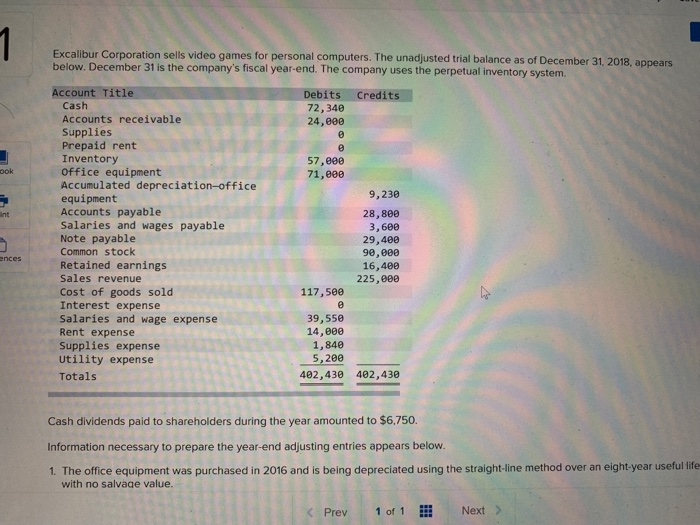

Excalibur Corporation sells video games for personal computers. The unadjusted trial balance as of December 31, 2018, appears below. December 31 is the companys fiscal year-end. The company uses the perpetual inventory system. Complete the worsheet below. Use thing information in the worksheet to prepare an income statement for 2018, a statement of shareholders equity for 2018, a balance sheet as of December 31, 2018, and prepare the necessary closing entries assuming that adjusting entries have been correctly posted to the accounts.

