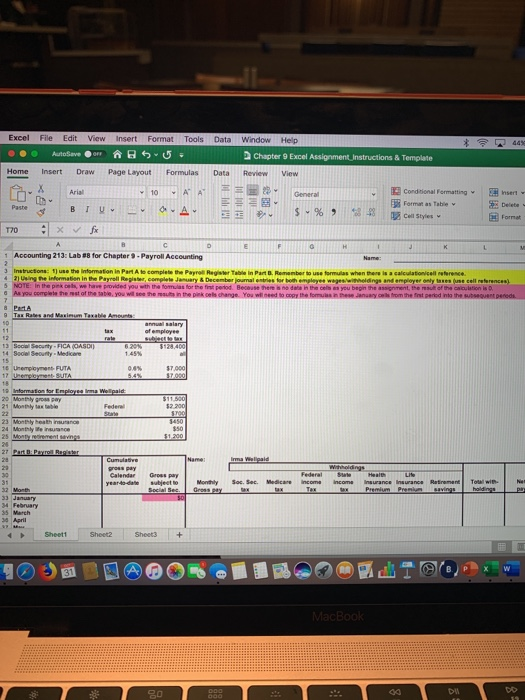

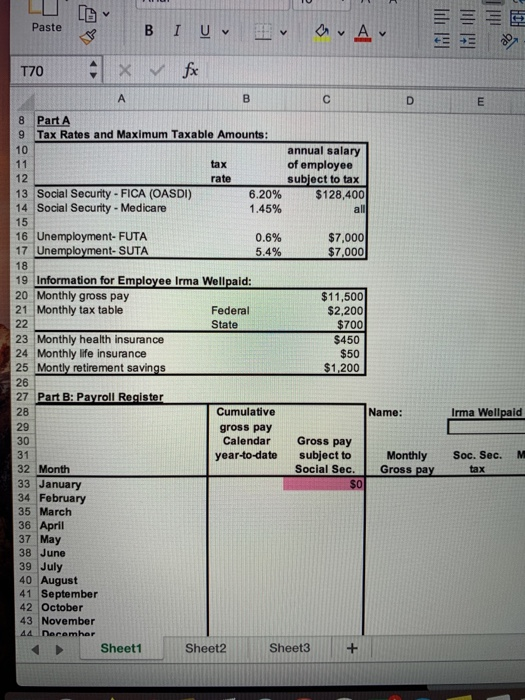

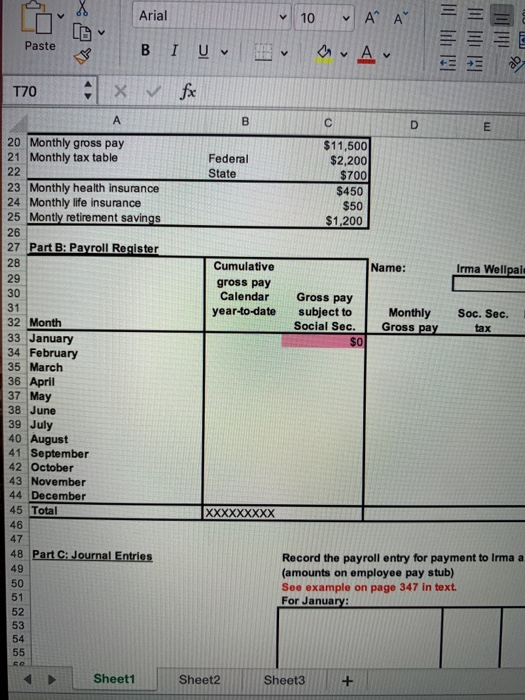

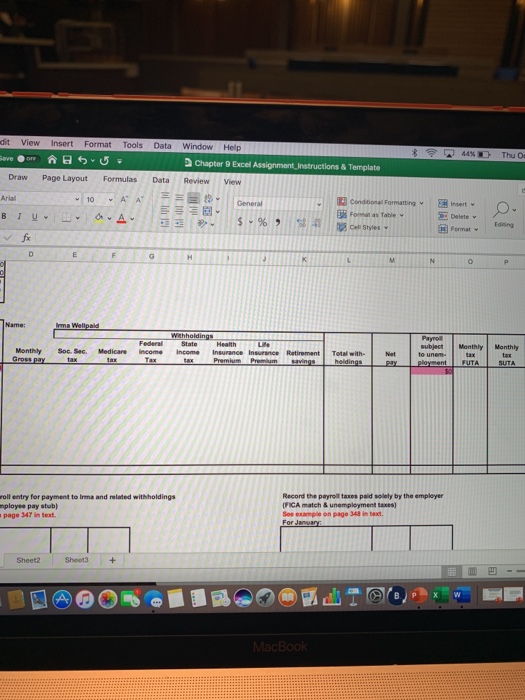

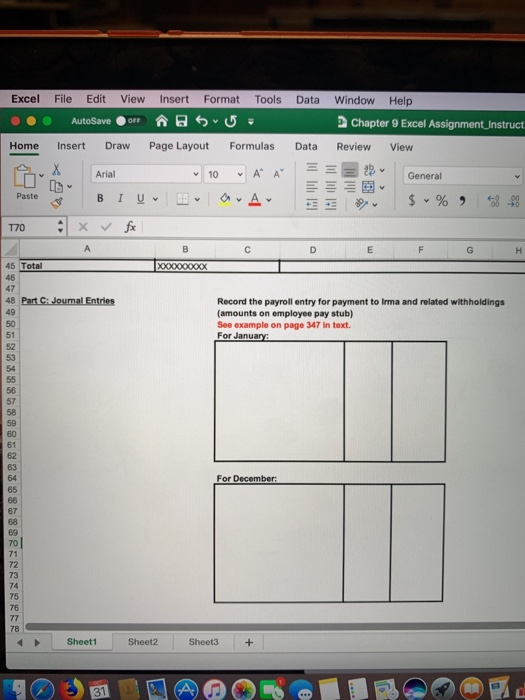

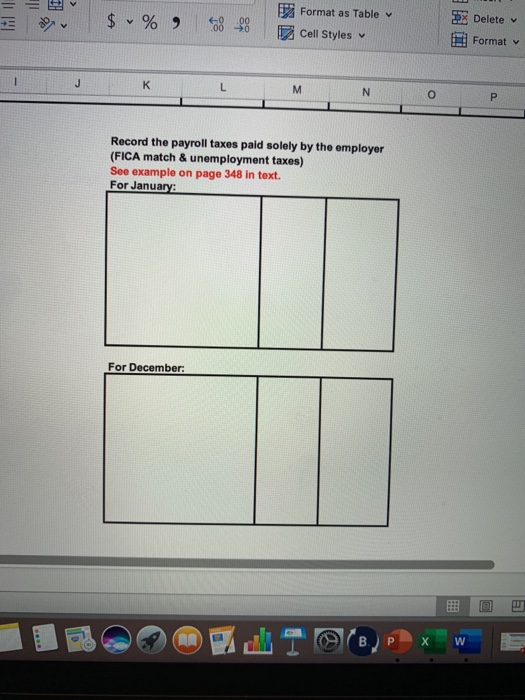

Excel * 443 File Edit View AutoSave Insert Draw insert Format Tools S u Page Layout Formulas Data Window Help Chapter 9 Excel Assignment Instructions & Template Data Home Ar 10 Conditional Formatting Insert TO X ft Accounting 213: Lab for Chapter 9. Payrol Accounting struction: The Part Highetene Pere VOTE ha Complete the set of the table you with Partn ers when concerne & Decor for w ap e nde yer y es cellence v e health of the Gostion is the pink change. You will seed to copy the fom e t rom the first perted into the subsequent per Tax Rates and Maintenance 13 S ecurity FICA (CAST) 14 Social Security - Medicare 14 Februar Sheet 80 LG Paste v BIU A T70 XV fx 8 Part A 9 Tax Rates and Maximum Taxable Amounts: annual salary of employee subject to tax $128,400 rate $7,000 $7,000 13 Social Security - FICA (OASDI) 6.20% 14 Social Security - Medicare 1.45% 15 16 Unemployment- FUTA 0.6% 17 Unemployment- SUTA 5.4% 18 19 Information for Employee Irma Wellpaid: 20 Monthly gross pay 21 Monthly tax table Federal State 23 Monthly health insurance 24 Monthly life insurance 25 Montly retirement savings $11,500 $2,200 $700 $450 $50 $1,200 27 Part B: Payroll Register Name: Irma Wellpaid Cumulative gross pay Calendar year-to-date Gross pay subject to Social Sec. M Monthly Gross pay Soc. Sec. t ax 32 Month 33 January 34 February 35 March 36 April 37 May 38 June 39 July 40 August 41 September 42 October 43 November 44 Decemher Sheet1 Sheet2 Sheet3 Arial 10 AA Paste 8 BIU A 770 x V fx 20 Monthly gross pay 21 Monthly tax table Federal State 23 Monthly health insurance 24 Monthly life insurance 25 Montly retirement savings $11,500 $2,200 $700 $450 $50 $1,200 Part B: Payroll Register Name: Irma Wellpai Cumulative gross pay Calendar year-to-date Gross pay subject to Social Sec. $0 Monthly Gross pay Soc. Sec. tax 32 Month 33 January 34 February 35 March 36 April 37 May 38 June 39 July 40 August 41 September 42 October 43 November 44 December 45 Total XXXXXXXXX 48 Part C: Journal Entries Record the payroll entry for