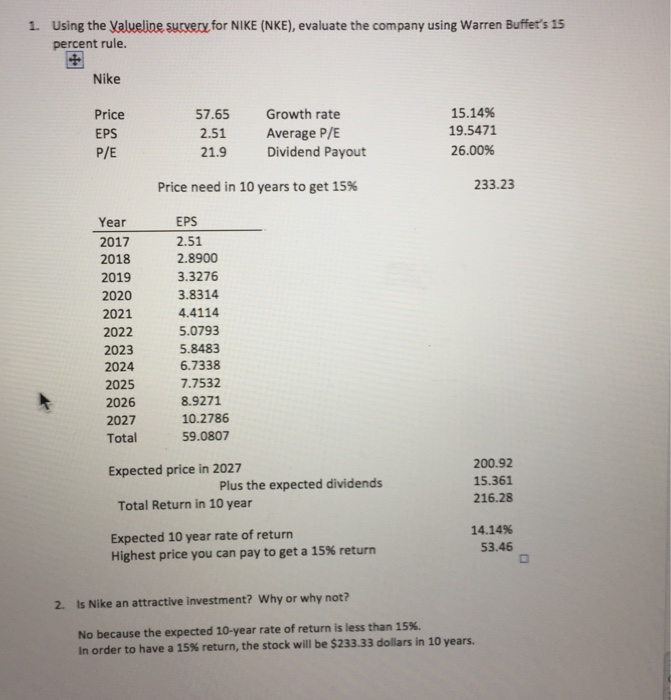

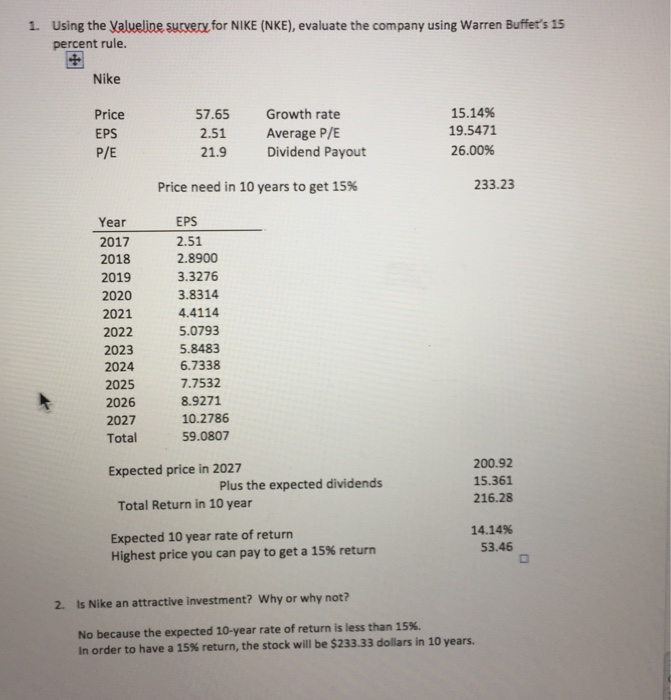

1. Using the Valueline survery for NIKE (NKE), evaluate the company using Warren Buffet's 15 percent rule. Nike Price EPS P/E 57.65 Growth rate 2.51 Average P/E 21.9 Dividend Payout 15.14% 19.5471 26.00% Price need in 10 years to get 15% 233.23 Year 2017 2018 2019 EPS 2.51 2.8900 3.8314 4.4114 5.0793 5.8483 2020 3.3276 2021 2022 2023 2024 2025 6.7338 2026 2027 Total 7.7532 8.9271 10.2786 59.0807 Expected price in 2027 200.92 15.361 216.28 Plus the expected dividends Total Return in 10 year Expected 10 year rate of return Highest price you can pay to get a 15% return 14.14% 53.46 2. Is Nike an attractive investment? Why or why not? No because the expected 10-year rate of return is less than 1s In order to have a 15% return, the stock will be $233.33 dollars in 10 years. 1. Using the Valueline survery for NIKE (NKE), evaluate the company using Warren Buffet's 15 percent rule. Nike Price EPS P/E 57.65 Growth rate 2.51 Average P/E 21.9 Dividend Payout 15.14% 19.5471 26.00% Price need in 10 years to get 15% 233.23 Year 2017 2018 2019 EPS 2.51 2.8900 3.8314 4.4114 5.0793 5.8483 2020 3.3276 2021 2022 2023 2024 2025 6.7338 2026 2027 Total 7.7532 8.9271 10.2786 59.0807 Expected price in 2027 200.92 15.361 216.28 Plus the expected dividends Total Return in 10 year Expected 10 year rate of return Highest price you can pay to get a 15% return 14.14% 53.46 2. Is Nike an attractive investment? Why or why not? No because the expected 10-year rate of return is less than 1s In order to have a 15% return, the stock will be $233.33 dollars in 10 years

Updated valueline

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started