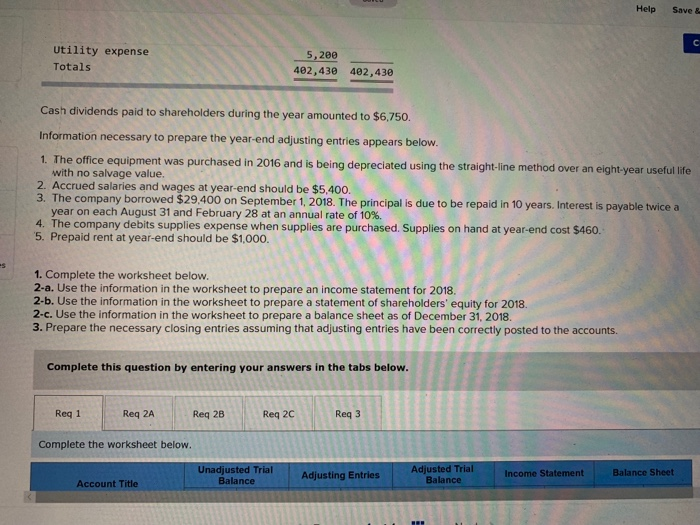

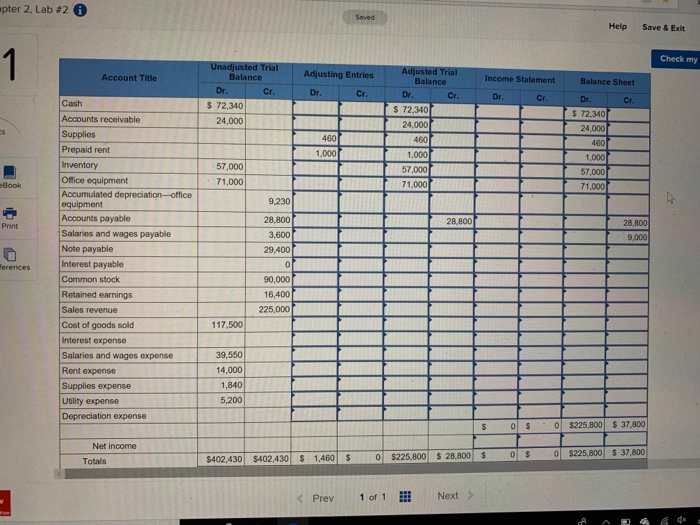

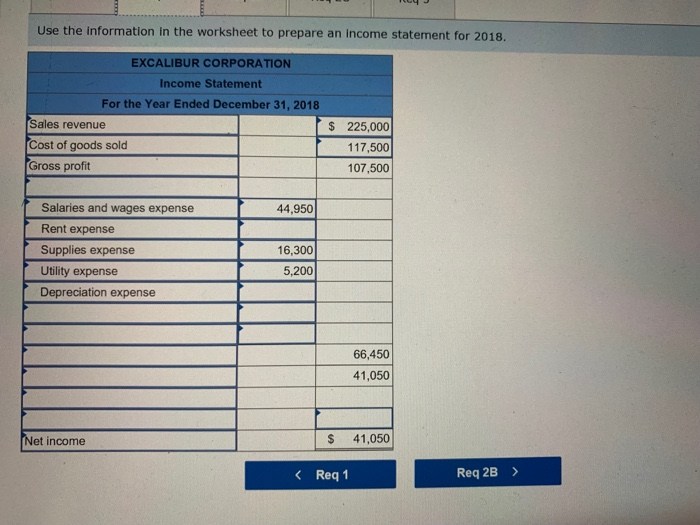

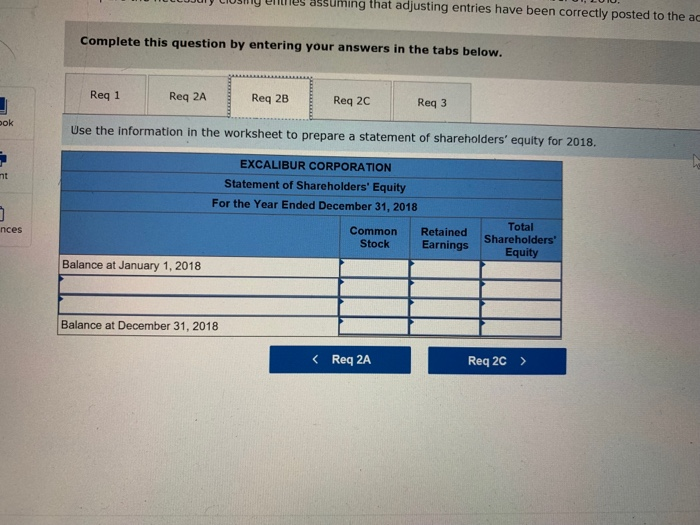

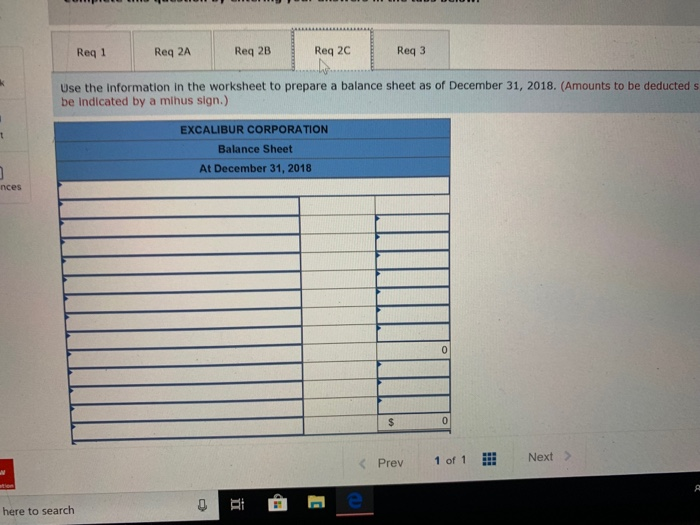

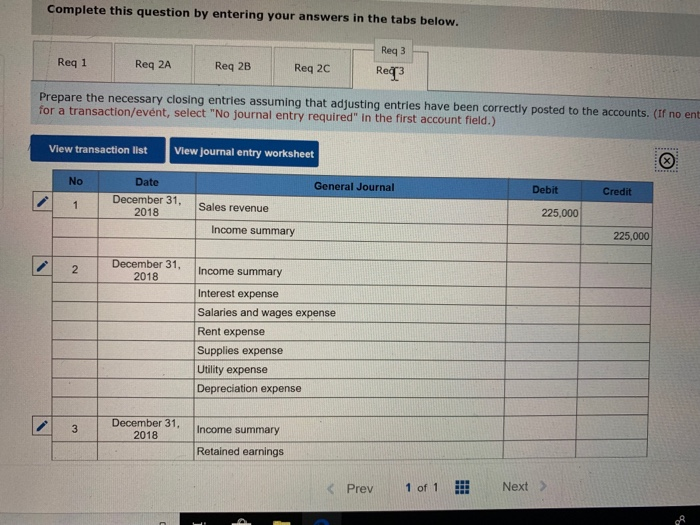

Excallbur Corporation sells video games for personal computers. The unadjusted trial balance as of December 31, 2018, appears below. December 31 is the company's fiscal year-end. The company uses the perpetual inventory system. Account Title Debits Credits 72,340 24,000 Cash Accounts receivable Supplies Prepaid rent Inventory Office equipment Accumulated depreciation-office equipment Accounts payable Salaries and wages payable Note payable Common stock Retained earnings Sales revenue Cost of goods sold Interest expense Salaries and wage expense Rent expense Supplies expense Utility expense Totals 57,800 71,800 ook 9,230 28,800 3, 600 29,48 90,800 16,480 225,000 117,580 39,558 14,000 1,840 5, 200 402,430 402,430 Cash dividends paid to shareholders during the year amounted to $6,750. Information necessary to prepare the year-end adjusting entries appears below. 1. The office equipment was purchased in 2016 and is being depreciated using the straight-line method over an eight-year useful life with no salvage value. Prev | 1 of 1 Next > Help Save & Utility expense Totals 5,200 402,430 402,430 Cash dividends paid to shareholders during the year amounted to $6,750. Information necessary to prepare the year-end adjusting entries appears below 1. The office equipment was purchased in 2016 and is being depreciated using the straight-line method over an eight-year useful life with no salvage value. 2. Accrued salaries and wages at year-end should be $5,400. e company borrowed $29 400 on September 1.2018. The principal is due to be repaid in 10 years. Interest is payable twice a year on each August 31 and February 28 at an annual rate of 10%. 4. The company debits supplies expense when supplies are purchased. Supplies on hand at year-end cost $460. 5. Prepaid rent at year-end should be $1,000. 1. Complete the worksheet below. 2-a. Use the information in the worksheet to prepare an income statement for 2018 2-b. Use the information in the worksheet to prepare a statement of shareholders' equity for 2018. 2.c. Use the information in the worksheet to prepare a balance sheet as of December 31, 2018. 3. Prepare the necessary closing entries assuming that adjusting entries have been correctly posted to the accounts. