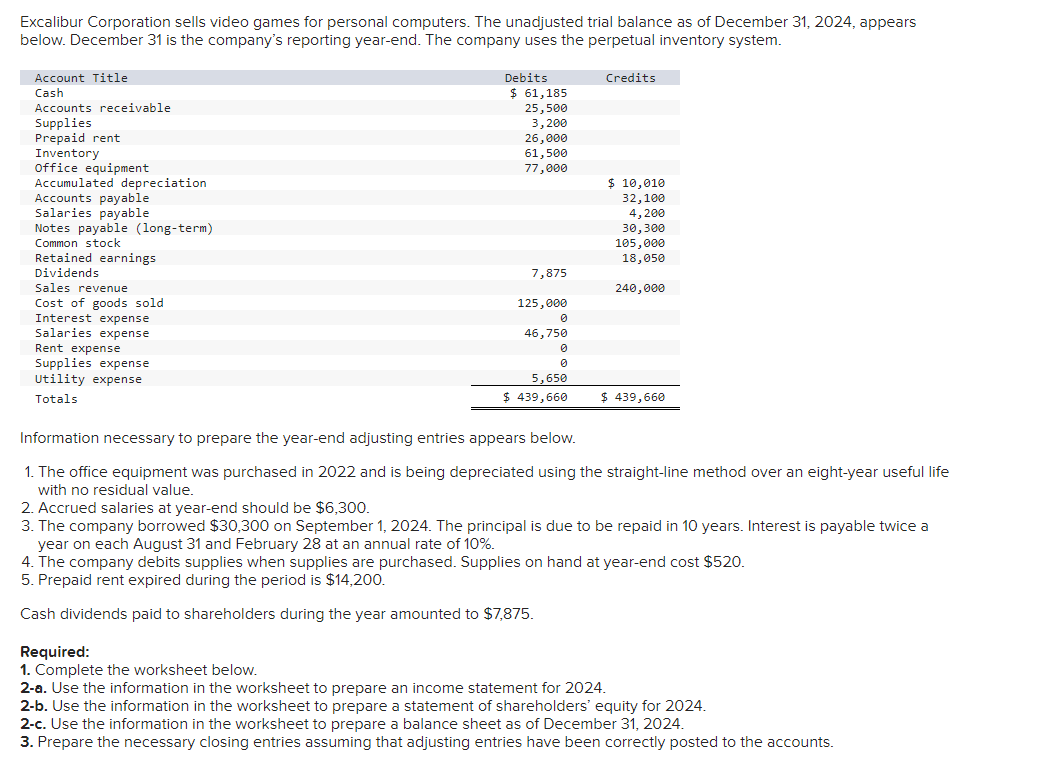

Excalibur Corporation sells video games for personal computers. The unadjusted trial balance as of December 31, 2024, appears below. December 31 is the company's

