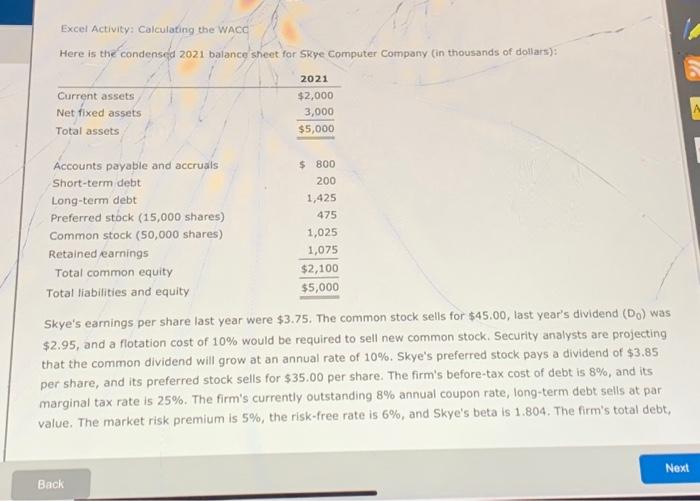

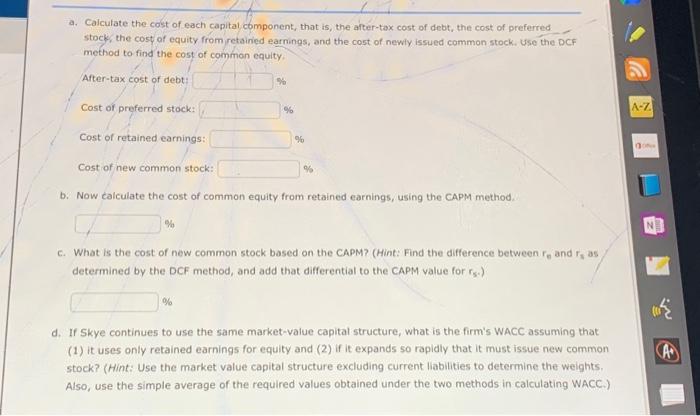

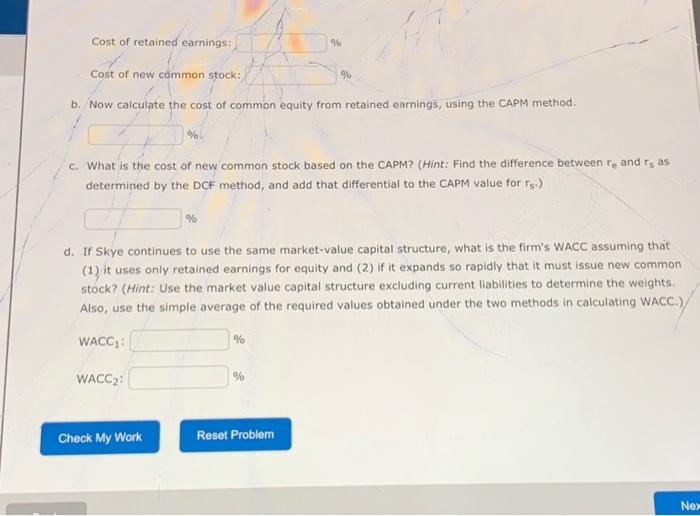

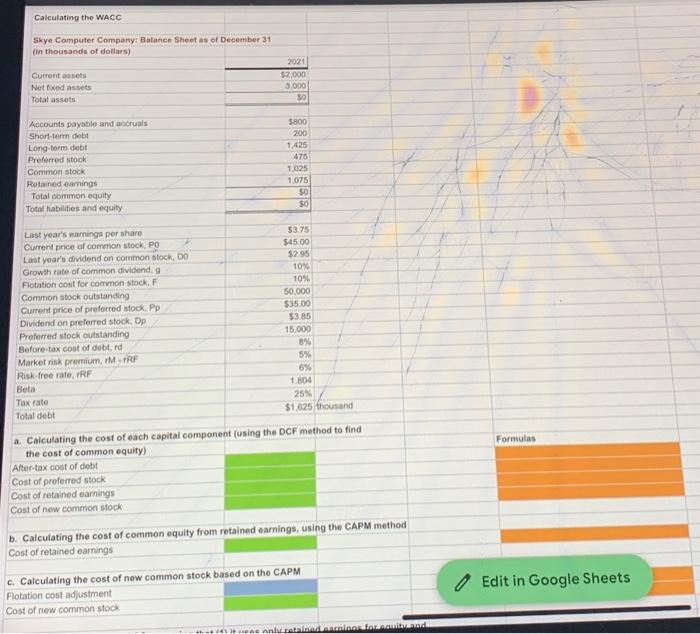

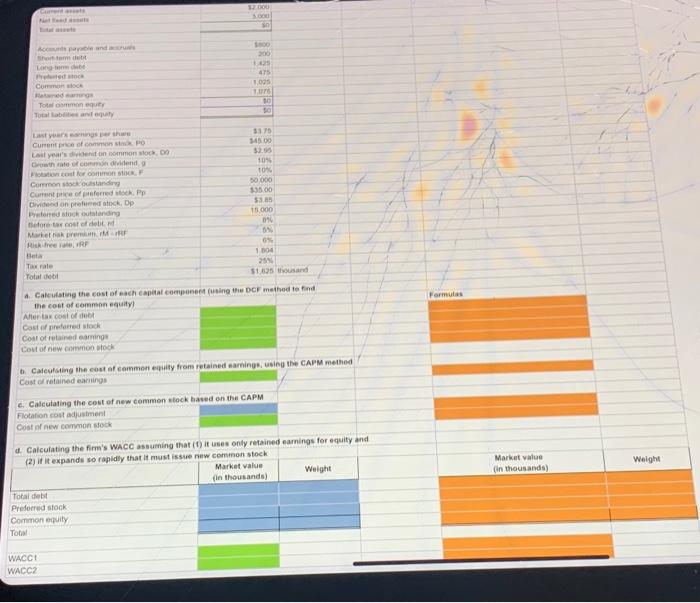

Excel Activity: Calculating the WACC Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars): Skye's earnings per share last year were $3.75. The common stock sells for $45.00, last year's dividend (D0) was $2.95, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 10%. Skye's preferred stock pays a dividend of $3.85 per share, and its preferred stock sells for $35.00 per share. The firm's before-tax cost of debt is 8%, and its marginal tax rate is 25%. The firm's currently outstanding 8% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skye's beta is 1.804 . The firm's total debt, a. Calculate the cast of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earrings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity After-tax cost of debt: Cost of preferred stock: Cost of retained earnings: Cost of new common stock: b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r6 and rs as determined by the DCF method, and add that differential to the CAPM value for r5.) d. If Skye continues to use the same market-value capital structure, what is the firm's WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new commin stock? (Hint: Use the market value capital structure excluding current liabilities to determine the weights, Also, use the simple average of the required values obtained under the two methods in calculating WACC.) Cost of retained earnings: Cost of new common stock: % b. Now calculate the cost of common equity from retained earnings, using the CAPM method. % c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between re and rs as determined by the DCF method, and add that differential to the CAPM value for rs) % d. If Skye continues to use the same market-value capital structure, what is the firm's WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock? (Hint: Use the market value capital structure excluding current liabilities to determine the weights. Also, use the simple average of the required values obtained under the two methods in calculating WACC.) WACC1:WACC2:%% -1..A-ala tha noet af now common stock based on the CAPM th. Caleutsing the eost at common equity from retained sarnings; using the CAPM methed Cast ol rotainad earnings c. Calculating the cost of new common slock based on the CAPM Flotation coit adjustment Cost of new common stock d. Calculating the firm's WACC assuming that (1) it uses only retained earnings for equity and