payment to Irma a (amounts on employee pay stub) See example on page 347 In text. For January: Sheet1 Sheet2 Sheet3 + T 44% ! Thu Da dit View Save Draw Insert Format Tools Data $ U Page Layout Formulas Data Window Help | Chapter 9 Excel Assignment Instructions & Template Review View Conditional Formatting 3Formatas Table Cell Styles 10 A Arial BTU NO Federal State Health Life roll entry for payment to Irma and related withholdings mployee pay stub) page 347 is text. Record the payroll taxes paid solely by the employer IFICA match & unemployment taxes) See example on page 348 in text. Sheet2 Sheet3 + MacBook Excel File Edit View Insert Format Tools Data Window Help Home Data AutoSave Insert Draw X Arial BI : x fx S U : Page Layout Formulas 10 A A OA Chapter 9 Excel Assignment Instruct Review View E 29 General w $ % 9 38-28 TO XO0000000 48 Part C: Joumal Entries Record the payroll entry for payment to Irma and related withholdings (amounts on employee pay stub) See example on page 347 in text. For January: For December Sheet1 Sheet2 Sheet3 + D $ % 9 8 % Format as Table Cell Styles Delete Format J K L M N Record the payroll taxes paid solely by the employer (FICA match & unemployment taxes) See example on page 348 in text. For January For December: Excel * 443 File Edit View AutoSave Insert Draw insert Format Tools S u Page Layout Formulas Data Window Help Chapter 9 Excel Assignment Instructions & Template Data Home Ar 10 Conditional Formatting Insert TO X ft Accounting 213: Lab for Chapter 9. Payrol Accounting struction: The Part Highetene Pere VOTE ha Complete the set of the table you with Partn ers when concerne & Decor for w ap e nde yer y es cellence v e health of the Gostion is the pink change. You will seed to copy the fom e t rom the first perted into the subsequent per Tax Rates and Maintenance 13 S ecurity FICA (CAST) 14 Social Security - Medicare 14 Februar Sheet 80 LG Paste v BIU A T70 XV fx 8 Part A 9 Tax Rates and Maximum Taxable Amounts: annual salary of employee subject to tax $128,400 rate $7,000 $7,000 13 Social Security - FICA (OASDI) 6.20% 14 Social Security - Medicare 1.45% 15 16 Unemployment- FUTA 0.6% 17 Unemployment- SUTA 5.4% 18 19 Information for Employee Irma Wellpaid: 20 Monthly gross pay 21 Monthly tax table