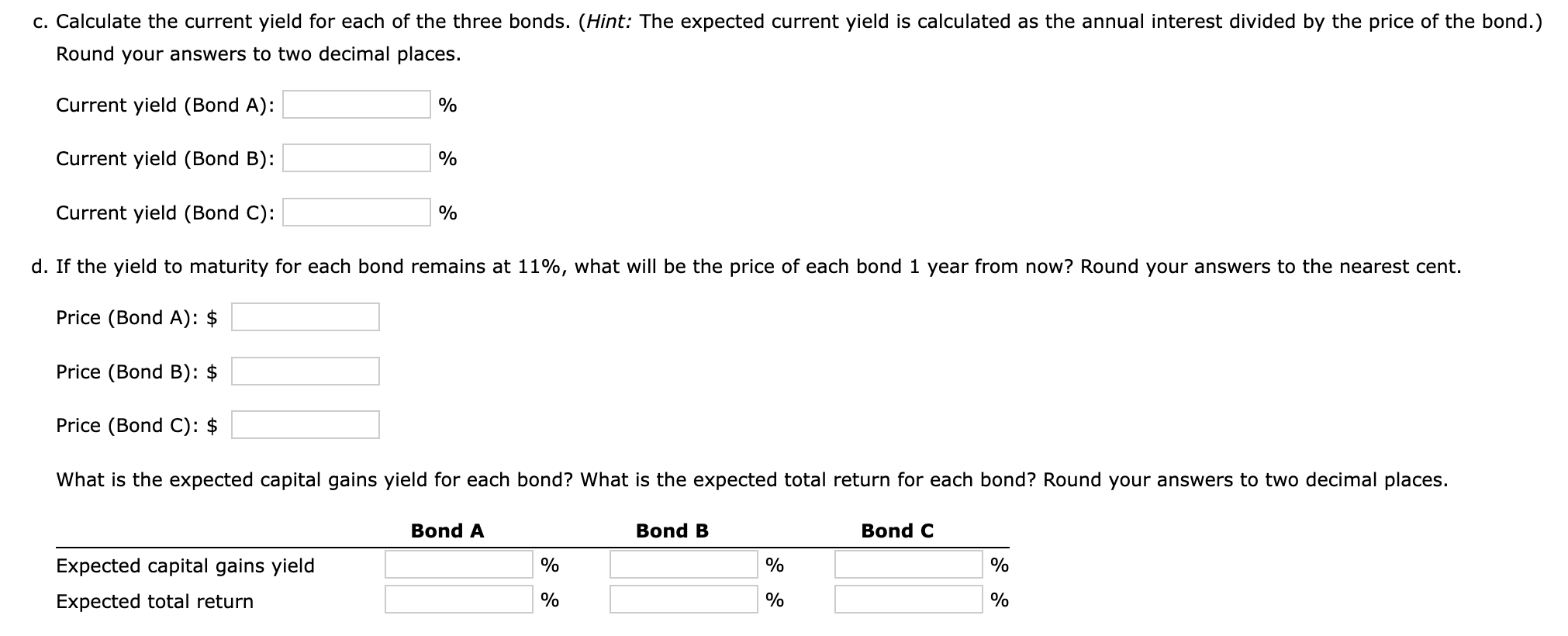

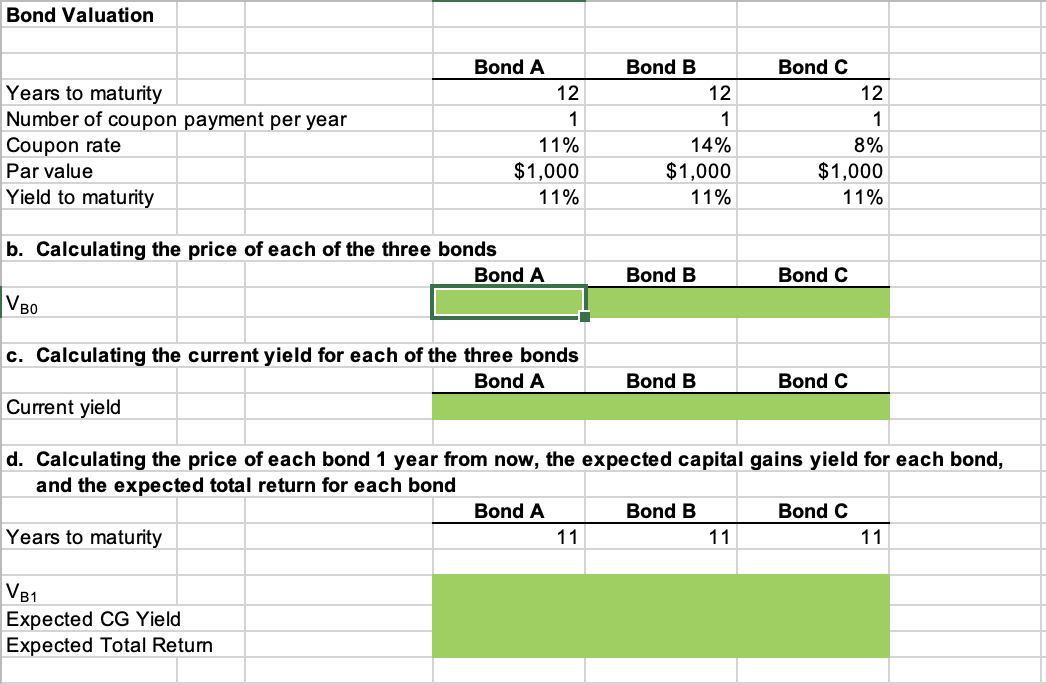

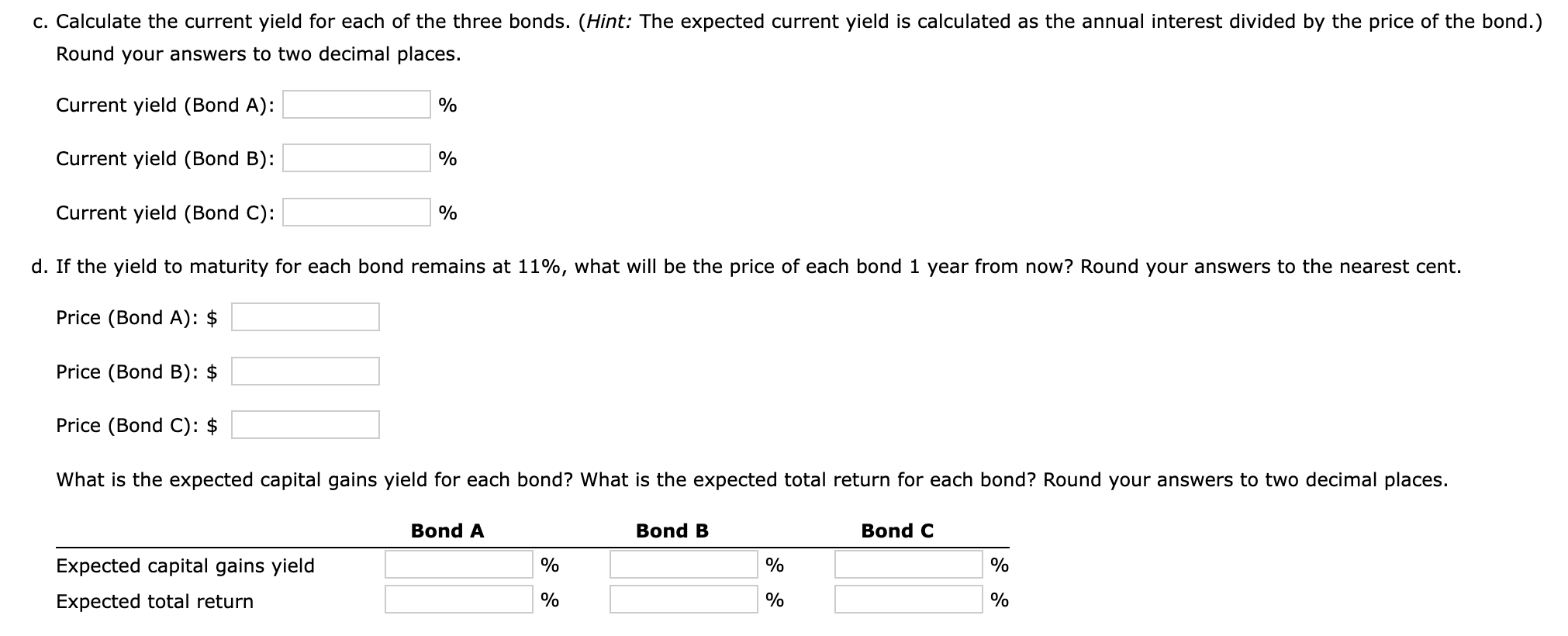

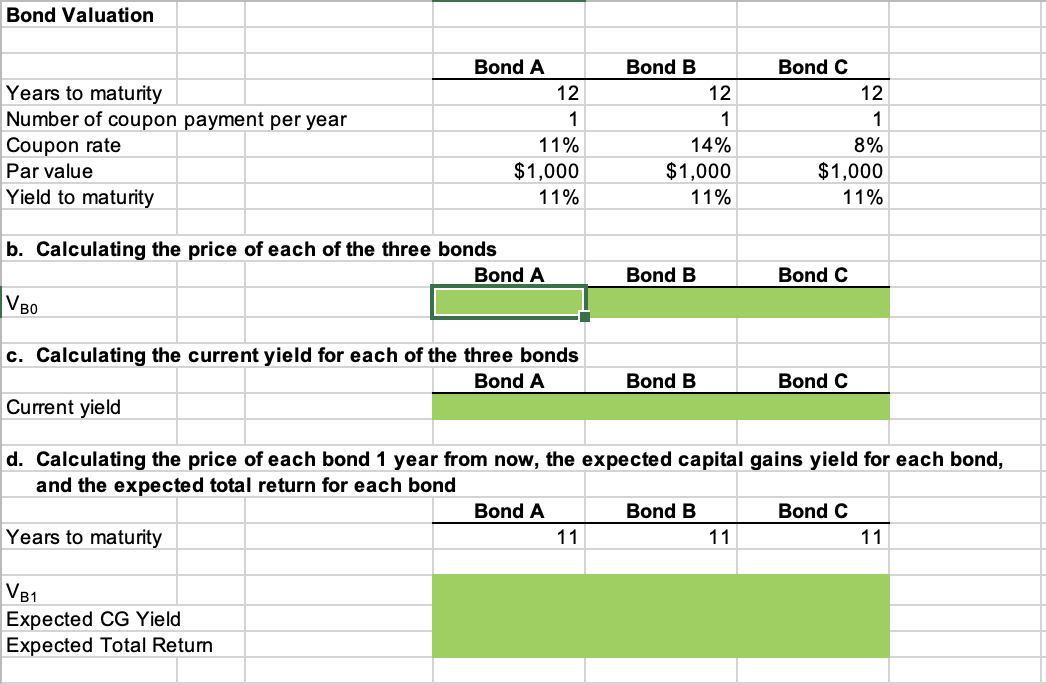

Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has an 11% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 14% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 11%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below round intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter "0". c. Calculate the current yield for each of the three bonds. (Hint: The expected current yield is calculated as the annual interest divided by