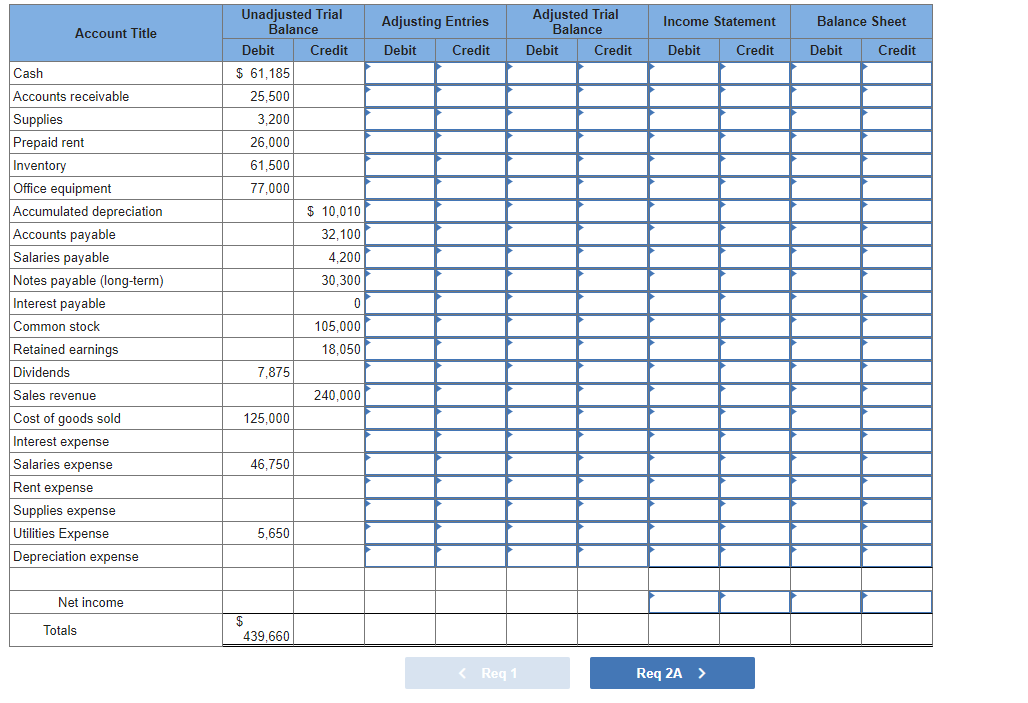

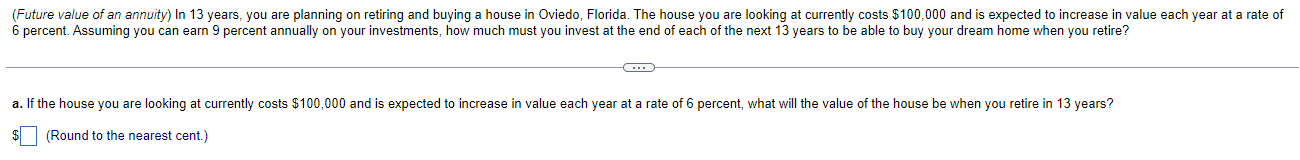

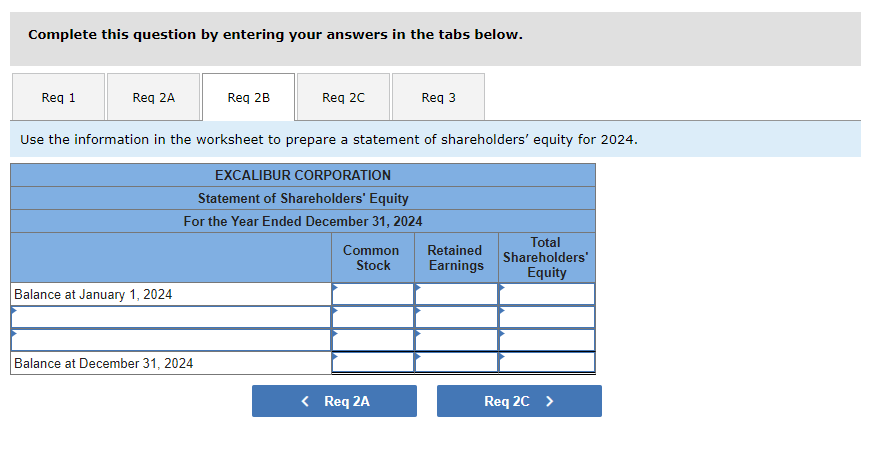

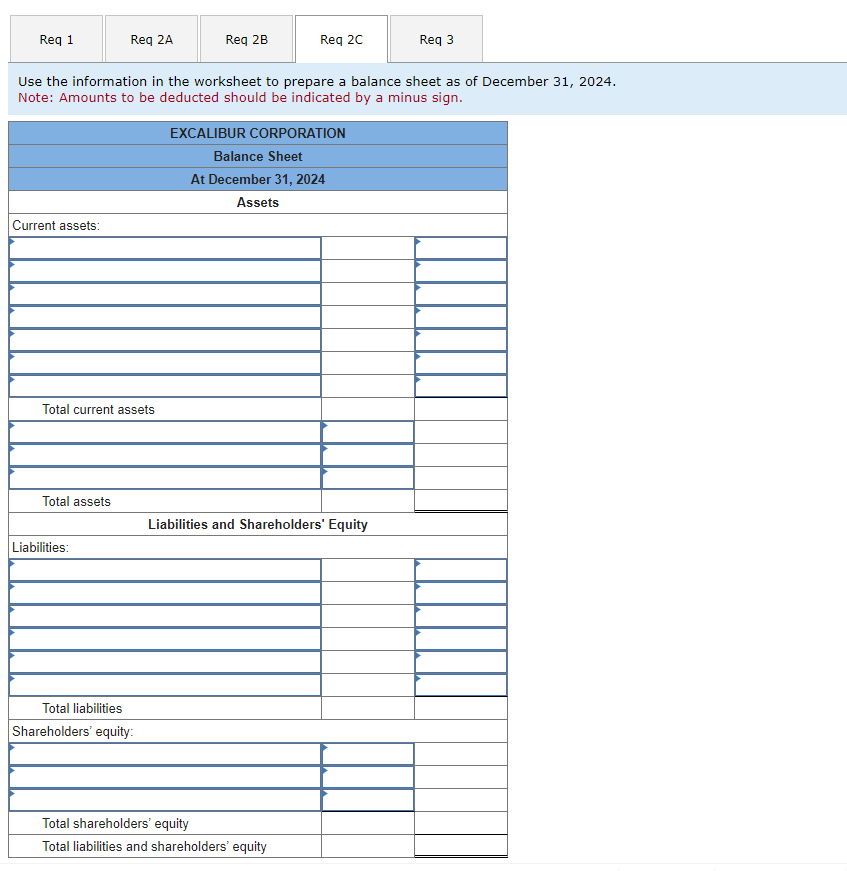

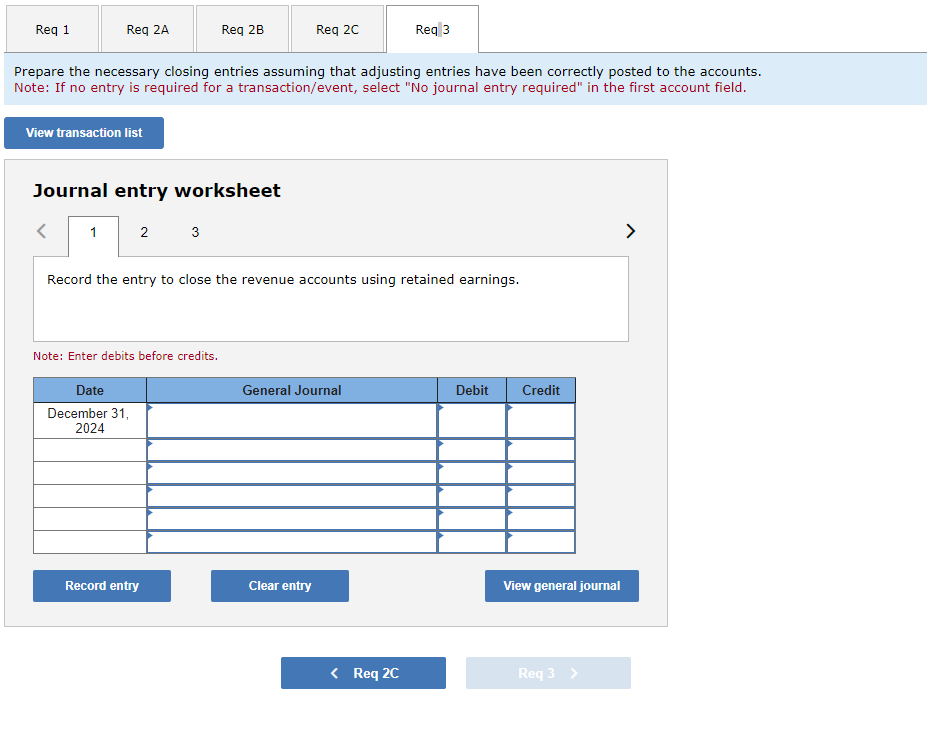

Excalibur Corporation sells video games for personal computers. The unadjusted trial balance as of December 31, 2024, appears below. December 31 is the company's reporting year-end. The company uses the perpetual inventory system. Account Title Cash Accounts receivable Supplies Prepaid rent Inventory Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable (long-term) Common stock Retained earnings Dividends Sales revenue Cost of goods sold Interest expense Salaries expense Rent expense Supplies expense Utility expense Totals Debits $61,185 25,500 3,200 26,000 61,500 77,000 7,875 125,000 46,750 0 5,650 $ 439,660 Credits $ 10,010 32,100 4, 200 30,300 105,000 18,050 240,000 $439,660 Information necessary to prepare the year-end adjusting entries appears below. 1. The office equipment was purchased in 2022 and is being depreciated using the straight-line method over an eight-year useful life with no residual value. 2. Accrued salaries at year-end should be $6,300. 3. The company borrowed $30,300 on September 1, 2024. The principal is due to be repaid in 10 years. Interest is payable twice a year on each August 31 and February 28 at an annual rate of 10%. 4. The company debits supplies when supplies are purchased. Supplies on hand at year-end cost $520. 5. Prepaid rent expired during the period is $14,200. Cash dividends paid to shareholders during the year amounted to $7,875. Required: 1. Complete the worksheet below. 