Question

Excel Activity: Feasible Portfolios Following is information for the required returns and standard deviations of returns for A, B, and C: Stock r i i

Excel Activity: Feasible Portfolios

Following is information for the required returns and standard deviations of returns for A, B, and C:

| Stock | ri | i |

| A | 7.0% | 35.47% |

| B | 10.0% | 50.65% |

| C | 18.0% | 88.75% |

The correlation coefficients for each pair are shown in the following matrix, with each cell in the matrix giving the correlation between the stock in that row and column. For example, AB = 0.1554 is in the row for A and the column for B. Notice that the diagonal values are equal to 1 because a variable is always perfectly correlated with itself.

| A | B | C | |

| A | 1.0000 | 0.1554 | 0.1890 |

| B | 0.1554 | 1.0000 | 0.1644 |

| C | 0.1890 | 0.1644 | 1.0000 |

Do not round intermediate calculations. Round your answers to two decimal places.

A. Suppose a portfolio has 30% invested in A, 50% in B, and 20% in C. What are the expected return and standard deviation of the portfolio?

Expected return: 10.70 %

Standard deviation: ???? %

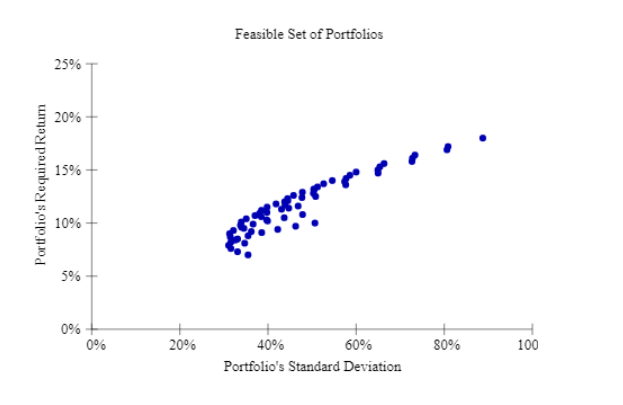

B. Construct a scatter diagram showing the required returns and standard deviations already calculated. This provides a visual indicator of the feasible set. Choose the correct graph.

The correct graph is graph D

If you seek a return of 10.5%, then what is the smallest standard deviation that you must accept?

Smallest Standard Deviation: ???? %

Feasible Set of Portfolios Feasible Set of PortfoliosStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started