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 2C Req 3 Complete the worksheet below. justed TrialAdjusting Entries Balance Income Statement Bala Balance Account Title pter 2, Lab #2 Help Save&Exit Check my Account Title Balance Adjusting Entries Income Statement Balance Dr. Balance Sheet Dr Cr. Dr Cr Cr. Dr $ 72.340 S 72,340 $ 72.340 24,000 Accounts receivable Supplies Prepaid rent Inventory Office equipment Accumulated depreciation-office equipment Accounts payable 24,000 1,000 57,000 71,000 1,000 57,000 71,000 57,000 Book 71,000 9,230 28,800 3,600 29,400 28,800 28,800 Salarios and wages payable Note payable Interest payable Common stock Retained earnings Sales revenue 9,000 90,000 16,400 225,000 117,500 Cost of goods sold Interest expense Salaries and wages expense Rent expense Supplies expense 39,550 14,000 1,840 5,200 Ublity expense Depreciation expense $225,800 $ 37,800 Net income 1,460 01 S225.800| s 28,800T 0 $225,800 $ 37,800 Totals Prev 1 of 1 EEI Next > Use the information in the worksheet to prepare an income statement for 2018 EXCALIBUR CORPORATION Income Statement For the Year Ended December 31, 2018 Sales revenue Cost of goods sold Gross profit 225,000 117,500 107,500 Salaries and wages expense Rent expense Supplies expense Utility expense Depreciation expense 44,950 16,300 5,200 66,450 41,050 Net income S 41,050 Req 1 Req 2B> loilny Ullies assuming that adjusting entries have been correctly posted to the ac Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 2C Req 3 ok Use the information in the worksheet to prepare a statement of shareholders' equity for 2018. EXCALIBUR CORPORATION Statement of Shareholders' Equity For the Year Ended December 31, 2018 nt Total Retained Shareholders Earnings nces Stock Equity Balance at January 1, 2018 Balance at December 31, 2018 K Req 2A Req 2C> Req 1 Req 2A Req 2B Req 2C Req 3 Use the information in the worksheet to prepare a balance sheet as of December 31, 2018. (Amounts to be deducted s be Indicated by a mihus sign.) EXCALIBUR CORPORATION Balance Sheet At December 31, 2018 nces here to search Complete this question by entering your answers in the tabs below Req 3 Req 2C Req3 Req 1 Req 2A Req 2B the necessary closing entries assuming that adjusting entries have been correctly posted to the accounts. (If no ent for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit Decembe Sales revenue 2018 225,000 Income summary 225,000 December 31 2018 2 Income summary Interest expense Salaries and wages expense Rent expense Supplies expense Utility expense Depreciation expense December 31, Income summary 2018 Retained earnings