For each of the following independent scenarios, determine the upper and lower limit for the elected transfer price. In addition, indicate the tax consequences

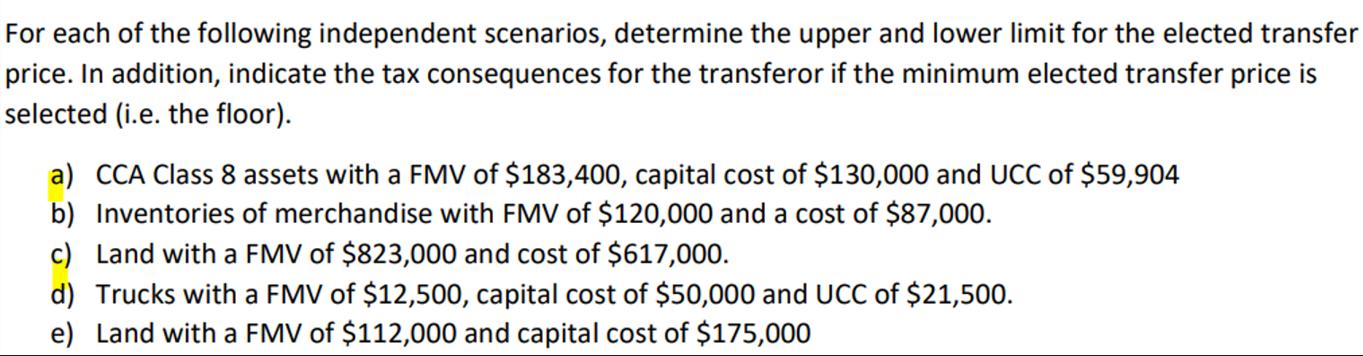

For each of the following independent scenarios, determine the upper and lower limit for the elected transfer price. In addition, indicate the tax consequences for the transferor if the minimum elected transfer price is selected (i.e. the floor). a) CCA Class 8 assets with a FMV of $183,400, capital cost of $130,000 and UCC of $59,904 b) Inventories of merchandise with FMV of $120,000 and a cost of $87,000. c) Land with a FMV of $823,000 and cost of $617,000. d) Trucks with a FMV of $12,500, capital cost of $50,000 and UCC of $21,500. e) Land with a FMV of $112,000 and capital cost of $175,000

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The lower limit for the elected transfer price for CCA Class 8 assets is the UCC of 59904 The uppe...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started