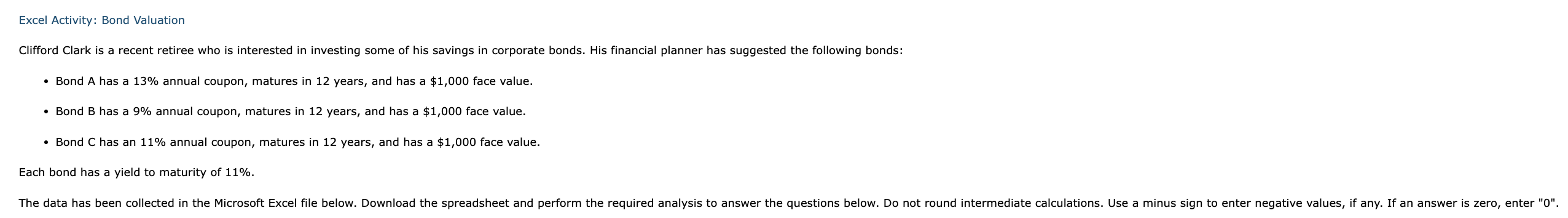

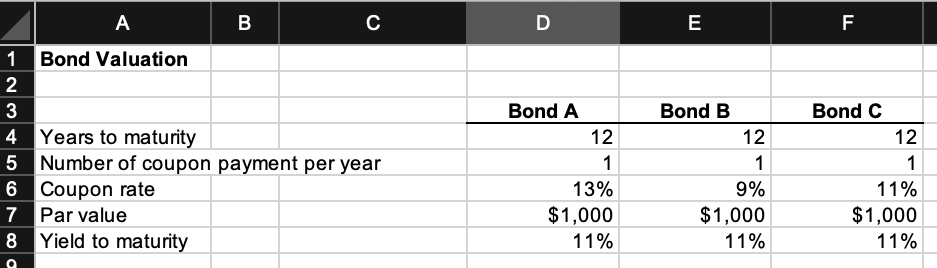

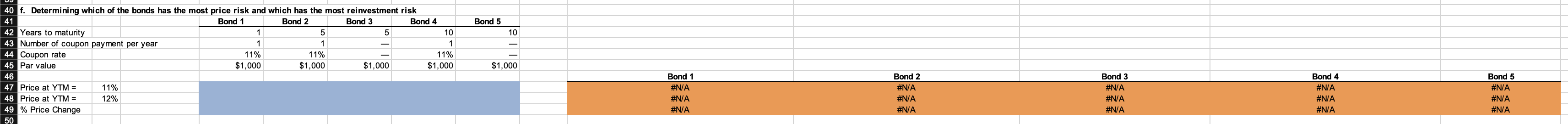

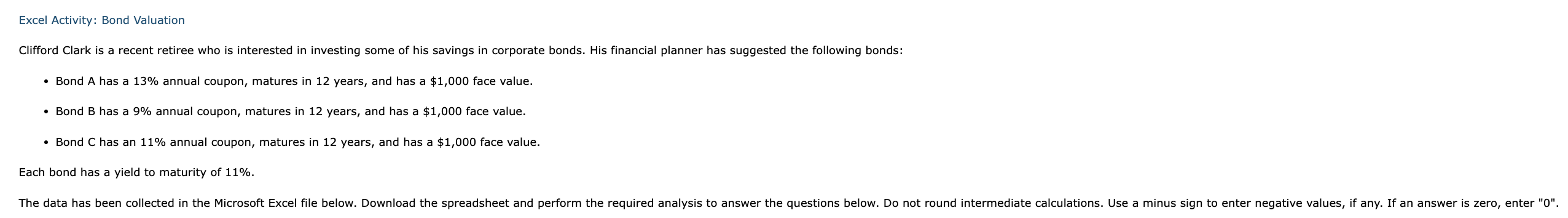

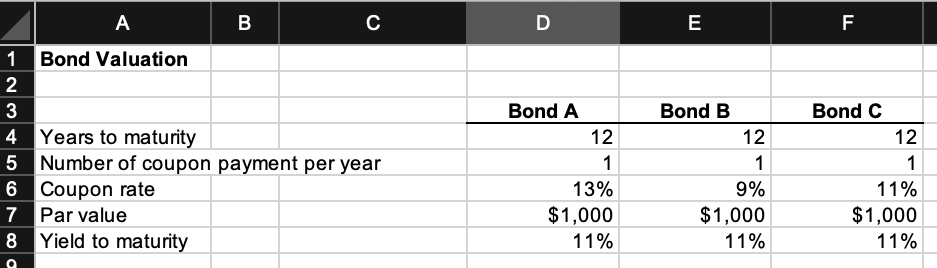

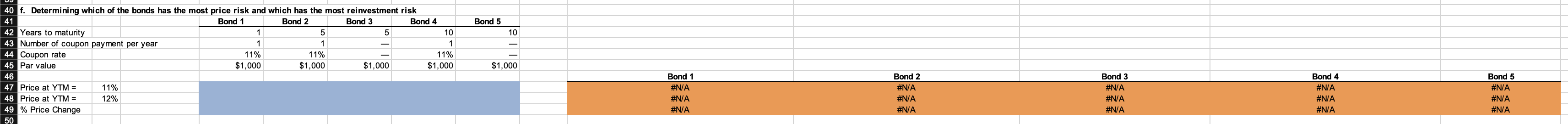

Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has sugested the following bonds: - Bond A has a 13% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has an 11% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 11%. \begin{tabular}{|l|l|r|r|r|r|} \hline & \multicolumn{1}{|c|}{A} & B & C & \multicolumn{1}{|c|}{ E } & \multicolumn{1}{c|}{ F } \\ \hline 1 & Bond Valuation & & & & \\ \hline 2 & & & & \\ \hline 3 & & \multicolumn{1}{|c|}{ Bond A } & \multicolumn{1}{|c|}{ Bond B } & \multicolumn{1}{|c|}{ Bond C } \\ \hline 4 & Years to maturity & 12 & 12 & 12 \\ \hline 5 & Number of coupon payment per year & 1 & 1 & 1 \\ \hline 6 & Coupon rate & 13% & 9% & 11% \\ \hline 7 & Par value & $1,000 & $1,000 & $1,000 \\ \hline 8 & Yield to maturity & 11% & 11% & 11% \\ \hline \end{tabular} Determining v \begin{tabular}{l} Coupon rate \\ \hline Par value \\ \hline \end{tabular} \begin{tabular}{rrrrrr} Bond 1 & \multicolumn{1}{l}{ Bond 2 } & \multicolumn{1}{l}{ Bond 3 } & \multicolumn{1}{r}{ Bond 4 } & \multicolumn{1}{c}{ Bond 5 } \\ \hline 1 & 5 & 5 & 10 & 10 \\ 11 & 1 & - & 1 & - \\ $1,000 & $1,000 & $1,000 & $1,000 & $1,000 \\ & & & & \end{tabular} PriceatYTM=PriceatYTM=%PriceChange11%12% \begin{tabular}{ll} Bond 1 & Bond 2 \\ \hline#NA & #NA \\ #NA & #NA \\ #N/A & #NA \end{tabular} Bond 3 #N/A #NA #NA Bond 4 N A #NA #NA #NA f. Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond values due to an increase in interest rates is called . The risk of an income decline due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year bond with an 11% annual coupon - A 5-year bond with an 11% annual coupon - A 5-year bond with a zero coupon - A 10-year bond with an 11% annual coupon - A 10-year bond with a zero coupon A | has the most price risk. A | has the most reinvestment risk