Federal State 23 Monthly health insurance 24 Monthly life insurance 25 Montly retirement savings $11,500 $2,200 $700 $450 $50 $1,200 27 Part B: Payroll Register Name: Irma Wellpaid Cumulative gross pay Calendar year-to-date Gross pay subject to Social Sec. M Monthly Gross pay Soc. Sec. t ax 32 Month 33 January 34 February 35 March 36 April 37 May 38 June 39 July 40 August 41 September 42 October 43 November 44 Decemher Sheet1 Sheet2 Sheet3 Arial 10 AA Paste 8 BIU A 770 x V fx 20 Monthly gross pay 21 Monthly tax table Federal State 23 Monthly health insurance 24 Monthly life insurance 25 Montly retirement savings $11,500 $2,200 $700 $450 $50 $1,200 Part B: Payroll Register Name: Irma Wellpai Cumulative gross pay Calendar year-to-date Gross pay subject to Social Sec. $0 Monthly Gross pay Soc. Sec. tax 32 Month 33 January 34 February 35 March 36 April 37 May 38 June 39 July 40 August 41 September 42 October 43 November 44 December 45 Total XXXXXXXXX 48 Part C: Journal Entries Record the payroll entry for payment to Irma a (amounts on employee pay stub) See example on page 347 In text. For January: Sheet1 Sheet2 Sheet3 + T 44% ! Thu Da dit View Save Draw Insert Format Tools Data $ U Page Layout Formulas Data Window Help | Chapter 9 Excel Assignment Instructions & Template Review View Conditional Formatting 3Formatas Table Cell Styles 10 A Arial BTU NO Federal State Health Life roll entry for payment to Irma and related withholdings mployee pay stub) page 347 is text. Record the payroll taxes paid solely by the employer IFICA match & unemployment taxes) See example on page 348 in text. Sheet2 Sheet3 + MacBook Excel File Edit View Insert Format Tools Data Window Help Home Data AutoSave Insert Draw X Arial BI : x fx S U : Page Layout Formulas 10 A A OA Chapter 9 Excel Assignment Instruct Review View E 29 General w $ % 9 38-28 TO XO0000000 48 Part C: Joumal Entries Record the payroll entry for payment to Irma and related withholdings (amounts on employee pay stub) See example on page 347 in text. For January: For December Sheet1 Sheet2 Sheet3 + D $ % 9 8 % Format as Table Cell Styles Delete Format J K L M N Record the payroll taxes paid solely by the employer (FICA match & unemployment taxes) See example on page 348 in text. For January For December