2-a. Use the information in the worksheet to prepare an income statement for 2024. 2-b. Use the information in the worksheet to prepare a statement of shareholders' equity for 2024. 2-c. Use the information in the worksheet to prepare a balance sheet as of December 31, 2024. 3. Prepare the necessary closing entries assuming that adjusting entries have been correctly posted to the accounts. Account Title Cash Accounts receivable Supplies Prepaid rent Inventory Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable (long-term) Interest payable Common stock Retained earnings Dividends Sales revenue Cost of goods sold Interest expense Salaries expense Rent expense Supplies expense Utilities Expense Depreciation expense Net income Totals Unadjusted Trial Balance Debit $ 61,185 25,500 3.200 26,000 61,500 77,000 7,875 125,000 46,750 5,650 439,660 Credit $ 10,010 32,100 4,200 30,300 0 105,000 18,050 240,000 Adjusting Entries Debit Credit < Req 1 Adjusted Trial Balance Debit Credit Income Statement Debit Credit Req 2A > Balance Sheet Debit Credit (Future value of an annuity) In 13 years, you are planning on retiring and buying a house in Oviedo, Florida. The house you are looking at currently costs $100,000 and is expected to increase in value each year at a rate of 6 percent. Assuming you can earn 9 percent annually on your investments, how much must you invest at the end of each of the next 13 years to be able to buy your dream home when you retire? a. If the house you are