the price of the bond. Round your answers to two decimal places. Current yield (Bond A ): % Current yield (Bond B): % Current yield (Bond C): % d. If the yield to maturity for each bond remains at 11%, what will be the price of each bond 1 year from now? Round your answers to the nearest cent. Price (Bond A ): $ Price (Bond B): $ Price (Bond C): \$ Bond Valuation Years to maturity Number of coupon payment per year Coupon rate Par value Yield to maturity \begin{tabular}{|r|r|r|} \hline \multicolumn{1}{|c|}{ Bond A } & \multicolumn{1}{c|}{ Bond B } & \multicolumn{1}{c|}{ Bond C } \\ \hline 12 & 12 & 12 \\ \hline 1 & 1 & 1 \\ \hline 11% & 14% & 8% \\ \hline 1,000 & $1,000 & $1,000 \\ \hline 11% & 11% & 11% \\ \hline \end{tabular} b. Calculating the price of each of the three bonds VB0 c. Calculating the current yield for each of the three bonds Current yield \begin{tabular}{c|c|c} Bond A & Bond B & Bond C \\ \hline \multicolumn{2}{c}{} \end{tabular} d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, and the expected total return for each bond Years to maturity \begin{tabular}{r|r|r|} \hline \multicolumn{1}{c|}{ Bond A } & Bond B & Bond C \\ \hline 11 & 11 & 11 \end{tabular} VB1 Expected CG Yield Expected Total Return