looking at currently costs $100,000 and is expected to increase in value each year at a rate of 6 percent, what will the value of the house be when you retire in 13 years? (Round to the nearest cent.) Complete this question by entering your answers in the tabs below. Req 1 Req 2A Balance at January 1, 2024 Req 2B Balance at December 31, 2024 Req 2C Use the information in the worksheet to prepare a statement of shareholders' equity for 2024. EXCALIBUR CORPORATION Statement of Shareholders' Equity For the Year Ended December 31, 2024 Common Stock Req 3 < Req 2A Retained Earnings Total Shareholders' Equity Req 2C > Req 1 Current assets: Req 2A Total current assets Total assets Use the information in the worksheet to prepare a balance sheet as of December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. Liabilities: Req 2B Total liabilities Shareholders' equity: Req 2C EXCALIBUR CORPORATION Balance Sheet At December 31, 2024 Assets Liabilities and Shareholders' Equity Total shareholders' equity Total liabilities and shareholders' equity Req 3 Req 1 Req 2A View transaction list < 1 Prepare the necessary closing entries assuming that adjusting entries have been correctly posted to the accounts. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 2 3 Req 2B Note: Enter debits before credits. Date December 31, 2024 Record the entry to close the revenue accounts using retained earnings. Record entry Req 2C General Journal Clear entry Req|3 < Req 2C Debit Credit View general journal Req 3 >

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started